Here we are on the last Friday in February, and Spring is just around the corner (I’m already looking for the first sign of hummingbirds returning to the yard). Every week we bring you the most interesting and relevant industry and technology news for the community banker who wants to be in the know. This week FI’s assemble to push back on the Fed debit card network deadline, an inside look at Wells Fargo’s phony account legacy, and handling a forced migration of your web analytics.

1. Regulated FI’s ask for delay in debit network ruling

A combined effort by The American Bankers Association, Consumer Bankers Association, Credit Union National Association, National Association of Federally-Insured Credit Unions and The Clearing House petitioned the Fed to delay the deadline on debit transaction routing. Originally put into law as part of 2010 Dodd-Frank Act, delays came around challenges to online/card not present (CNP) transactions. The Fed voted in October to clarify the rules’ applicability to CNP and gave issuers a July 1, 2023, deadline to comply.

The trade groups are arguing for a one and half year extension based on the technical and commercial headwinds smaller community banks and credit unions face in the short term.

Such time pressure also places issuers at a disadvantage during contract negotiations, as processors and their subsidiary debit networks may leverage the issuer’s legal obligations and short deadline for compliance as effective leverage to force concessions from issuers, increasing issuer costs and fraud liability and potentially compromising reliability and security for consumers

The Merchants Payments Coalition, representing retailers, isn’t having it, and claims delays amount to an unfair tax on consumers:

“Congress told banks and card networks a dozen years ago to implement routing choice for all debit card transactions and that meant both in-store and online… That law has saved merchants and their customers billions of dollars for in-store transactions, but the card industry has continued its anticompetitive practices when it comes to online transactions.”

All of this takes place in the shadow of a possible “Durbin 2.0” assault on credit card network routing, so far stalled in Congress.

2. Inside the Wells Fargo Investigation

Kevin Wack at American Banker has a 5 part page-turner titled Alarm bells, arrogance and the crisis at Wells Fargo. Wack details the history of the phony-accounts scandal and resulting coverup that cost the San Francisco bank a $3B settlement with the DOJ and SEC. His final part covers some of the personal fines, many still coming, faced by individual executives.

In January 2020, former Wells Fargo CEO John Stumpf agreed to pay a $17.5 million penalty and consented to a ban from banking. Stumpf had resigned in October 2016, and the bank had already clawed back approximately $69 million of his compensation. His lawyers did not respond to requests for comment.

(Hope) Hardison, who was promoted from HR director to chief administrative officer before leaving the bank in 2018, reached a $2.25 million settlement with the OCC in 2020. Hardison declined to comment…

Three years after retiring as chief risk officer, Mike Loughlin agreed to pay $1.25 million. In early 2021, former General Counsel Jim Strother, who’d left the bank four years before, settled civil charges by the OCC for $3.5 million. Lawyers for Loughlin and Strother did not respond to requests for comment.

3. Google forcing Google Analytics 4 deployments

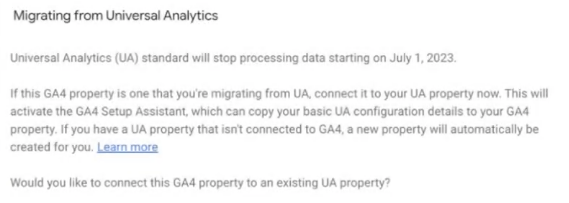

With the July 1 end-of-life deadline approaching, you may have gotten a notification from Google that they will automatically deploy Google Analytics 4 (GA4) for legacy Google Analytics properties next month. If you’ve already deployed GA4, you will want to opt out of this in the UI pop-up below to prevent having multiple GA4 properties for your site.

Additionally, go into the admin menu for your Universal Analytics property, and under “GA4 Setup Assistant” deselect “Automatically set up a basic Google Analytics 4 property”.

If you haven’t taken the plunge yet into GA4, we highly recommend taking a careful and deliberate approach sooner and than later and not via a one-size-fits-all automatic effort by Google. Download our free Google Analytics 4 guide for Community Banks and Credit Unions.

That’s it for this Friday. And, of course, a blog on banking and finance in the cannabis industry is titled Money Puff. Thank you, as always, for reading. Let us know how we did, hits and misses, at blog@mindspaninc.com.