This week, we look at PwC’s annual digital banking Survey, consumer expectations for personalization from brands, and investors’ advice on leveraging consumers’ affinities for emerging Fintechs.

1. Digital Banking Trends

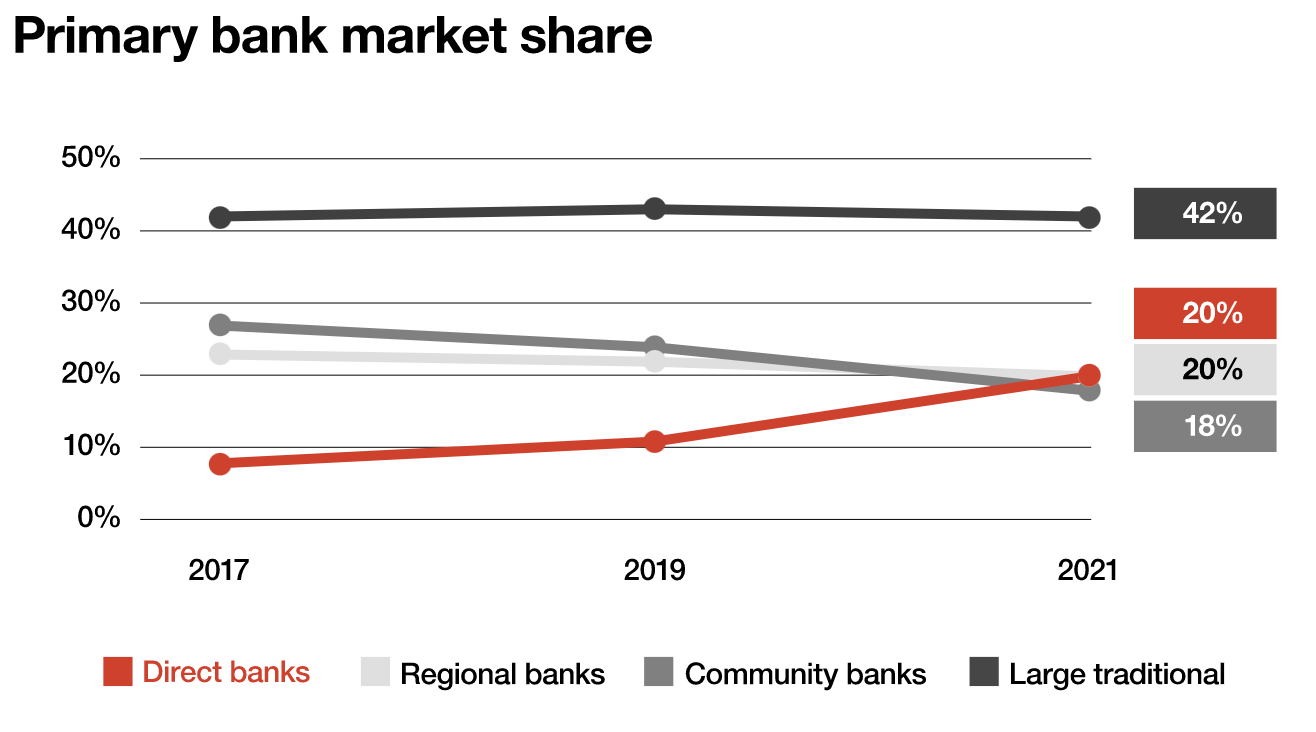

PwC published their 2021 Digital Banking Consumer Survey. in addition to trends in digital banking usage, digital account opening, and embedded finance, PwC’s survey covers the trends in where consumers consider their primary FI:

We’re also seeing a generational shift in the definition of a primary bank, with checking accounts becoming less dominant and advice and social support growing in importance:

- While 60% of baby boomers (consumers over 55) assume that their primary bank is where they hold their primary checking account, only 34% of Gen Z consumers (ages 18-24) say the same.

- In contrast, 26% of Gen Zers say their primary bank is the company that they trust to give the best advice, compared to just 7% of baby boomers.

- There’s also a small—but growing—share of consumers who say their primary bank is the one that acts in the best interest for the environment and society, including 14% of Gen Zers and 12% of millennials (ages 25-39). But only 2% of baby boomers feel the same.

2. Personalization as the Growing Competitive Lever

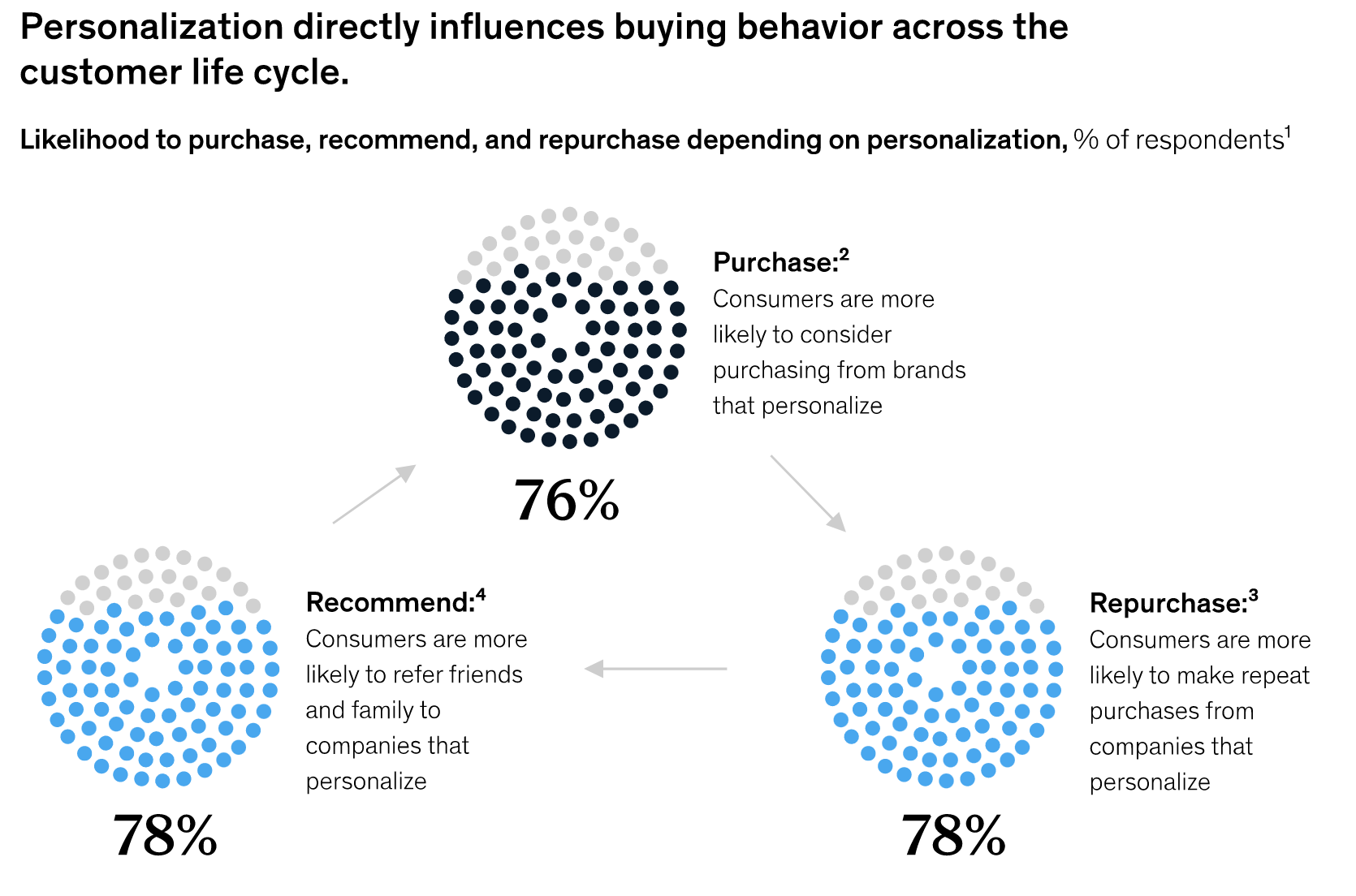

McKinsey reports on their finding that the value of getting personalization right—or wrong—is multiplying. Their research shows the outsized impact of a well-executed personalization strategy for customer experience.

- Personalization matters more than ever, with COVID-19 and the surge in digital behaviors raising the bar. Three-quarters of consumers switched to a new store, product, or buying method during the pandemic.

- Seventy-one percent of consumers expect companies to deliver personalized interactions. And seventy-six percent get frustrated when this doesn’t happen.

- Personalization drives performance and better customer outcomes. Companies that grow faster drive 40 percent more of their revenue from personalization than their slower-growing counterparts.

3. The Rise of “Community” Fintechs

Ron Shevline of Cornerstone Advisors shares his advice for emerging Fintechs in Forbes. Looking beyond the traditional competitive markets of geography, Shevline looks at Fintechs catering to groups like environmentally conscious, African-American, LGBTQ, and gig working consumers.

Many banks and credit unions have tried to create new revenue sources outside of traditional financial products, but have struggled because they don’t understand which segments of their customer base want which products and services.

With a narrow focus on a particular segment of the market, community fintechs will be better positioned to understand which non-financial products their communities want—and will be better positioned from a technology-perspective to integrate with partners to provide those products and services.

And that wraps up the week and 1Q. We hope you defy expectations in the coming quarter. Drop us a note at blog@mindspaninc.com, and if you made it this far, share below.