This week, we look at Accenture’s surprisingly optimistic outlook for banks in 2024 and how providers are struggling to develop the fraud tools needed for growing real-time payments adoption.

1. Banking Trends for 2024

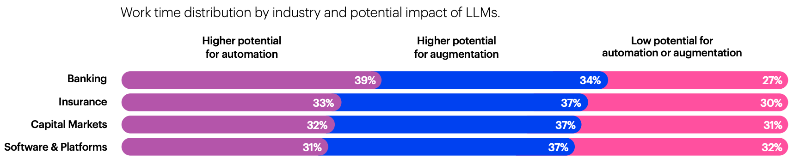

Accenture published their annual trends in banking research report. The report covers areas from gaps in digital capabilities to emerging risks (like real-time below), overcoming the drag from legacy cores, and re-thinking operating models. However, the biggest impact on financial institutions will likely come from the successful use of AI.

As we enter the Age of AI, many bankers feel the same sense of awe that their counterparts did a quarter of a century ago as they stood on the verge of the Digital Age. Michael Abbott / Accenture Global Banking Lead

The opportunities are not just generative AI but also the ability to quickly extract insights from data to provide improved pricing and service levels in areas like recommendations and advice. Well worth digging into is the section on Capturing the Digital Divide:

While most banks have mastered digital, its focus—more often than not—has been on servicing. Turning even a modest number of digital interactions into opportunities holds immense potential. To do that, banks will need to find ways to have meaningful conversations with customers across digital channels.

2. Fraud concerns grow with real-time payments adoption

With the accelerated adoption of real-time payments, including The Clearing House’s RTP, FedNow, and Zelle (if settled with RTP), fraud presents new threats. What is clear from talking to banking leaders and heads of payment operations is that the tools available to institutions lag behind the quickly evolving threats.

The Fed’s recent meetings with institutions and partners have highlighted this gap and the urgent effort on the part of system operators and vendors. FedNow’s head of product development, Bernadette Ksepka, spoke to participating banks last month with a promise of better capabilities to manage risk.

As it’s building out the new system, the Fed is planning to enhance “configurable fraud controls,” among other improvements, she noted as part of a slide presentation. Those tools will be in addition to some FedNow fraud-prevention capabilities and reporting requirements that were there from the start.

“We know that fraud is top of mind for many of you, and it’s definitely top of mind for us,” Ksepka said.

Exposure to fraud is often cited as the leading reason for FIs not implementing real-time payments. Balancing that risk against customer demands for lower friction banking puts institutions in a difficult position, sometimes to great cost.

Fintech Plaid is expanding its fraud capabilities, specifically to address the growing demand for real-time payments. Mollie Curran, payments lead at Plaid, points to where they are building new capabilities for customer institutions.

Risks are threefold, she contended. There’s identity risk — that merchants, banks and platforms can trust that someone is who they say they are. Solidifying that trust means ensuring that know your customer (KYC) systems are connected to the rest of the commerce ecosystem..

Account risk (like account takeover) mandates that verification and monitoring are robust. And finally, there remains transaction risk, which involves making sure the receiver of funds is legitimate as well.

That’s a wrap for this week. Still wearing an onion on your belt like it’s 1993? That’s OK because it was the style at the time.. Click below to let us know how we did: