We’ve looked at the warning issues commercial real estate in general, but multifamily real estate (MFR) loans may be the first shoe to drop for mid-sized institutions.

Bill Moreland’s must-read BankRegData has an excellent in-depth analysis of the trends in MFR and the patterns that emerged in 2008 to watch for.

While at arm’s length, there doesn’t seem to be an issue, Moreland points out three factors to consider:

2023 Q2 NPL % of 0.21% is up slightly from the 0.15% to 0.13% from 2017 through 2019, however, is lower than the majority of the past two decades.

With such fast recent MFR growth it’s important to remember that as the denominator (MFR Loans) grows quickly the delinquency rates will naturally have downward pressure. As the loans’ age’ you would expect delinquencies to increase.

In the last major recession it took NPLs 4 years to hit peak delinquency going from 0.29% in 2006 Q2 to 4.56% in 2010 Q2. What’s interesting is that NPLs climbed quickly at first and then 30-89 Days Past Due (Early Stage) climbed later and peaked earlier. Peak 30-89 was 1.21% in 2009 Q2 with peak Q2 NPLs coming a year later.

Part of this is that MFR likely goes straight through delinquency, not lingering in current to early stage. Another part is a possible reluctance to Charge Off loans so they sat in NPL longer than normal.

And the concentration of growth in MFR is in banks with assets from $500M to $1B:

A rise to 4% NPLs at $600 Billion of MFR loans would mean NPLs rise to $24B, drastically above the current $1.27B.

Even a rise to a not-unrealistic 2% would result in $12B of NPLs.

The double whammy affecting the situation now is spiking insurance costs. Konrad Putzier at the WSJ writes:

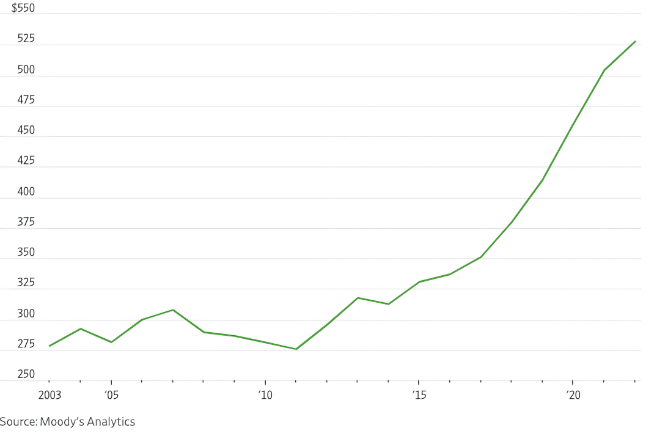

Commercial real-estate insurance costs have risen 7.6% annually on average since 2017, according to Moody’s Analytics. Those increases can result in hundreds of thousands of dollars or more in additional annual costs, depending on location and size of the property. They can be steep enough to wipe away a year’s worth of profits.

While insurance premiums are rising virtually everywhere and for all building types, some cities have been particularly hard hit, especially for multifamily buildings. Costs to insure rental-apartment buildings rose 14.4% annually on average in Dallas, 13% in Los Angeles and 12.6% in Houston. Some owners struggle to find anyone willing to insure their buildings, Moody’s said.

For some property owners, the impact of rising insurance costs has been more punishing than rising interest rates. Many landlords still have low debt costs because they signed long-term, fixed-rate mortgages before 2022 that don’t expire for years to come. But insurance contracts typically renew every year. That means virtually every property owner has been forced to either sign a new policy at a higher cost, or skip insurance altogether.

And this is leading to impasses between lender and landlord, often landing in court:

Because of the spike in insurance payments, the building’s revenues are no longer enough to cover expenses and debt payments, said Three Pillars Chief Executive Gautam Goyal.

Earlier this month, Three Pillars took the unusual step of suing its lender for breach of contract and breach of fiduciary duty, alleging that Bancorp forced it to take out unnecessary and excessively expensive insurance.

It’s worth the time to look at your CRE portfolio in general and for any leading signals of accelerating risk in MFR.