Alan Murray, CEO of Fortune Media, wrote this week (in his excellent daily newsletter):

Big company CEOs recognize that A.I. will transform their business, but remain uncertain as to exactly how. And they aren’t sure they want the risk of being a first mover. Meanwhile, many smaller companies with less concern about risk smell an opportunity to disrupt. How this plays out over the next few years is impossible to predict. But CEOs ignore it at their peril.

It seems that large banks aren’t the only ones worried about their exposure to more energized and relevant competitors energized by AI.

There is a fear of complexity, of the unknown. It comes from an inability to understand the ins and outs of a new technology and how it will reshape business.

This sentiment sounds like the observations in Leonard Read’s 1958 I, Pencil. In it, Read unpacks the incredible complexity of making even something as simple as a wooden pencil:

There isn’t a single person in all these millions, including the president of the pencil company, who contributes more than a tiny, infinitesimal bit of know-how.

Laissez-faire screeds aside, Read has it right. You can’t know everything, even about the humblest of instruments of school children.

However, embracing the unknown and uncertainly opens the door to opportunity for a disruption of the staleness in large-scale banks.

There is an opportunity for community banks and credit unions to legitimately present a challenge to much larger banks. A challenger who accepts that risk now, before everyone plays follow the leader, could reap rewards many times over.

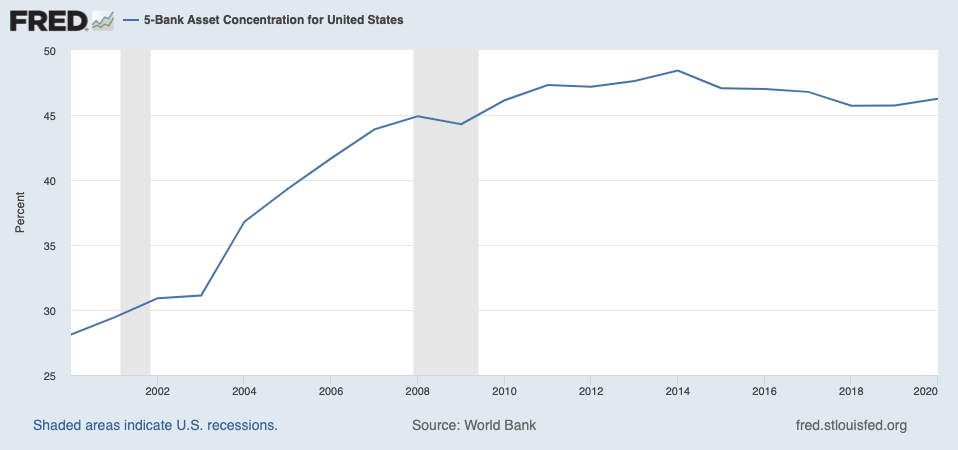

The consolidation at the top of the asset pyramid has only accelerated.

The classic judo move uses the weight and inertia of a large opponent to defeat them. Fearful, taking relatively small steps to avoid the challenging task of change helps maintain the status quo.

I’ll leave the last word to Chris Williamson:

“Opportunities only look like opportunities in the rearview mirror.

— Chris Williamson (@ChrisWillx) August 26, 2023

Today, they look like risk.”