This week, a look at support for the CFPB’s Open Banking rules, check cashing vs. traditional banking, and a top-down view of credit and debit cards market size.

1. CFPB data rules

Security expert Bruce Schneirer analyzes the proposal from the CFPB in their pending change to the CFPA titled Personal Financial Data Rights. Schenirer is a voice often quoted in the domain of security, and he has little sympathy for legacy system issues.

On the banking side, the steady consolidation of the banking sector has resulted in a small number of very large banks holding most deposits and thus most financial data. Behind the scenes, a variety of financial data clearinghouses—companies most of us have never heard of—get breached all the time, losing our personal data to scammers, identity thieves and foreign governments.

The CFPB’s new rules would require institutions that deal with financial data to provide simple but essential functions to consumers that stand to deliver security benefits. This would include the use of application programming interfaces (APIs) for software, eliminating the barrier to interoperability presented by today’s baroque, non-standard and non-programmatic interfaces to access data. Each such interface would allow for interoperability and potential competition. The CFPB notes that some companies have tried to claim that their current systems provide security by being difficult to use. As security experts, we disagree: Such aging financial systems are notoriously insecure and simply rely upon security through obscurity.

The use and handling of financial data is increasingly becoming a required core competency for financial institutions of all sizes. The regulator costs of mistakes are rising. However, that burden is also compounding the value of 1st party data, and opening competitive advantages for even the smaller organization that can harness it to provide unique and standout offerings and service.

2. The business of check cashing

Banking and payments expert Patrick McKenzie (aka @patio11) writes a direct and blunt assessment of the check cashing industry and how it manages to co-exist with traditional banks.

The clerk at a check cashing business is not a bank teller. She does not disdain talking to poor people; being able to do that in such a way that most poor people end up liking her is her job. Don’t take my word for it; take the customers’. We have studied this industry extensively. We ran surveys. The customers keep saying things like “I like my local check cashing place because the girl behind the counter is kind and doesn’t judge me like those #%*(#%( at the bank.”

You can present as being kind to almost all of your customers and be obviously unemployable as a bank teller.

3. Card Chronicles

Finance data visualization blog Genuine Impact presents a look at the stats around the credit and debit industry by issuing networks.

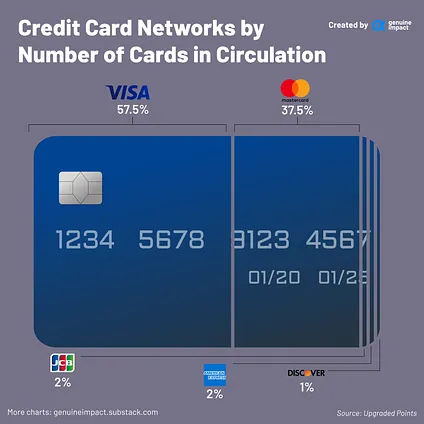

Out of all credit cards in circulation globally, 57.5% of them are from Visa- that’s a huge amount! The next most popular credit card network is Mastercard, responsible for 37.5%. These two networks alone make up 92% of all credit cards in circulation. The next 3 highest are JCB, American Express (both at 2%), followed by Discover (1%).

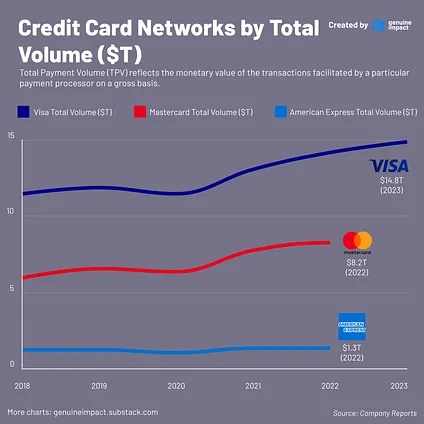

Visa comes out on top again for credit card networks by total volume, with almost $15T in 2023. Mastercard has consistently had just over half of Visa’s total volume, while American Express is a lot lower. Perhaps one reason here could be down to AmEx’s higher processing fees for merchants. Another thing to note here is they all demonstrate a slight dip in total volume in 2020 which is obviously down to people spending less during Covid.

The Genuine Impact teams also present an interesting look at the top purchase volume by debit card issuer, with the overwhelming top positions of Chinese mega banks.

Check out the latest episode of our podcast, Behind the Vault. This week, we spoke with Toshiba Global Commerce COO Gregg Margosian about how consumer demand for self-checkout is changing the face of retail and payments.

A thought to leave you with for the week is advice from Irish professional golfer and 3-time major champion Pádraig Harrington on sharing your hobbies and passions with your kids.

If you’re a dad and you want your kids to share hobbies with you, watch this video.

— Nick Huber (@sweatystartup) December 19, 2023

Nothing is more important to me in life than sharing memories with my kids and making them want to be around me when they’re old enough to not be around me.

pic.twitter.com/dkbMxHZMVK

Click below to let us know how we did: