This week a deeper dive into new research on consumer access to banking and other financial services. First is the FDIC annual survey for under/unbanked U.S. households. Also, we have new work on financial inclusion, its linkage to the UN Sustainable Development Goals, and how women in the U.S. stand out in this measure.

1. Covid Programs Result in More Banked Households

The FDIC released its annual survey on Unbanked and Underbanked Households this week. The report shows an increase of 1.2 million banked households since 2019. Almost half of which stated government relief payments led them to open an insured bank/credit union deposit account.

“During the pandemic, consumers opened bank accounts to access relief funds and other benefits quickly and securely,” said FDIC Acting Chairman Martin J. Gruenberg. “Safe and affordable bank accounts provide a way to bring more Americans into the banking system and will continue to play an important role in advancing economic inclusion for all Americans. Today’s results highlight the importance of ensuring consumers who are receiving benefits or starting a new job, two key bankable moments, can easily find and open a bank account that meets their needs.”

Also of note is the rapidly increasing usage of fintech payment products in place of traditional banks:

Use of Nonbank Online Payment Services Increases Overall. Nonbank online payment services such as PayPal, Venmo, and CashApp have quickly become a common tool for many households—banked and unbanked—to conduct financial transactions. Nearly half of all households (46.4 percent) used a nonbank online payment service in 2021, including two-thirds of households younger than 35.

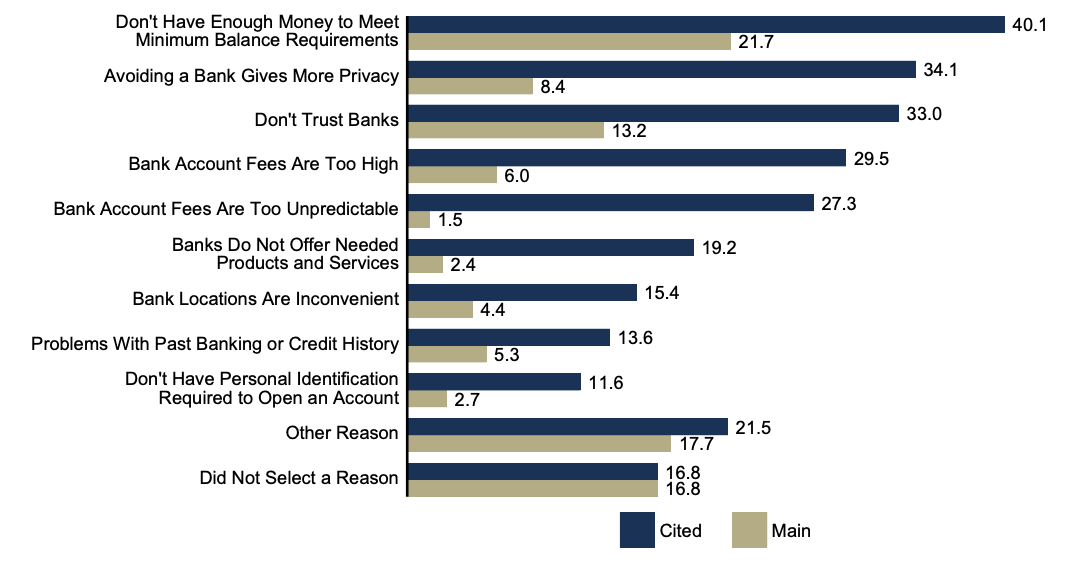

The FDIC’s survey also delves into respondents contributing and main reasons for not having a bank account.

2. The Who and Where of Financial Inclusion

Principal Financial Service this week released its Global Financial Inclusion Index 2022. Principal’s research looked at measures of financial access to and support from government and industry to identify relationships to broader issues.

We found clear correlation between how countries rank for financial inclusion and for indicators such as economic resilience, food security, standards of living, and action on climate change. These relationships suggest how improving access to relevant financial tools, services, and advice might help markets make progress against concerns such as hunger, climate resiliency, and enhancing overall health and well-being.

The U.S., like many other global comparisons, stands out.

The financial inclusivity scores for the U.S. defy categorization. For example, it achieves scores comparable to a mature, backward-looking economy in terms of its government infrastructure but performs more like a young, forward-looking economy in terms of its tech adoption, employer support, and pro-business philosophy.

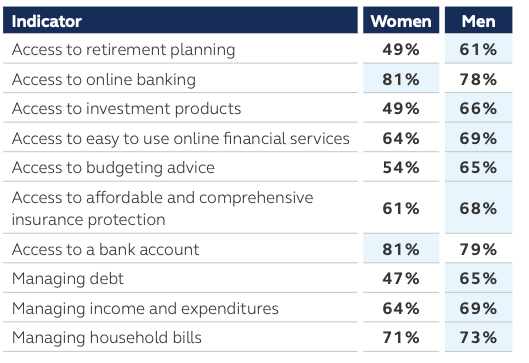

However, there is strong evidence that women in the U.S. feel far less supported by the financial system than men, citing concerns such as access to credit, which could be a limiting factor in terms of the growth of entrepreneurial female-led businesses.

Like other research, women were under-represented in access to financial services and a potential opportunity for community banks and credit unions to address, beyond just as a targeted demographic.

And that’s for this last Friday in October. Time waits for no one.. How are we doing? Let us know at blog@mindspaninc.com, and give it a share to someone who this would help.