Each Friday, we look at what bubbled up in our reading for the week, often where banking and technology overlap, and what piqued our interests and stood out.

This week, lobbying by the big nationals gets results with the Fed on risk, and the emerging trend in the combining of headcount and software spending.

1. Fed Regulators Softening on Big Bank Capital Requirements

The WSJ reports on word that regulators are backing off capital increases for the largest US banks.

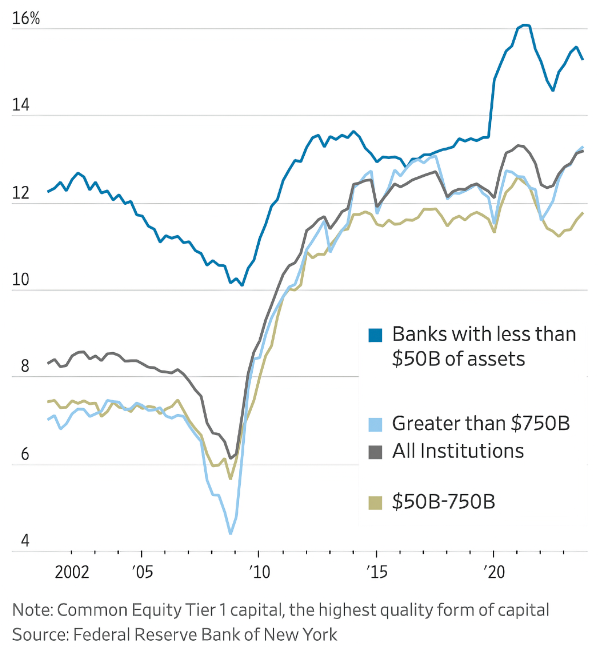

In bottom-line terms, regulatory agencies had previously estimated that the core capital requirement for the largest categories of banks would rise by 19%. That would translate into roughly $150 billion more capital for the eight U.S. global systemically important banks

With Federal Reserve officials hinting at changes to the proposal earlier this year, bank stocks have been solid performers. The KBW Nasdaq Bank index is up 10% in 2024, just shy of the S&P 500’s 11% rise.

Taking back half of that potential increase for those very largest banks—or roughly $75 billion—would likely deliver on investors’ expectations. Some analysts and industry groups even believe the original proposal’s increase would have been larger than the 19% projection.

The 8 systemically important banks targeted by this part of Basel endgame regualtion are BoA, Mellon, Citi, Goldman, JPMC, Morgan Stanley, State Street, and Wells Fargo.

This change in attitude by regulators is apparently the result of JPMC’s Jamie Dimon’s effort to rally his fellow banking leaders and take advantage of the lack of consensus at the Fed.

Dimon at a meeting in Washington last fall told his fellow CEOs to bypass Michael Barr, the central bank’s vice chair for banking supervision and the main architect of the original plan. Dimon urged his fellow bankers to instead press other Fed governors, in particular Chair Jerome Powell, to alter the proposed capital rules.

By doing so, the bankers hoped to capitalize on internal disagreement and concern on the seven-member Fed board over the regulatory proposals.

Barr is still in charge of shepherding the plan day-to-day, but is now closely coordinating with Powell, who is playing a more active role.

In March, Powell said that the new rules won’t be finalized without broad and material changes. He also said any plan would have broad support on the board and opened the door to scrapping the existing plan and starting over again with a fresh proposal.

2. AI eats Noninterest Expense

In his piece Ayo Kunle writes on the growing shift of opex into AI enable software spend.

Many industries that have heavy documentation burdens + a talent shortage + high turnover will benefit from AI being deployed.”

CEO Satya Nardella’s comment is that Microsoft is for the first time seeing this discussion happen inside their customers. Said plainly, in 2024 a lot of corporations will start funding software spend from headcount budgets.

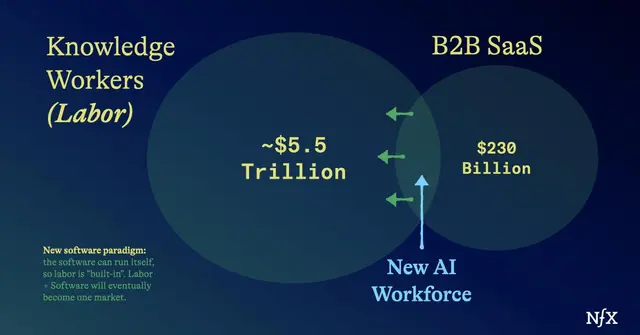

We wrote previously on the investor view, notably from VC firm NfX on how that shift changes both how software is funded but also what it is being asked to do at a corporate level.

With traditional B2B SaaS, we augmented human work and services with software. Now, the software itself is doing the whole job.

AI is forcing a reversal of the SaaS acronym. From Software-as-a-Service to Service-as-a-Software.

Across the whole economy, this means the labor market, and the software markets have been separate – and within a company, the hiring budget has always been orders of magnitude larger than the software budget.

Now, software can both organize and execute tasks. Labor and software are fusing into one massive market.

That’s it for this week. Not all can resist the siren’s call of endless shrimp -> “Some people are just a different type of stupid, and they all wander into Red Lobster.”” Click below to let us know how we did: