This week, we look at Fed Chair Jay Powell’s rare public interview and Regional bank troubles in NY.

1. Powel on rates and the economy

Fortune’s CEO Alan Murray writes (in his excellent daily newsletter) on Fed Chairman Jay Powell’s appearance on 60 Minutes last weekend.

Fed chairs don’t frequently appear on television. Paul Volcker almost never did. Alan Greenspan did it once—Oct. 4, 1987—and was asked if he was enjoying his new job. His answer: “So far.” Two weeks later, the market dropped 22%, and he never went on TV again.*

*Of course, outside appearance before Congress.

Selected highlights:

When will you cut interest rates?

“Well, we have a strong economy. Growth is going on at a solid pace. The labor market is strong: 3.7% unemployment. And inflation is coming down. With the economy strong like that, we feel like we can approach the question of when to begin to reduce interest rates carefully.”

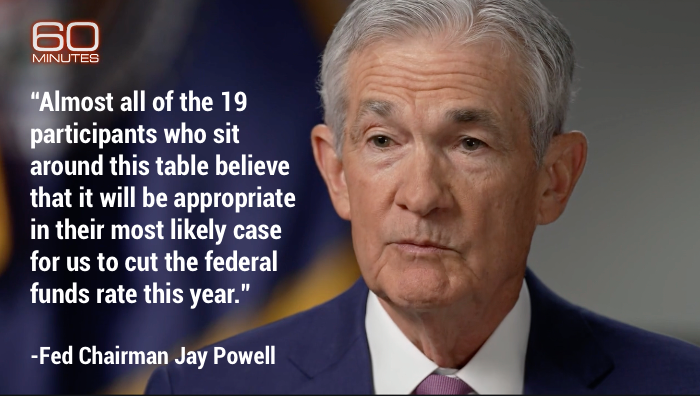

Is there unanimity among Fed officials that it should happen this year?

“Almost all of the 19 participants who sit around this table believe that it will be appropriate in their most likely case for us to cut the federal funds rate this year.”

Will the decision be influenced by the election?

“We do not consider politics in our decisions. We never do. And we never will.”

Should you have raised rates sooner than you did?

“In hindsight, it would’ve been better to have tightened policy earlier.”

Is it unusual to beat back inflation without prompting a recession?

“Yeah, it’s historically unusual… I’ll tell you why I think it is. And that is that it was these pandemic-related distortions, both of demand and supply.”

Is rising federal debt a problem?

“We mostly try very hard not to comment on fiscal policy and instruct Congress on how to do their job when actually they have oversight over us…I would say this: in the long run, the U.S. federal government is on an unsustainable fiscal path.”

With people working from home and office real estate crashing, could there be another banking crisis?

“I don’t think that’s likely…We looked at the larger banks’ balance sheets, and it appears to be a manageable problem. There are some smaller and regional banks that have concentrated exposures in these areas that are challenged.” (see below)

Will China’s economic problems affect the U.S.?

“Our financial system is not deeply intertwined with theirs. Our production systems are not deeply intertwined with theirs…We may feel them a bit, but they shouldn’t be that large.”

Why is immigration so important to the economy?

“Well, first of all, immigration policy is not the Fed’s job…I will say, over time, though, the U.S. economy has benefited from immigration. And, frankly, just in the last year, a big part of the story of the labor market coming back into better balance is immigration returning to levels that were more typical of the pre-pandemic era.”

What’s the greatest threat to the economy?

“I think in the near term, I would point to the geopolitical risks…There’s a war going on in Ukraine. There’s a war going on in the Middle East, and there’s potential trouble in Asia.”

What’s the single most important factor for the future of American prosperity?

“Single most important factor? Well, with your permission, I’ll name two things.

One is I think we need to just remember that we have this dynamic, innovative, flexible, adaptable economy. More so than other countries. And this is the big reason why our economy has come through so well…

The other thing I’ll point to, for the United States, is: There’s a real desire for American leadership. Since World War II, the United States has been the indispensable nation supporting and defending democracy, security arrangements, economic arrangements…And it is clear that the world wants that. And I would want people in the United States to know that this has benefited our country enormously. It benefits our economy so much. And I hope that continues.”

Video and full transcript of the interview here.

2. New York Community Bankcorp’s struggles

Felix Salmon of Axios looks at the flagging performance of regional bank NYCB:

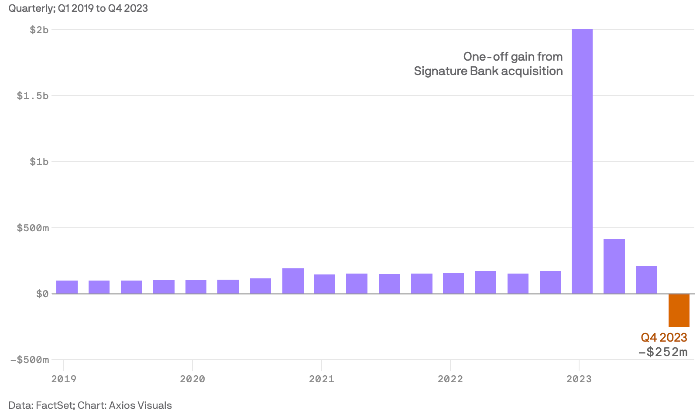

New York Community Bancorp,a midsized New York lender, once looked like a winner of the regional banking crisis of 2023. Now it’s in trouble.

Why it matters: The bank’s shares have been plunging over the past week — and with more than $100 billion of assets, NYCB is big and important enough that its failure, were it to happen, would reverberate nationally and even internationally.

Where it stands: NYCB is not a Wall Street institution. Its headquarters are literally in a town named Hicksville, a place that senior investment bankers might occasionally fly over in a helicopter on their way to their summer house in the Hamptons.

- NYCB’s assets — its loans — are heavily weighted toward commercial and multi-family real estate. The former has been hit hard by the failure of New Yorkers to return to the office after the pandemic, while the latter has suffered in the wake of a 2019 law that made it much harder for landlords to raise rents.

On the anniversary of the last major bank scare, NYCB doesn’t face asset flight, yet. Its biggest trouble is its acquisitions.

- After the two acquisitions, NYCB found itself over the $100 billion mark for total assets — a level which comes with significantly increased scrutiny from regulators and stricter capital requirements.

Driving the news: On Jan. 31, NYCB announced it had lost money in the fourth quarter, after taking a $552 million provision for credit losses on its commercial real-estate portfolio. It also slashed its dividend.

- That precipitated a plunge in the share price, as well as the revelation that the bank’s chief risk officer and chief audit officer had both been pushed out.

- On Tuesday, Moody’s cited “high governance risks” as it downgraded the bonds of NYCB’s parent company to junk status. (Flagstar Bank, however, retains its investment-grade deposit rating.)

And on the topic of banking acquisitions…

“Don’t dabble! Committing is the only way it works.”

From the latest episode of our podcast, Behind the Vault, we spoke with UniFi Financial’s CEO, J.R. Grimshaw, on how they made their acquisition by community FI, Bank of Ann Arbor, a screaming success.

And to roll into your weekend, enjoy this line of copy never seen before: “For eight months, the alleged secret agent was held in custody… then the animal rights nonprofit PETA helped secure the bird’s release.”

Click below to let us know how we did: