Each week, we look at a couple of stories at the intersection of banking, data, and technology that may have been overlooked or offer a unique and contrarian perspective on the world.

This week, more data on CRE risk, and how the big banks are reskinning branches to rebrand as more community-focused.

1. CRE, NPL rates, and reserves

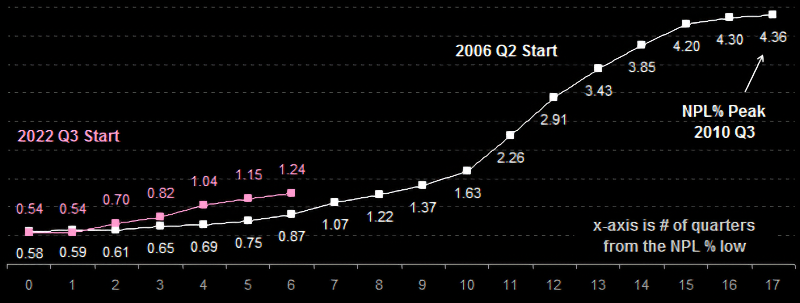

Bill Moreland of BankRegData makes a hard call on the lurking threat of CRE on banking balance sheets in Bank NPLs Signaling Recession?

Pink represents the cycle low and high for each of three periods. The grey shading is the overlaid Recessions as per FRED. The white dots represent the quarter of the first Fed Cut while the gold dots represent the drop to 0% (sigh).

Observations:

1) Note how rising delinquencies overlap and presage recessions.

2) The current period is sharper and faster than 2006 Q2 starting period.

3) First Fed cut (white dots) starts near the inversion of CRE NPLs.

4) Dropping to 0% (gold dots) does not stop the pain.

Bill’s punchline:

My take is that a lot of banks are not well reserved right now.

With a humble fear of being considered Chicken Little, I firmly believe the NPL data points to this getting significantly worse. I look at a sizable number of banks and Merchants Bank is not an anomaly. More and more banks are cascading into a worsening situation.

A disturbing 943 (21.21%) of the 4,446 banks with CRE portfolios have a material Sentry CRE Event flag of 30-89 Days Past Due, Nonperforming, Nonpaying and/or Charge Off. One in 5 banks are now experiencing increasing CRE issues.

For a light rebuttal, I’ll point to our discussion this week with Elizabeth Magennis of ConnectOne, and her take on the systemic risk CRE represents.

2. Big bank branch in disguise

Bloomberg’s Fola Akinnibi talks with interior design firm HOK on their work with large banks to recreate the “third place”, away from work and home, that Starbucks coffee shops pioneered. Increasingly, this is part of efforts to recast the large institutions as more “community focused” and accessible.

“Chase is known as the bank for the rich and didn’t really have a good reputation here in the community,” says Rocky Chowdhury, a community manager at the Harlem location. The new model is an effort to address that perception.

Increasingly, customers are visiting physical banks to receive guidance on products such as mortgages, loans and financial planning, while accessing more basic services online. These trends are industrywide, and Citi isn’t the only bank to rethink its physical spaces in response. JPMorgan Chase & Co. has renovated 2,300 Chase branches since 2018 and plans to redo 1,700 more by 2027; at one of its branches near New York’s Grand Central Terminal, there are more than 50 offices for advisory services and no teller lines.

And that is it for this Friday. In the wake of its recent bankruptcy, some wild stories have emerged about Red Lobster and its ill-fated Endless Shrimp offer, including this killer quote, “Some people are just a different type of stupid, and they all wander into Red Lobster.” Click below to let us know how we did: