This week, Visa and MasterCard give (kind of) on card interchange fees, the big banks sending business to CDFIs, and Ed Thorp continues his streak of success at money and life into his 90s.

1. Lower swipe fees, but merchants are not happy

In the continuing class action lawsuit against the card issues, a settlement on fees is the latest development in litigation that dates back to 2005.

The legal team that struck the deal for the merchants said that would amount to eliminating $30 billion in fees over five years. The networks and banks collected $72 billion in total interchange fees last year, according to card data company Nilson Report.

The pact would lower all rates by 0.04 percentage point for three years, and the average rate across the networks would be lowered by 0.07 percentage point for five years.

Beyond the eye-popping rate change, the settlement also allows merchants to charge different fees to customers based on their card choice. From Bloomberg:

The deal, if approved by courts, will finally allow US merchants to charge customers extra when they’re paying with certain types of Visa and Mastercard credit cards. That threatens to upend the world of luxury credit card programs in the US, where banks charge pricey annual fees in exchange for offering perks like airline miles or hotel stays and ride credits.

“Forcing consumers to think about the surcharge, if you’re the merchant, creates a lot of friction at the point of sale, for not that much gain and benefit,” Lulu Wang, an assistant professor of finance at the Kellogg School of Management, said in an interview. “If all you’re saving is a small percentage point for holding up one of your highest paying customers, you’re holding up the line.”

2. Bank of America connects SMBs and CDFIs

BoA, in conjunction with non-profit Community Reinvestment Fund, launched a referral portal to connect SMBs and local Community Development Financial Institutions (CDFIs).

More than 150 CDFIs and other support organizations participate on the platform, offering capital and other resources for small businesses.

“When small businesses have access to responsible capital and other resources, they create jobs, grow wealth and provide critical services for communities,” Patrick Davis, senior vice president of platform at technology services at CRF, said.

Sharon Miller, president of small business at Bank of America, said: “Thousands of small businesses fail each year because they lack the connections, resources and funding to continue operating. Through this longstanding partnership, we aim to help make connections stronger between startups, entrepreneurs and funding partners to fuel new ideas, jobs and economic value.”

BoA is expanding on their 2021 launch Access to Capital Directory targeting Women-owned businesses. Their approach joins similar efforts like Citi’s Bridge marketplace, and Wells Fargo’s Small Business Navigator.

For an inside take on CDFI’s see our discussion with OneUnited’s Teri Williams.

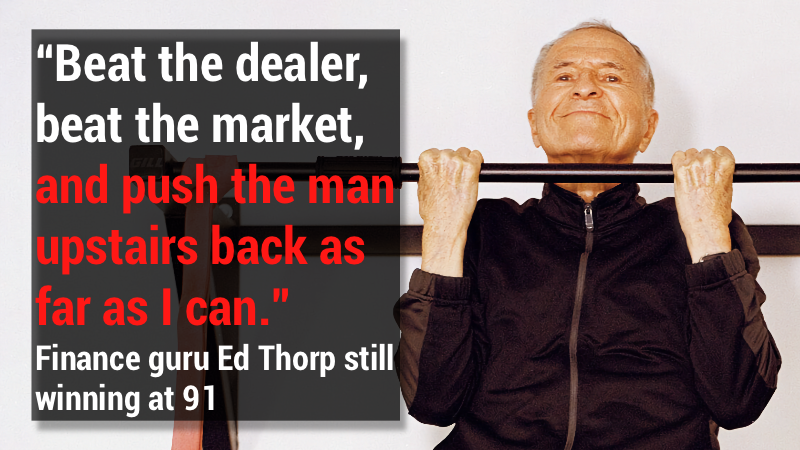

3. The smartest man in finance on beating the house in blackjack and being fit at 91

Polymath and legendary finance innovator Ed Thorp recently gave an interview to Bloomberg. The focus is on his unbelievable health and fitness level, but it also delves into his fascinating life and how it impacts his approach to growing old well (I’m really surprised no one has made the movie on Ed’s life yet).

Some highlights:

“The goal is to have a long life that’s also a healthy, productive one. As opposed to being in assisted living somewhere. I think of it as having two parts. One I’ll call defense, in which you minimize the chance of really bad outcomes of one sort or another. And you try to eliminate weak links. It just takes one weak link to finish you off. Like alcoholism or a terrible skiing accident.”

“I take maybe four or five supplements. So we took Fosamax and then Boniva for three years. The change was remarkable. I’d had a steady climb over the last 20 years from first this Boniva and Fosamax experience and then taking regular calcium, magnesium, vitamin K, vitamin D supplements. The turnaround was remarkable.”

“Another interesting supplement is Finasteride, which I take for an enlarged prostate. That’s a neat drug, because I noticed after I started taking it that my thinning hair simply stopped thinning. It’s been the same for the last 20-plus years.”

Beyond health and agin tips, here are a few great resources on Ed if any of this piqued your interest:

- His interview with Tim Ferriss from 2022 (you won’t believe he’s 89 at the time of recording)

- David Senra of the Founder’s podcast concise lessons learned from this autobiography

- Ed’s autobiography, which includes a wild story about working with information and computing pioneer Claude Shannon (namesake of Anthropic’s ChatGPT competitor) on building a wearable computer to predict roulette wheels movement, and the mob poisoning him and cutting the brakes on his car.

That’s a wrap for this week. Many of you have financial education as part of your service; I wonder about the right approach for this person seeking advice on a major life event (the comments pull no punches). Click below to let us know how we did: