This week, we have three must-reads on the changing future of community banking:

- The spike in turnover in smaller institutions and what’s in play beyond table stakes compensation.

- We look at what’s holding back FedNow adoption and what the feds might do about it.

- An economist’s look at Generative AI and how it might return employment to the 1970s.

1. Retention, culture, and compensation

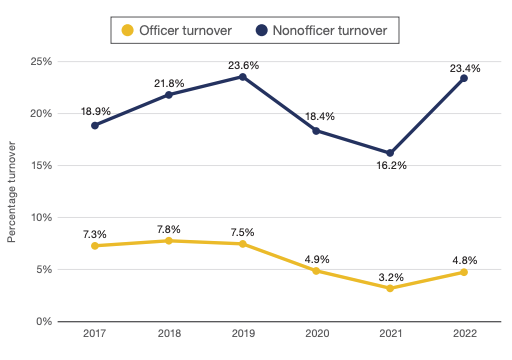

Financial consulting firm Crowe published their 2022 banking employment survey. The report presents data collected from institutions mostly with under $5B in assets. The chart above highlights the stark issue of non-executive/officer turnover, jumping to 23% in 2022 after a dip in 2020-2021.

In work related to why people leave jobs, Brett & Kate McKay presented a framework based on Albert Hirschman’s Exit, Voice, Loyalty: Responses to Decline in Firms, Organizations, and States.

The exit, voice, loyalty, neglect (EVLN) framework will help you understand why people stay in or leave a relationship (including friendships), why people stay in or leave a job, why people stay in or leave a church, and many more of life’s interpersonal and institutional dynamics.

One important cultural factor is how strongly someone believes they are heard.

Efficacy of the Response

In deciding between exit, voice, loyalty, and neglect, people will also consider which response will be the most effective at resolving their dissatisfaction.

A big factor in whether someone thinks a particular response will be effective is whether they believe there’s hope for improvement. If someone has this hope, they’re more likely to choose voice or loyalty; if they don’t, they’re more likely to choose exit or neglect.

The whole article is worth reading and using as a guide to assessing your team, department, or institution’s ability to retain your best and most valuable talent.

2. The headwinds for FedNow

Seema Amble of a16z writes on the systemic issues that are slowing the adoption of FedNow by institutions of all sizes.

Any financial institution that wants to work with FedNow will have to consider if it wants to invest in the technology required to connect to and maintain a connection to the service.

Fraud and risk controls are also major concerns. Each FI on FedNow will be responsible for creating their own end-user interface and implementing most of the security around the faster payment transactions. The Fed has said it will launch some controls, but the responsibility sits squarely with the FIs….

Pricing is also still unclear. For 2023, the Fed will waive the participation fees for banks, though they will have to pay a monthly $25 fee for each routing transit number enrolled to receive credit transfers from the FedNow service starting in 2024.

Aaron Klein of the Brookings Institute puts the onus on regulators to drive adoption* like programs in Brazil, India, and Thailand.

“If you saw a regulatory action that required faster funds availability, you would then see the type of changes that have occurred all around the rest of the world where there’s huge demand” for faster payments, he said, suggesting the U.S. is behind other countries in which quick electronic payments are more widely adopted.

*One weakness of these comparisons is the relative percentage of unbanked populations contributing to the leapfrogging of traditional banking into payment services. More on neobanks’ role in Brazil’s RTP system here.

3. Gen AI and the middle class

Behavioral economist Noah Smith has collected several emerging studies on the impact Generative AI may have on skills. In particular is the capacity for generative AI to level the playing field in skills, unlike AI power tools before. Smith notes studies in the areas of education, programming, law, creative writing, and customer support:

The productivity impact of AI assistance is most pronounced for workers in the lowest skill quintile…who see a 35 percent increase in resolutions per hour. In contrast, AI assistance does not lead to any productivity increase for the most skilled workers…Less-skilled agents consistently see the largest gains across our other outcomes…These findings suggest that while lower-skill workers improve from having access to AI recommendations, they may distract the highest-skilled workers, who are already doing their jobs effectively.

Lowering the skill required to leverage computing removes the requirement for more experience and education for many tasks.

It looks increasingly likely that traditional IT acted like a shovel — something that complemented people’s natural abilities — while generative AI acts more like a steam shovel. A steam shovel handles the muscle-power for you… Technologies that substitute for natural ability tend to make natural ability less scarce, and therefore less valuable.

He additionally draws parallels to the availability and cost of energy combining to return wage growth and gaps to pre-1970s level potentially.

Not without controversy, it’s a view worth reading and considering, as it potentially exposes a shift in long-term trends in employment, hiring, and economic outcomes.

That’s a wrap for this week. Those that lament lax enforcement of financial crimes haven’t seen where sentences exceed the half-life of Carbon-14. Click below to let us know how we did: