The FDIC sponsored Annual Community Banking Conference recently published their community banking leader survey for 2021.

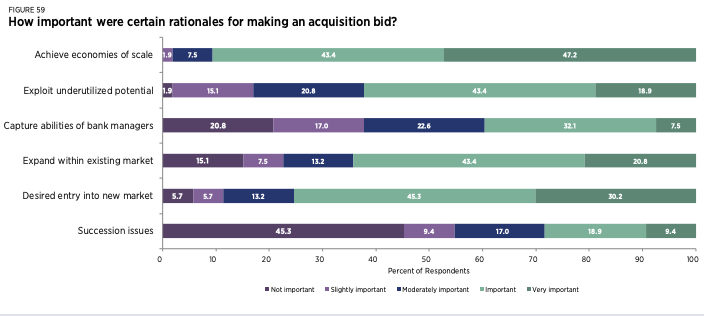

In looking at M&A, community banking leaders cited economies of scale as the highest rationale for M&A activity.

You’re in good company if you think this is the way to grow. JP Morgan has been growing this way for over 30 years.

However, the role back of industry conglomerates like GE, Toshiba, and J&J show that achieving those savings from being bigger and potentially spreading fixed costs across a larger customer base is difficult to execute.

In addition, higher regulatory scrutiny for mergers in the banking sector can be expected going forward.

But now, the large banks have stopped buying other banks. Now they’re buying Fintech companies.

Because the biggest threat to any bank right now is not another bank.

It’s VC-backed Fintech. Companies like Venmo and Cash App have each gained as many depositors in under five years as JP Morgan did in 30 years of major M&As. They did it by approaching customer acquisition like a tech company, not a bank.

These venture-backed companies can grow rapidly while operating at a loss, spending big on advertising with an eye to their next round of funding. You can’t compete or stay relevant in a market like this by simply opening new branches or merging with a bank in an adjacent region.

So even if you think M&A is inevitable for your institution, even if you see no other route to meeting your goals, what fundamentals will drive your valuation? What’s your plan to drive them up above the average so that you can get the high end of that valuation range?

Staying a viable player in a market that’s being disrupted on multiple fronts from channel, technology, and regulatory fronts requires real differentiation—a genuine ability to stand out and provide highly relevant and personal service to your customers. That’s just the way community banks have stood out from the impersonal and faceless customer service models of the nationals.

But now, it’s how you extend that personal, high touch, empathetic experience across all your channels that matters. How you harness your data, particularly your 1st party data, that only you have will make the difference between the market leaders and the also-rans that sold at a discount.

Think about how you can leverage your unique assets to get ahead? Let us help you get started.