One of the most valuable uses of data is prediction, especially when it points you in the right direction. We’ve covered how looking at customers through the lens of Lifetime Value as an onramp to personalization, increasing retention of existing customers, and setting a winning strategy.

With a predictive view of individual customers, there are three main ways you can drive significant impacts on your community bank or credit union:

-

Getting New Customers: A useful prediction of customer behavior supercharges your targeting and acquisition of new customers and members. It helps you avoid spending too much money and ensures that acquired customers will be profitable in the long run.

-

Keeping Your Best Customers: Understanding what your customers like and don’t like is indicated by their transactions, and how much money they deposit and borrow over time. Optimizing your offerings, terms, experience, and communications is the path to better product decisions and marketing overall.

-

Finding Opportunities: With a view towards more defined segments, ideas for new offerings are easier to identify and test. This fuels your ability to serve customers better and set yourself apart in ways meaningful to your best customers, hard to copy by competitors, and sustainably profitable.

Most insights from work like this are, understandably, kept confidential. Efforts like this yield valuable competitive advantage. However, researchers at UC Berkley published a case study on the Royal Bank of Scotland’s implementation of a customer experience focused reinvention of their retail banking brands.

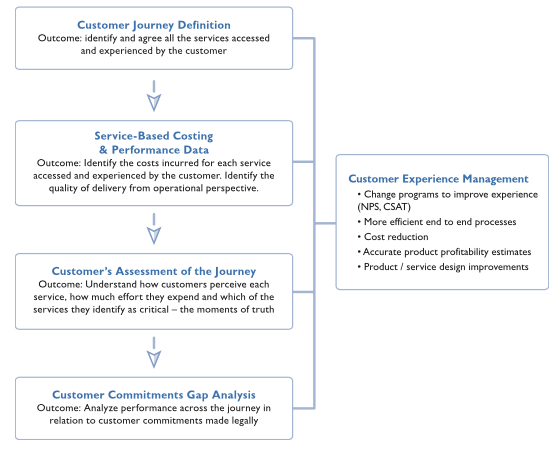

A cornerstone of this approach was their focus on measuring revenue and costs, customer based vs. product/service line value, in their process. While broad in the parts of the business the program touched, working through an LTV expansion at a program-by-program level helped the bank generate a net +15-20% of operating income and a reduction of account churn by more than 6%.

To acquire and retain profitable customers, businesses must leverage the wealth of customer data available to them. Analyzing customer behavior through Lifetime Value analysis and predictive modeling enables tailored marketing strategies, optimized product offerings, and identification of new opportunities. By investing in a data-driven approach to customer management, businesses can stay competitive and succeed in today’s market.

If you think your organization could benefit from a lifetime view of your customers, let us know. You can leverage our experience and tools to jumpstart your effort and get the quick wins to build momentum and a virtuous cycle of success that changes the direction of community institutions.