Here comes November, and with it, cold weather and the first Friday of must-read items from the week’s news. For today:

- The sharp decline in commercial real estate

- Big banks push back on PE and private credit

- A look at valuation multiples enjoyed by tech, not so much by traditional banks

1. CRE loans grind to a halt

Peter Grant writes in the WSJ on how the money has stopped flowing in Commercial Real Estate.

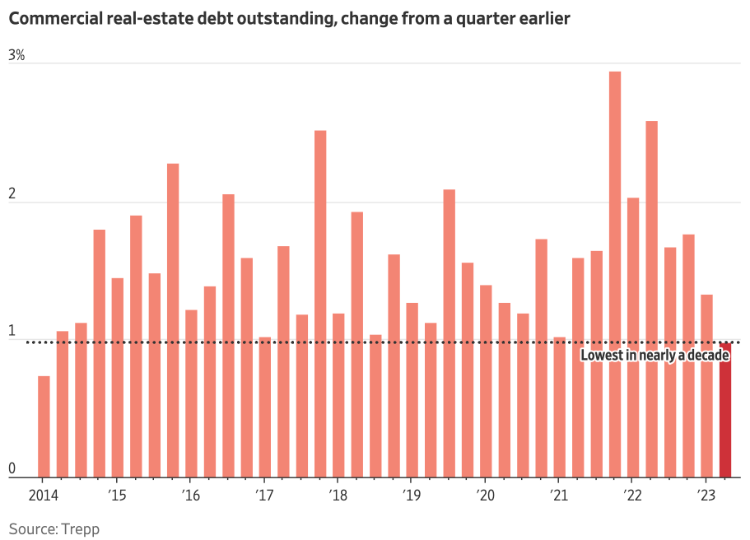

Total volume of commercial real-estate loans held by banks, the largest source of debt financing, declined during the first two weeks of October, according to analysis of Federal Reserve figures by Trepp, a data provider. Bank commercial property lending has declined for only two months since 2014. Most other two-week periods since 2014 have shown positive growth.

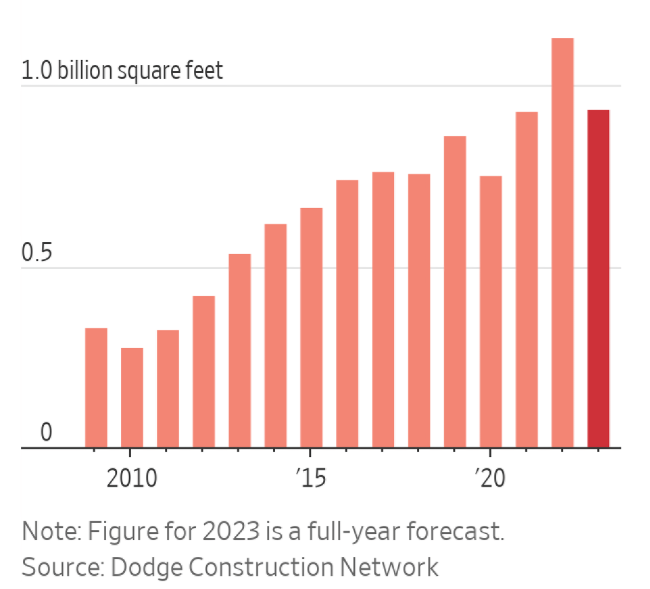

This has the obvious and direct effect of slowed construction starts.

Dodge Construction Network, a data and analytics firm, is forecasting that commercial-property construction starts will fall to 935 million square feet this year, a 17% decline from last year. That would be the largest annual decline since 2009.

Despite many delayed or canceled projects, deals have not entirely stopped.

Bankers and mortgage brokers say conditions aren’t as bad as during the global financial crisis when lenders had almost completely vanished and buyers disappeared. Loans are still available today but from fewer players and at a higher price.

The decline in lending is partly due to a falling demand for debt from would-be investors who have little interest in buying or developing property with interest rates so high. Only $89.2 billion in U.S. commercial property was purchased in the third quarter, a decline of 53% from the same period last year, according to data provider MSCI Real Assets.

2. JPMC looks to take on private credit

We’ve looked previously at the growth in private credit, particularly among PE firms. The monumental rise in their portfolios outside the LBO markets hasn’t gone unnoticed. JPMorgan is out raising funds to build on top of its own private credit play. Gillian Tan and Paula Seligson at Bloomberg write:

JPMorgan is looking for third-party capital to supplement the more than $10 billion of balance sheet cash that it has already set aside for its private credit strategy, which it began rolling out in the last year. A bigger pool of capital would allow the bank to better compete with heavyweights such as Blackstone Inc., Apollo Global Management Inc. and Ares Management Corp. by making larger commitments or participating in larger deals.

Matt Levine writes on how this exposes the shift in time horizons of banking’s money:

Private credit is increasingly substituting for bank loans because it has a better funding model. Pension funds, insurance companies, sovereign wealth funds and the alternative asset managers that do private credit investing for them have very stable long-term funding; US regional banks have flighty short-term deposits. Private credit is a form of “narrow banking,” a model in which banks invest deposits at the Fed and lending is done by specialized firms with long-term equity funding. The specialized firms are private-credit managers, and the long-term funding comes from pensions.

But it is not just US regional banks with flighty deposits; it’s global megabanks with sticky deposits too. Even at JPMorgan, there is a push to make banking narrower.

3. The depressed valuation of banks

With earning season wrapping up, Chris Skinner takes a look at the divergent trends in profitability and market caps for banks

All of these banks are seeing an eroding stock price over time, because banks are basically less relevant in the financial services ecosystem.

- Citi revenue was up 10% and stock is down 8% YoY

- Wells Fargo’s revenue was up 6.5% and stock is down 1.3% YoY

- Bank of America revenue was up 3% and #stock is down 5% YoY

Because banks are not rising to the challenges of the future. In fact, I find it interesting how the tech industry has the highest price-to-book value. Why? Because tech is the future.

This combination is why FinTech firms see their valuations far exceeding their delivery, and why banks like Goldman Sachs (and their disastrous foray into consumer finance) get frustrated with their poor delivery.

That’s it for this week. The fever dream of every gearhead is to drive a lap of Germany’s famed tollroad-com-racetrack Nürburgring, but probably not like this. Click below to let us know how we did: