“Who’s your biggest competition?” I asked.

“National banks,” was the response, without a moment’s hesitation. I’m on the phone with a CEO of a community bank in the southeast, but I’ve heard this story time and time again.

The thing is, however, the story isn’t true.

In 2021 alone, over $131B flowed into funding Fintech companies globally. IPO’s accounted for $30B in volume led by BNPL company Affirm, emerging market credit/debit card issuer NuBank, trading platforms Robinhood, and Coinbase. M&A and SPACs racked up a record setting $337B, with Block’s (née Square) $29B acquisition of Australian BNPL behemoth Afterpay leading the pack.

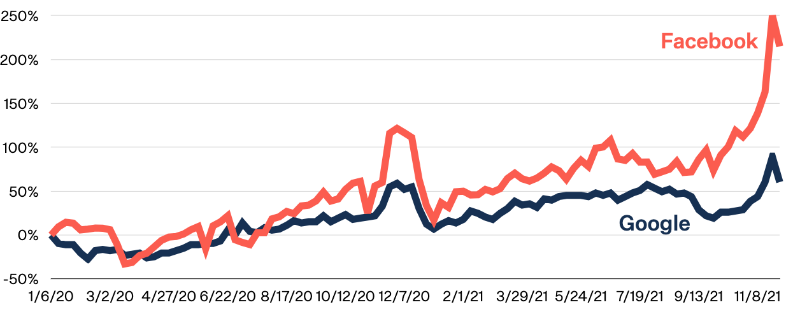

What do the flows of all this capital mean for the local community bank? Even if you don’t think you’re directly competing with these firms, you’re certainly bidding against them in all of your advertising and user acquisition costs.

With literally billions of dollars flowing into the ad driven user acquisition machine of venture backed Fintech companies, how can you hope to keep up let alone stay ahead?

Pouring more money into the top of your funnel and addressing an even wider (and likely less qualified) audience isn’t a long term scalable strategy.

If it feels like you’re running up an ever steeper hill in growing your client base, it’s time to change up the playbook. A quick call can make the difference.