This week, we have a look at mergers and acquisitions in the banking sector in three acts:

- The mixed tale of tape in bank deals YTD

- Goldman Sachs looks to unload their consumer unit

- An insider’s look at the mechanics of M&A valuation and the non-obvious factors.

1. Bank and Credit Union Deals Rebound

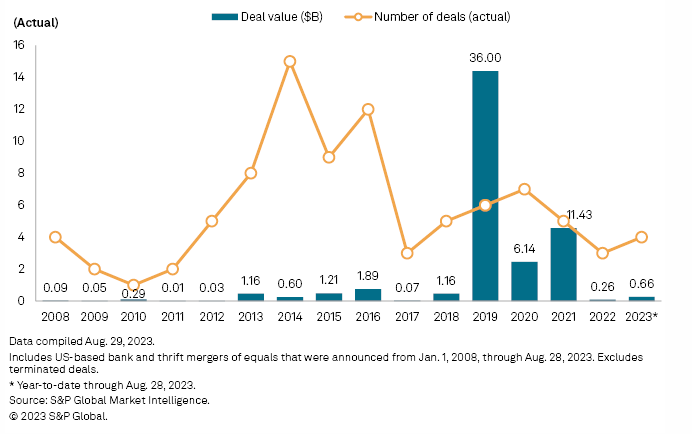

M&A for banks and credit unions acquiring banks have ticked up this year. S&P Global Intelligence reports on the increase of merger of equals deals.

While broader M&A appetite soured this year and led to a slowdown in activity, merger of equals (MOE) activity was unwavering as banks increasingly viewed those deals as an attractive alternative to pair up and gain scale to tackle ongoing headwinds amid a lack of buyers and low valuations. These deals are especially attractive for smaller community banks.

A third of deals resulted in merged banks <$1B in assets, while just over half resulted in banks <$10B.

While whole bank deals have rebounded, the number of branch deals continues to decline.

“Banks have offloaded a lot of ‘excess’ branches in the prior years and have already worked down to more desired levels,” said Stephen Scouten, a managing director and senior research analyst at Piper Sandler. “So, there is just less supply.”

Credit union deals acquiring banks have also jumped year to date.

Ten bank acquisitions by credit unions have been announced so far in 2023, just four shy of the record of 14 such deals last year, excluding terminated transactions. Half of this year’s deals were announced in the four days between Aug. 28 and Aug. 31.

2. Goldman looks to unwind Consumer Deal

Goldman Sachs has put its GreenSky consumer lending unit up for sale..

The reverse course on a consumer strategy, like GreenSky and the souring deal with Apple is part of growing dissatisfaction with the leadership of CEO David Solomon. Most vocal have been employees from those in higher profile and lucrative investment banking.

The bank is also now selling its GreenSky point-of-sale financing business. Yet the acquisition, which Goldman made in 2021 for $2.2 billion, still rankles Goldmanites. The deal never made sense to many people inside Goldman, especially those in its investment-banking division who had spent their careers advising corporate executives on takeover targets. …

It’s not just internal people who have noticed. One former partner who spoke with Insider said that in calling on clients, people had had to answer for Goldman’s consumer-banking missteps.

“It’s kind of embarrassing when you are showing up to a client pitching for M&A business, position yourself as the best M&A advisor, pointing to these credentials, and our own deals have been an absolute mess,” the person said. “The number of jokes clients make, and there is some truth, why hire you to do M&A if you can’t even do your own M&A.”

3. “We need to just iron out the detail of the working capital peg.”

And speaking of M&A, the blog CFO Secrets (written by the “Secret CFO”) has a great series on mergers’ practical, and often messy, ins and outs. A great example of uncovering the hidden parts of deal-making is in the post Uncovering The Mystery of Working Capital in M&A.

The equity value of this business should vary based on the point in the year when the deal completes.

This is where ‘normalized working capital’ comes in. Also known as the ‘peg’.

Why is the peg important?

It goes directly to value.

The seasonal effect of working capital does not. If you buy $10m less working capital than the peg, because of a seasonal low. Sure you get a $10m discount to enterprise value. But you also have to invest that $10m to rebuild the working capital position over the coming months. You are no better or worse off (ignoring a bit of timing)

But if you can move the peg in a direction that favors you. Well, that is real value. It’s as good as a movement in enterprise value.

This, my friends, is where the game gets played.

The seller should want the peg as low as possible.

The buyer should want it as high as possible.

And that’s it for this Friday. I’ve been in this guy’s shoes, but I’ve never come up with a way to turn my kid’s birth into a payday. Click below to let us know how we did: