When it comes to the nuts and bolts of customer data and acquisition for banking, we’re a bit of a group of wonks here. We naturally gravitate to keeping up with the latest trends and changes in tactics and technology, particularly in personalization. The repeating line is always that any given tactic no longer works.

Segmentation, really understanding the problems, and the similarity of customers with that same problem is way more important and productive than demographic groups. If you dig into your ad response and acquisition, you’ll often find that performing “look-a-like” audiences don’t really look-a-like. Or at least not as much as you would think.

To put it another way, someone didn’t show up in one of your branches to apply for a mortgage or use a calculator on your website because they’re a 32 year old college educated professional. She did it because she’s getting ready to have a baby, and that first apartment is starting to look small and not cozy. The demo might point you in the right direction, but relying solely on that for segmenting and targeting opportunities will cost a lot of time and precious ad money sifting to the actual need.

Context, matching your products and offerings with the problem your customer is facing, is king. You may think your products are evergreen, or as Walmart used to say, “good enough for everyone, but not too good for anyone.” Tying your products as solutions to your customer’s problems or goals at their point in life will improve your relevance and performance more than laser-focused demographic targeting ever could.

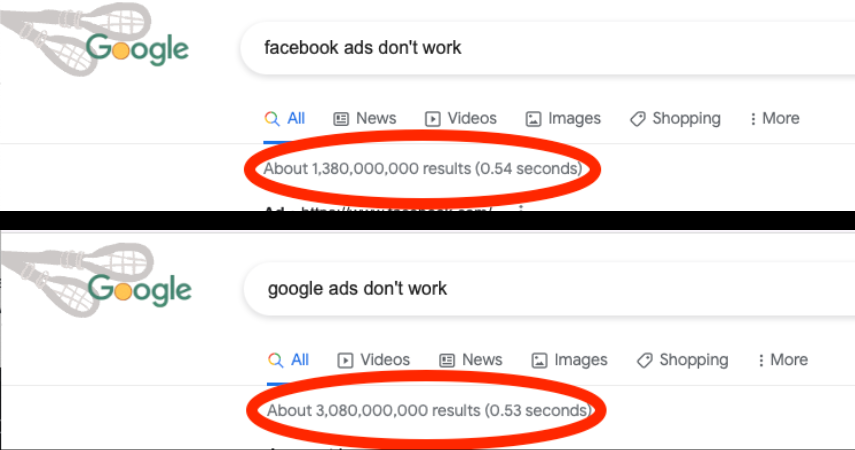

Showing up with the right solution to the problem at hand is critical. It’s what made SEM/Google Search a $149B business in 2021, but I heard on the internet that it doesn’t work anymore.

Sarcasm aside, thinking and acting in terms of customer problems, like the Jobs to Be Done framework, will get you a much better return in effort and coin than a straight ad buy boost.