This week we have some solid data and insights into today and the future. First, a look at the fastest growing brands and payments, thoughts on the rapid advancements in AI, and where racial disparities are starkest in mortgage approval and home buying in the US.

1. Zelle jumps ahead as the fastest-growing brand in P2P

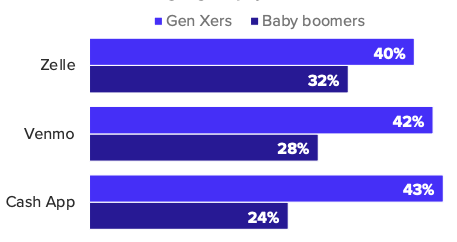

Morning Consult released their annual Fastest Growing Brands report. Chock full of trends and consumer brand affinities across generations, the report also specifically covered the outside growth in purchase intent for Zelle this year, particularly in older customers.

Zelle reached new older consumers.

Zelle showed growth among Gen X and Baby boomers. Trust was a big component in older audiences’ adoption of the payments platform…

With strongholds in the market, Zelle’s differentiator is the ease and security it can provide for more hesitant, late adopters of peer-to-peer payment networks. The brand has leaned into its relationship with major banking institutions to provide older generations with a frictionless way to use its services.

- Ease: Zelle is already integrated into major banks’ mobile apps, allowing users to start sending money right away — no need to download and set up another application.

- Security: Since the bank is already protecting their financial information, users can avoid sharing sensitive information with another third-party business

While P2P has been the wedge for fintech to enter more traditional banking, they still suffer from reputation issues in trust and customer services. These have proven to be an inhibitor to their expansion, starting at least to blunt their growth outside Gen Z and millennial consumers.

2. The noise about AI generation

This week the headlines in AI were all about OpenAI’s ChatGPT and how it might spell the end of Google’s dominance in search, copywriting, and maybe any creative pursuit by a human going forward.

Futurists Kevin Kelly has a great piece in Wired titled Picture Limitless Creativity at Your Fingertips. Kelly looks at many options in image generation and new technology’s disruptive and uneven adoption. He focuses on how, much like Gartner’s Hype cycle, new tech often follows a path of panic.

At its birth, every new technology ignites a Tech Panic Cycle. There are seven phases:

- Don’t bother me with this nonsense. It will never work.

- OK, it is happening, but it’s dangerous, ‘cause it doesn’t work well.

- Wait, it works too well. We need to hobble it. Do something!

- This stuff is so powerful that it’s not fair to those without access to it.

- Now it’s everywhere, and there is no way to escape it. Not fair.

- I am going to give it up. For a month.

- Let’s focus on the real problem—which is the next current thing.

Today, in the case of AI image generators, an emerging band of very tech-savvy artists and photographers are working out of a Level 3 panic. In a reactive, third-person, hypothetical way, they fear other people (but never themselves) might lose their jobs.

3. Missed opportunities

Debra Kamin at the New York Times writes on the discrimination in the home buying process. Based on data from the forthcoming National Association of Real Estate Brokers report, Kamin’s article points to the difference race is playing today in mortgage opportunity and outcome.

In 2021, among Black mortgage applicants, the largest segment — 42 percent — were women applying with no co-applicant. Black males applying alone made up 34 percent, and Black male-female co-applicants comprised 20 percent. Among white applicants, gender composition of the applicant pool was flipped: The largest group was male-female co-applicants, who made up 40 percent, followed by single men, who made up 34 percent. Single women represented only 22 percent of white applicants…

The application success rate of Black female applicants was also up: whereas the loan failure rate — a statistic that includes loan denials as well as loan applications that are withdrawn midway and approved loans that are ultimately not accepted — for Black female applicants was 46 percent in 2008, by 2021, it had dipped to 34 percent. Among white women, the loan failure rate was 23 percent in 2021.

Along with the uptick in Community Reinvestment Act enforcement actions, the disparity in outcomes may invite more regulation, but it also shows opportunity. Like checking accounts for divorced parents, the segments of consumers that don’t have financial offerings and products tailored to their needs is staggering. There is every opportunity today for community banks and credit unions to find unmet needs and differentiate themselves in ways big nationals or fintech are unable/unwilling to do. With the volume and quality of data available to community FI’s, those opportunities are even easier to find and build routes to than ever before.

And that’s the top reads for this week. Man, new empathy for what the dinosaurs went through. How’d you like the post? Let us know at blog@mindspaninc.com.