This week we’re going to only look at one essential read, Capgemini’s World Retail Banking Report for 2022, aptly subtitled The customer engagement imperative: What banks can learn from the FinTech playbook. If you’re going to spend a few minutes this week reading anything, make it this primary consumer and banking research. We break down their main points below, but the gist is summed up well in their executive summary:

Banks that leverage data to drive omnichannel engagement and seamlessly embed themselves in customers’ digital journeys can enhance loyalty and drive growth.

1. Customers expect personalized experiences from their bank and, if disappointed, will seek it elsewhere

Customer expectations, and their willingness to defect to FinTech competitors, continue to grow in the survey data. The majority of consumers showed both an attraction to and willingness to recommend FinTech alternatives when they provide lower friction, easier use, and more convenient alternatives to traditional banking.

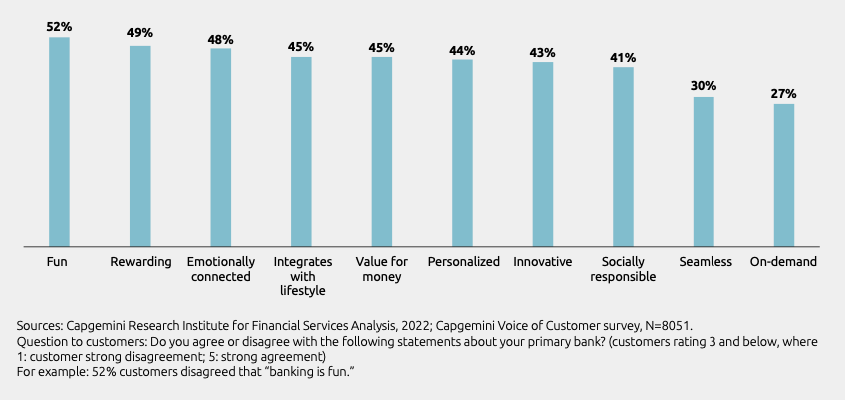

Customer expectations from their commercial interaction are rising, and banks are not keeping pace. Nearly half of respondents in our Voice of the Customer survey said their banking relationships were neither emotionally connected nor well-integrated into their lifestyles; 52% said banking was not “fun.” Many respondents say their banks don’t offer seamless experiences, personalization, and innovation they want from the “phygital” (that bridge physical and digital) relationships.”

2. Using data like a FinTech to drive customer engagement

Leveraging 1st party data, that FIs already have, for personalized experiences is a repeated theme in this report (and others). This can be a difficult lift for marketing organization not already on a data-driven path. Still, the research reveals a few fundamental tenets of a successful strategy.

- Make AU/ML the orchestrator of customer experience

- Centralize data

- Enhance data governance

- Embrace just-in-time experiences

- Use proprietary data to compete

- Leverage RegTech solutions to automate

Each element is further explained to make it actionable. The posture of a customer-centric marketer is quickly becoming the must-have of the majority as customer expectations rise:

With the vast amount of data banks possess, a customer would think the bank knows everything about them. However, most data is unavailable for targeted use.

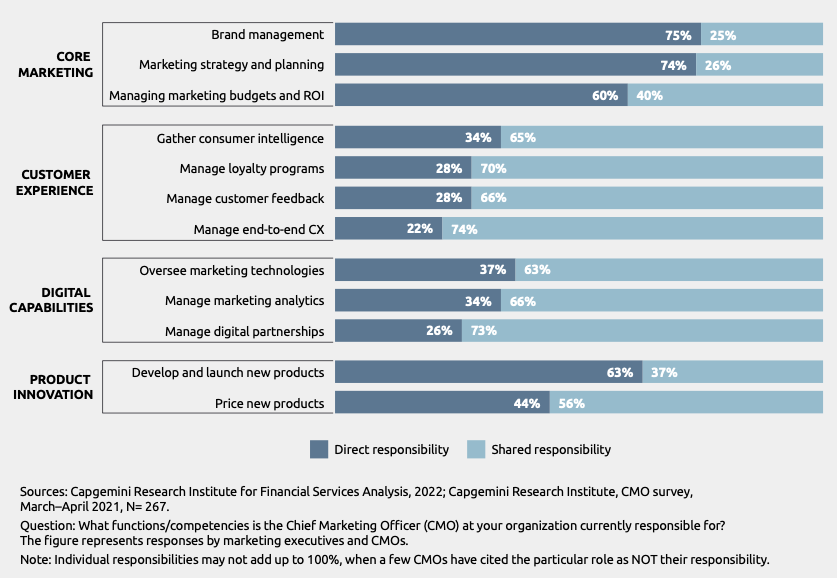

3. The CMO as customer strategist and chief engagement officer

Much like we’ve seen earlier from luminaries like Seth Godin, the role of the CMO is expanding beyond the external, and much more into everything that contributes to or negatively affects customer experience. That challenge, however, requires a different approach, skill set, and overall measure of success for what the modern banking CMO needs to lead her FI to growth.

Marketing is not necessarily about communication but delivering fluid experiences to customers, shifting monolithic broadcasting to engaging interactive media planning and delivery. CMOs are now taking centralized roles, moving from brand custodians to brand experience custodians.

The problem is that most CMOs are ill-equipped to guide the transition from product to customer-centric marketing, largely because the data needed to pursue those customer-based strategies is disconnected and siloed in ways that make it unusable.

Key CMO partners cover the critical areas of technology, data, customer experience, and products. CMOs who orchestrate these functions through a coherent, integrated strategy hold the recipe to new-era success.

And that’s it for this Friday. If you made it this far, enjoy this hypnotic battle of car vs. giant bulge.. We’d love to hear what you think of our posts at blog@mindspaninc.com, and if you caught the Tesla Cybertruck cameo, share below.