Not two seconds after Labor Day, and we’re already faced with this terror. It’s like the ever earlier playing of Christmas music. But I digress. For this early fall-ish Friday, we have two stories about the near-term future. The first looks at the looming disaster in local banking balance sheets, and the second on how generative AI might shake up the Fintech market.

1. The CRE specter for smaller banks

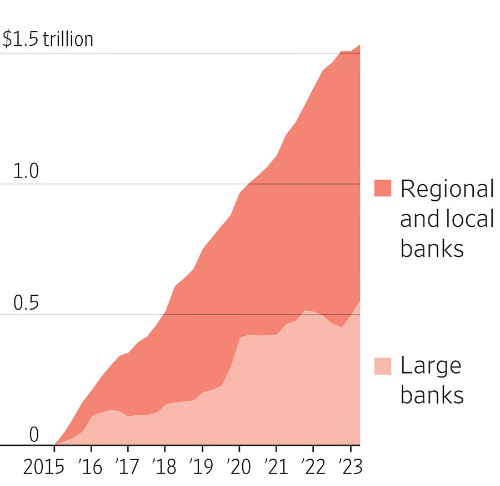

Shane Shifflett and Konrad Putzier of the WSJ write on the Real-Estate Doom Loop that threatens America’s banks. Beyond the break out of risk among FI by size, they also look at the collapsing value of urban commercial real estate and the coming refinance wave looming over lenders and landlords.

The first quarter of 2023 marked the first decline in banks’ commercial real-estate holdings since 2013, according to the Journal’s analysis. At that point, banks’ overall securities holdings had lost nearly $400 billion in value, largely due to higher interest rates. Banks don’t have to mark down the value of loans in most cases, so the real losses are likely greater.

Banks with less than $250 billion in assets held about three-quarters of all commercial real-estate loans as of the second quarter of 2023, the Journal’s analysis shows. They accounted for nearly $758 billion of commercial real-estate lending since 2015, or about 74% of the total increase during that period.

Roughly $900 billion worth of real-estate loans and securities, most with rates far lower than today’s, need to be paid off or refinanced by the end of 2024.

2. Generative AI and M&A

Alex Rampell at VC firm a16z writes on the potential shakeup in M&A that GenAI might spur, particularly in some aging fintech areas. Alex looks at the obvious areas where leaps in productivity may upset older business models.

There are really three investable opportunities in the category of “known knowns”:

- Sell software to incumbents

- Compete with incumbents, with generative AI at the core

- Buy incumbents and remake them with AI—what a “generative AI” KKR would be doing

Think about Rocket Mortgage, with thousands of mortgage brokers and 2022 net revenues of $5.8 billion, against almost $2.8 billion of “salaries, commissions, and team member benefits.”

Somebody will likely start a company/build a product to either supercharge Rocket’s existing workforce or replace more of their workforce with software. It’s clear Rocket could pay a lot for it, as would other companies that compete with Rocket.

Somebody will likely start a net new company that does mortgage origination and refinance with virtually no human interaction—think vertical integration of the prior software example.

And lastly, somebody might even acquire Rocket Mortgage—a $20 billion company as it is today—if its average EBITDA margin of 40% from 2019-2022 could be changed to 60% or more through generative AI.

Alex also looks into more speculative areas, when scale and cost may enable new product consumption, like fraud detection and authenticity services.

LVMH likely spends tens of millions of dollars a year fighting counterfeit goods, sending cease and desist letters, cooperating with law enforcement, etc. How many small Shopify merchants might want the exact same service? All of them! How many could spend $50M/year? None of them. How many might spend $1,000/year? Maybe all of them?

And that it for this Friday. Forget return to the office, what if your boss’s office came to you?. And give us a click below to let us know what you thought because that’s how we figure out what to bring you every week: