Every week we highlight a couple of stories at the intersection of banking, data, and technology that either fell through the cracks, or present a unique/contra view of the world.

This week, the trend of US banking branches, FedNow courts Fintech’s help, and how AI is linking the software and labor markets together in a new way.

1. The retreat from peak bank branches

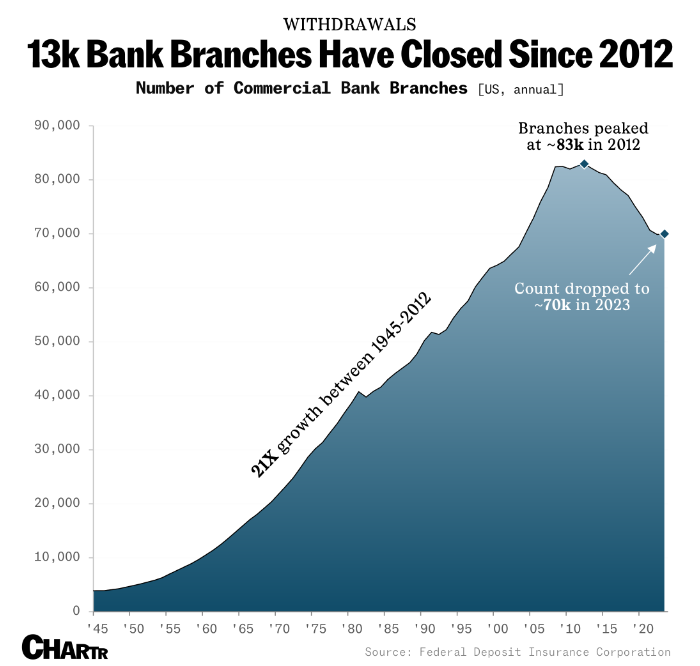

Chartr (recently acquired by trading app Robinhood) put together the above info graphic on the past decade’s decline in commercial bank branches in the US.

After decades of near-constant expansion throughout the 20th century, America has been shutting commercial bank branches during the last ~10 years, losing some 13,000 since 2012, per data from the Federal Deposit Insurance Corporation (FDIC).

Data from S&P Global showed that bank branch closures had slowed in 2023, while the FDIC, which tracks the institutions that it insures, also saw that number stay roughly flat (+0.1%).

Last week, JPMorgan closed its historic branch at 45 Wall St., ending its 150-year stint on the iconic street where John Pierpont Morgan and his ilk created the building blocks for what would become America’s largest bank.

Despite leaving Wall Street, JPMorgan is far from retreating from physical banking entirely: last year, JPM was a “net opener” of banks, and the company recently announced plans to open 500 new branches by 2027.

2. Fed courts Fintech for FedNow growth

While not offering direct access to its payment rails, the Fed is soliciting participation from core and other tech providers to spur adoption on FedNow.

The Fed is prohibited from connecting directly with fintechs because its congressional mandate only allows it to link with banks, or core service providers acting on banks’ behalf.

Fintechs can help the Fed see what’s on the horizon for the new faster payment system and allow the new real-time payments services to be easier to use, said Mollie Markham, a Federal Reserve Bank of Chicago specialist who works with nonbanks.

“Those core providers are really going to help us get the long tail of adoption, and maybe ramp up to a quicker adoption pace as we go,”

This effort appears to be in response to the seamingly slow adoption of FedNow to date.

FedNow had onboarded about 600 of the 10,000 some financial institutions in the U.S. as of March, but Fed officials are in the effort for the long run. Some major banks have not signed on with FedNow.

Markham said she would preempt one question she knew was coming by saying that the Fed isn’t yet willing to disclose FedNow’s payments volume at this time.

3. The AI Workforce is Here

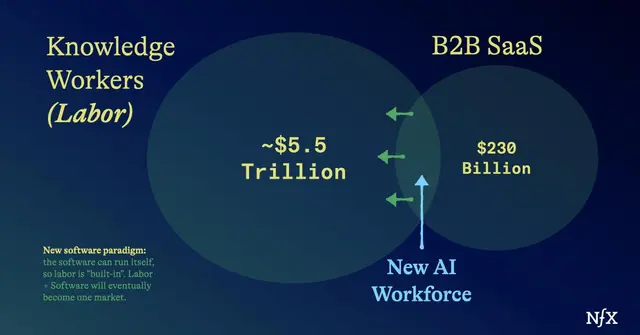

AI is impacting so many individual industries, the broad economic impacts are now being examined in detail. Pete Flint and Anna Piñol of VC firm NfX look at how AI may transform both the software and labor markets.

With traditional B2B SaaS, we augmented human work and services with software. Now, the software itself is doing the whole job.

AI is forcing a reversal of the SaaS acronym. From Software-as-a-Service to Service-as-a-Software.

The big picture: the rise of AI workers is creating a fusion of the software and labor market. This is going to create massive opportunities for Founders.

Across the whole economy, this means the labor market, and the software markets have been separate – and within a company, the hiring budget has always been orders of magnitude larger than the software budget.

If you run a very rough calculation, US businesses spend upwards of $5 trillion on knowledge workforces. By comparison, companies spend about $230 billion on B2B SaaS.

Now, software can both organize and execute tasks. Labor and software are fusing into one massive market.

The rest of the article dig into use cases and the characteristics of areas where AI excels and human labor may be weak. Home many of these factors are relevant to your operations?

- Large amount of process is automatable. This includes simple, repetitive, high volume tasks. This likely does not include complex, multi-step, bespoke tasks, initially.

- Human labor is particularly expensive.

- Hiring is difficult and there are poor labor market dynamics (including worker shortages and attrition)

- Long “time to ROI” for human workers (e.g. significant onboarding/ training required)

- High level of tool fragmentation, which provides an opportunity to consolidate tools into one top layer.

- High fault tolerance: i.e. the stakes are not life or death.

- Fields with large amounts of training data – preferably proprietary

Where does AI add additional value that may go beyond that of a human worker?

- Personalization will drive significant customer value

- Speed is a key factor in service quality, and 24/7 service matters

- Heterogeneity is a hindrance to high quality service

So closes this last full week of April. “If you talk to 1,000 Americans and say, ‘Where do you think the tallest building in America should be?’ I don’t think anyone would pick Oklahoma City.” Click below to let us know how we did: