This Friday, we look at the fast-growing competition in corporate lending from private equity. Also, we have a story on a community bank failure this quarter with an unusual backstory.

1. Your new bank is private equity

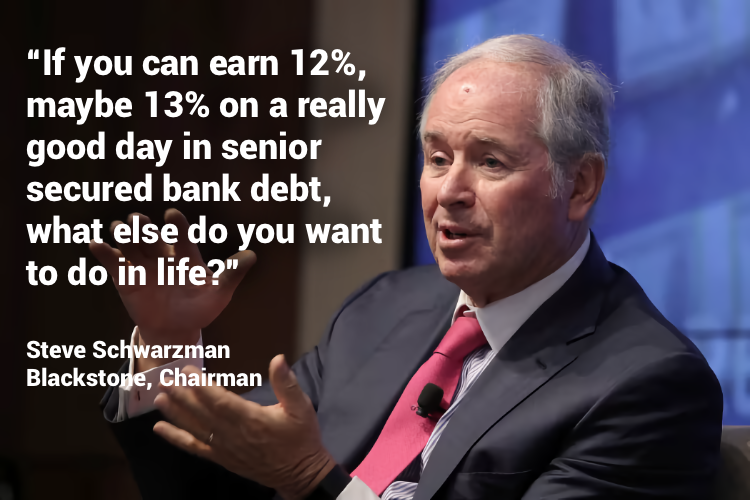

Will Louch of the FT writes on the growing role private equity is playing in more lending. While more traditionally on the equity side of leverage buyouts, the big PE firms are increasingly looking to take up the debt side of financing in this higher-interest environment.

In a sign of how private equity is rapidly moving beyond its swashbuckling roots in buying large companies, the focus in Paris was squarely on how firms are positioning themselves as an alternative to the traditional banking system, capable of making multibillion-dollar corporate loans.

Jim Zelter, Apollo’s co-president, said that in an era of higher rates there were “unprecedented” returns available in private credit. The New York-based firm is increasingly targeting loans to large companies, according to people familiar with the matter. A recent example includes a €500mn loan to Air France.

Apollo’s private credit unit now manages more than $400bn, dwarfing the $100bn in assets under management in its buyout division, historically the cornerstone of the group’s business.

We looked last week at Goldman Sachs’ retreat from consumer finance. This is a different angle on the rapid change in competition for banks emerging from the roller coaster ride in the cost of money.

2. There, by the grace of God

Bloomberg presents an emerging story about scams, crypto, and the downfall of a former chair of a state banking association.

The chief executive officer of Heartland Tri-State Bank (Elkhart, KS) asked if the client would lend him $12 million so he could get his money out of a cryptocurrency investment. He promised he’d pay him back 10 days later, offering $1 million in interest to make it worth his while.

(CEO) Hanes said he knew someone who was helping him invest in crypto. But there was an issue with wire payments, the story went, and he needed to put more money in. At least some had gone to an entity in Hong Kong.

About a week later, after learning from a bank employee that Hanes had wired the $12 million, he went to a member of Heartland’s board. He told the director about his meeting with Hanes and asked if the bank might have exposure. A bank representative then went to regulators. On July 28, the Kansas Office of the State Bank Commissioner declared Heartland insolvent and shut it.

The FDIC expects to foot a $54M loss, for an institution that reported only $139M in assets at the end of 2Q. Heartland’s assets and branches were acquired by Dream First Bank at the end of July.

That is a wrap for this Friday. In more mundane news, musician squabbles with florist over house; painkillers, a deceased nun, and the quote “Fighting an international pop sensation in court is certainly not something I had on my lifetime bingo card.”

Let us know how we did this week by clicking below: