It’s Friday again, and we’ve got some longer items to dig into for your summer doldrum reading. First is McKinsey’s look at digital working for and not just against the branch, and then a thought exercise on what if Apple was your primary bank.

1. A look at digital channels vs. the branch

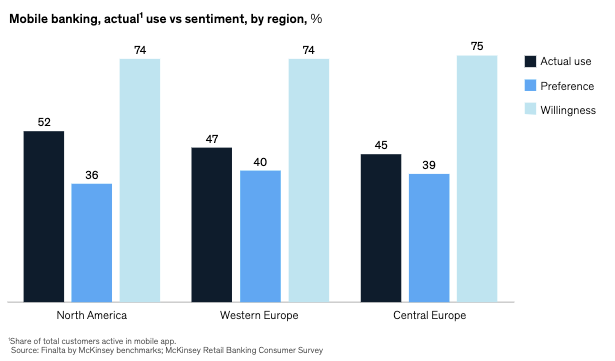

Consulting firm McKinsey & Company looks at the different strategies and performance in Best of both worlds: Balancing digital and physical channels in retail banking. One compelling insight from their research and polling is the gap in consumer willingness, preference, and actual usage of digital banking channels.

While the mobile growth is impressive, mobile service use exceeded customer preference by nearly ten percentage points during 2021, implying that banks haven’t fully won over customers and risk leaving them dissatisfied. Like sales, willingness for mobile is much higher than use (75 percent on average). The disparity among mobile use, preference, and willingness is consistent across regions.

With consumer willingness, preference, and actual behavior out of balance, banks should rethink the prevailing “digitize” mindset, which approaches digital by recreating offline journeys online. Banks applying that mindset have achieved substantial success among early adopters. Now, however, they must not only tailor solutions to digital skeptics but also deliver a true unique-to-digital experience to balance the three dimensions by bringing preference and use in line with willingness

Their work recommends that top-performing FIs continue to advance the functionality and overall experience of their digital properties and make the most of their branch footprint. Using data, segment leaders offer a more personalized approach to smaller segments and enhance their in-branch capabilities and customer interactions.

Digitally enable the human experience. Over a quarter of developed-market banks now offer remote advisory for some complex products. A large Western European bank introduced remote advisory coupled with cutting-edge digital marketing for investment products, boosting assets under management by 1.5 times and doubling adviser productivity in less than a year. Similarly, banks that enhance the physical experience with dedicated features in the bank’s mobile app (for example, queue management, pre-appointment reminders, in-meeting identity verification and e-signature, and post-appointment feedback surveys) can significantly boost customer satisfaction by 60 percent through a blend of physical and digital.

2. Speculative fiction on what an Apple bank account might look like

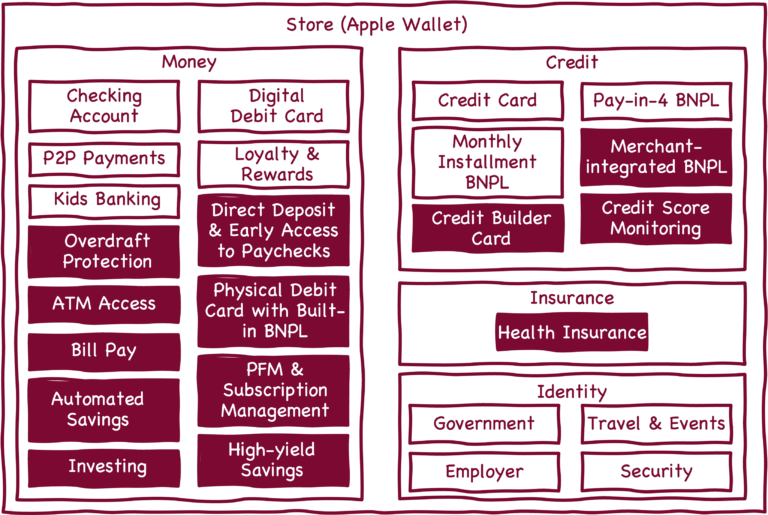

Alex Johnson on Workweek writes on how Apple might approach banking beyond their recent foray into BNPL, and previous entrant into payments and credit card issuance. Alex draws a rough vision of what that might look like and how they might get there.

Assuming Apple chooses to build a more fully-featured bank account on top of its existing Apple Cash product, it would likely utilize a combined checking & high-yield savings structure, with automated savings capabilities that can intelligently shuttle money back and forth. It would have a physical debit card (odds are it would be the best designed, most premium feeling debit card on the market) with virtual one-time and subscription token capabilities and built-in BNPL financing for larger purchases. It would allow for direct deposit, and it would provide two-day early access to customers’ paychecks. It would refund 100% of out-of-network ATM fees and it would have a limited amount of PFM functionality (modeled after the Apple Card UI). I do not think that it would feature any overdraft protection or paycheck advance services (that’s not Apple’s target market) and I doubt that it would include any investing capabilities (feels like a bridge too far for Apple right now).

Green Dot is the current bank partner for Apple Cash. If Apple decides to expand on its bank account product, it could choose to go in several different directions. It could expand its partnership with Green Dot. It could buy a bank or apply for a de novo bank charter, thereby allowing it to directly hold customer funds and realize 100% of the upside. Or it could partner with a smaller, less sophisticated bank, which would require Apple to do more of the heavy lifting on the infrastructure side but would give it greater leverage to negotiate a superior revenue split.

And that’s a wrap for this first week in August. Eminem vs. Rhianna, the polar opposites in lyrical repetition (but you really only get to use Mom’s spaghetti once). How’d you like this post? Let us know at blog@mindspaninc.com and share below. It’s Free!