It’s Friday, where we bring you the best we’ve read on being effective as a community banking leader. This week we have a comprehensive look at the successful elements of customer-centric strategies for community banks and credit unions. Also, FIS backs out of its merchant services strategy in the fallout from the disrupted payments market.

1. Putting customers at the center of your strategy

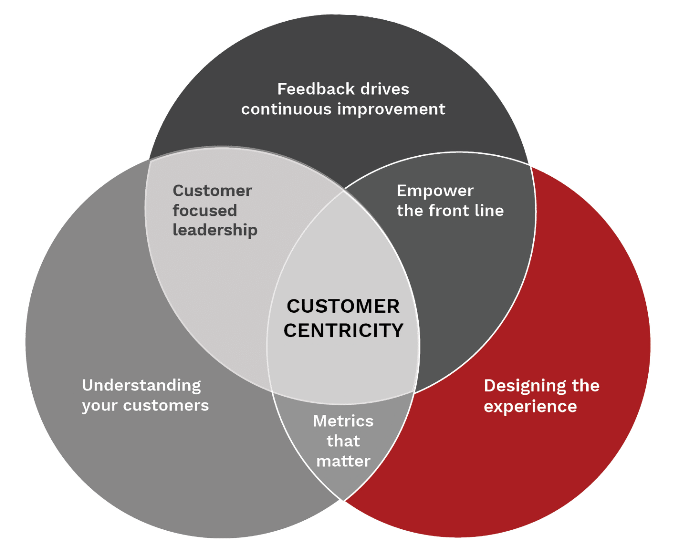

Jim Marous at the Financial Brand presents a well-researched and synthesized thesis in the 4 Priorities for Increased Customer Centricity.

Leaning into practical “walk-the-walk” approaches, the recommendations all point towards getting closer and actively responding to customers and members. This leads to continuously improved service levels and experience.

The foundation is a solid grasp of customer data.

When the customer becomes the core of a business, data is collected, analyzed and deployed on a regular basis to get a full 360-degree view of the customer. This data helps banks and credit unions in the following ways:

- Better understanding buying behavior, interests and engagement across entire customer journey.

- Identifying opportunities for new products, services, and promotions.

- Building segmentation strategies for increased loyalty and lifetime value.

- Empowering employees to better democratize experiences.

Most importantly, the CMO is placed squarely in the middle as the leader of this effort and defender of the brand.

A good customer experience, while important, is only a transactional interaction between the customer and the financial institution. On the other hand, customer engagement involves ongoing, two-way communication and a commitment to meeting customers’ evolving needs and expectations. This level of interaction and commitment can lead to a stronger, more sustainable relationship between the customer and the brand. To achieve this level of relationship requires a central point of authority.

The one thing I would say missing from Jim’s assessment is a lens into competition. You can do all these things, especially as a community bank or credit union, and still fail to stand out from larger institutions and fintech alternatives.

Using a brand investment framework from NYU Stern’s Scott Galloway, apply three considerations to your products, promotions, and experiences plans:

- Differentiated - does this clearly stand out from direct competitors and substitutes?

- Relevant - while it may be different, how important is this to our target market? Does it solve an urgent problem?

- Sustainable - or to what extent can we own this? How does what we’re doing create a moat or barrier to competitors?

2. FIS dumps Worldpay

As part of new CEO Stephanie Ferris’s strategy, FIS announced the spin off of its merchant payment business Worldpay, only four years after the $43B acquisition. The transaction followed competitor Fiserv’s $22B acquisition of First Data just months before.

The move came after a comprehensive review of the business in December, under pressure from hedge fund investors.

Beyond disappointing financial performance, analysts were non-plussed with the spin out approach.

SVB MoffettNathanson analyst Lisa Ellis wrote that she and others were hoping FIS might sell the merchant business if it indeed decided to part ways with it.

“This outcome may still come to pass (once FIS more fully separates Worldpay), but the fact that it has not happened already suggests that an obvious, eager strategic buyer has not presented itself — another indicator that the business is likely deteriorating rapidly,”

The results here come from an increasingly volatile segment. We wrote last week on payment leading fintech investments in 2022. The push by tech (big tech and fintech) to digital wallets, specialized merchant services, and embedded finance continue to disrupt incumbents. Despite pulling back to pre-pandemic levels of funding flowing into fintech, payments remain a desirable wedge to extend a company’s relationship with its customers, potentially building a “super app”.

Watch this sector.

–

And that’s a wrap for this week. Turns out it’s totally OK if your kids eat Legos. Science. Thanks for sticking with us. Feedback and comments help us keep this relevant. Drop us a line at blog@mindspaninc.com.