Another week, another Friday, and another batch of must-reads for the busy community banker looking to stay out in front. We’ve got another potential Durbin amendment to shake up payments and fee structures for issuing institutions, what the future might hold for your social media customer acquisition channels, and a key data set from the Federal Reserve and how it can help shape your view of consumers and your strategy.

1. Durbin 2.0?

Seema Amble at a16z writes on the potential regulatory shakeup in credit card network fees, aimed at Visa and Mastercard. Like Senator Durbin’s 2010 amendment to Dodd-Frank, this legislation is directed at large incumbents. However, the unintended consequences could hit smaller community FI’s, particularly in non-interest income opportunities.

The legislation, if enacted, would require large credit card-issuing banks with over $100B in assets to offer merchants the ability to route transactions to a second card network, aside from Visa and Mastercard.

The intent of this new legislation is to create competition for Visa and Mastercard, who account for roughly 75% of the market, and thereby lower credit card fees for merchants. However, while the idea of fostering more competition and driving down fees sounds good for the merchant, it’s unclear how much of an impact this act would have in doing so.

So why not just cap fees directly? After all, the EU, Australia, and many others have moved to regulate and cap credit interchange fees. Interchange essentially funds the rewards that issuers provide back to the consumer. Lower interchange means fewer rewards to the consumers. Since the Durbin amendment limiting debit interchange went into effect, debit rewards have almost entirely disappeared. The U.S. is more rewards oriented than other countries, and cutting into them is likely politically unpopular. Moreover, some research has pointed to the increase in other fees, most often borne by the lowest-income consumers. Here, issuers could tack on additional fees for consumers.

2. Thinking of acquisition - the future of Instagram/Meta, TikTok, and social

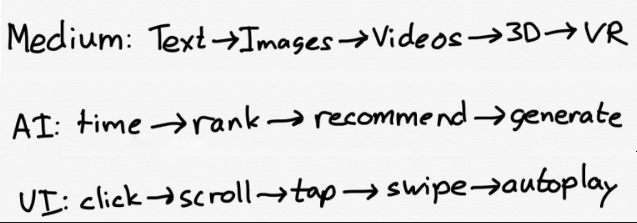

Ben Thompson of Stratechery writes on the existential fight Instagram is in with TikTok, but more so, the long-term trend for social. This is a longer read and analysis, but worth understanding the role that AI may play in supplanting user-generated content and flipping the proverbial apple cart of where most community banks say is their #2 area of digital ad spend.

You can make the case that if Meta survives the TikTok challenge, it will be on its way to the sort of moat enjoyed by the likes of Apple, Amazon, Google, and Microsoft, all of which have real world aspects to their differentiation. There is lots of talk about the $10 billion the company is spending on the Metaverse, but that is R&D; the more important number for this moat is the $30 billion this year in capital expeditures, most of which is going to servers for AI. That AI is doing recommendations now, but Meta’s moat will only deepen if Lessin is right about a future where creators can be taken out of the equation entirely, in favor of artificially-generated content.

3. Household finance and Fed research

The Federal Reserve provides many valuable source of information, most recently updating their Survey of Consumer Finances (SCF). The study provides detailed data and trends on household finances going back to 1983. The Fed offers both the raw data and the research on consumer spending and saving.

The Survey is normally a triennial cross-sectional survey of U.S. families. The survey data include information on families’ balance sheets, pensions, income, and demographic characteristics. Information is also included from related surveys of pension providers and the earlier such surveys conducted by the Federal Reserve Board. No other study for the country collects comparable information. Data from the SCF are widely used, from analysis at the Federal Reserve and other branches of government to scholarly work at the major economic research centers.

Data from this series of surveys can be seen in many studies like Princeton’s Ellora Derenoncourt’s study on the racial wealth gap in the U.S.

And so closes this week. And apparently, it’s Isaac and Chloe, not Issac and Chole. What did you think of this post? Let us know at blog@mindspaninc.com, and if you thought it was worth reading this far, share below.