Are you providing the personalized experience your customers are demanding?

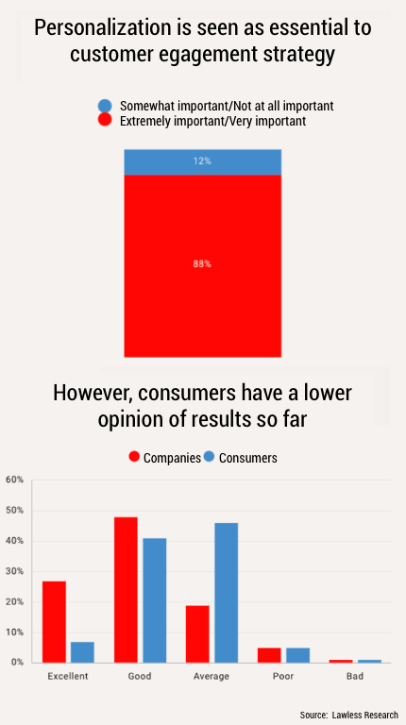

The vast majority of consumers prefer doing business with companies offering personalized experiences. But community FI's are underperforming in the hyper-competitive area of consumer expectations.

Wouldn't it be great if your digital experience matched the branch experience, especially where it matters?

Top-performing banks employ a data-driven personalized approach to draw your customers and prospects closer. Using your digital channel to "listen" to your customers can deliver results like :

- 50% increase in Return on Ad Spend (ROAS)

- 50% increase in email click thru rates

- 60% decrease in Acquisition Costs

- 40% reduction in direct cost of manipulating and managing data - “No more endless version of spreadsheets”

- More confidence in decisions, faster time to market with new offerings, and more reliable and higher CSAT/NPS of your clients

Why do 80% of FI's face roadblocks in data availability AND the ability to leverage it in key areas like experience personalization and identifying new customer segments?

- Skills: Have the analytical and technical skills to manage, let alone collect, analyze, and put into use your data often require a mix of both market/industry experience and technical skill not readily available

- Culture: incorporating data into activities more traditionally driven by previous experience and gut often require the willingness to try a new approach and by open to lessons learned

- The lack of data governance: not having a framework or approach to handling data, even just knowing what you have and where it is, which leads to...

- Fears of compliance (e.g. GLBA, CCPA): customer data including PII is often seen as risky and a 3rd rail better left to core service providers

- Data being seen as an IT function: executing data-driven initiatives within an IT portfolio of cost-saving projects is a recipe for mediocrity

Powerful personalization meets customers where they are, to take them where they want to go with you by their side. Where do you even start?

-

Option 1: Do nothing.

Look for other ways to meet your overall goals, like continuing to pay the rapidly growing cost of acquisition and retention. You’ll have to entice customers to accept the gaps in customer experience or continue to fall behind competitors. We all know where this leads. -

Option 2: Try something on your own.

Take on the challenge to execute internally with available skills, resources, and structure. This is a viable approach, and there are examples of success. But - and you knew there was a but - all of these resulted from top-down driven turnarounds, where it was the #1 goal, including total alignment of internal goals, incentives, and budget. Even then, it required several years of recruiting new talent, significant infrastructure investment, and FI-wide change management to achieve lasting results. -

Option 3: Rely on core service providers.

You could benefit from the resulting feature and capabilities in the roadmap of your core banking/service providers. As of late, NPS/feedback has not shown that to be a good approach, with stalled features, low-quality ratings, and the newest features being released to larger/higher-cost tier customers than you. Additionally, this approach offers you, the community FI, little advantage over competitors.

Or, you could lean into getting closer to your customer and leveraging what you know, your data, that your competitors don't.

So back to what makes you great. What differentiates you as a community FI?

The level of service and proximity to your customers.

The intimacy and relevance of service to your customers.

A well trained branch, sales, and customer service staff that knows how to provide stand out service and expertise to their neighbors.

Taking this approach and supercharging it with the unique data you possess, across all your customer touchpoints is key to competitive advantage in today's market.

So why us?

- FASTER TIME TO VALUE & RESULTS: Specific experience with retail community banks; reduced risk from using proven patterns and architecture for identifying unique customer attributes and characteristics to improved marketing yield.

- LESS RISK: Experienced vendor to FIs, ability to satisfy unique risk and regulatory requirements.

- LONG TERM VALUE: Technical competence in integration across organizations: Can tie into existing solutions/ infrastructure and leverage your existing investments.

“I consistently get better open rates of message, better CTR’s in digital advertising, and better conversion rates overall with targeted and personalized messaging. You can’t do that without segments, and you can’t be effective without being able to easily create segments…. Now, it’s a click of a button to do that. I don’t need developers, my market and customer experts can do that themselves.” -Customer Growth Manager

I want to make a small ask, schedule just a single 10 minute phone call. But what could you possibly get out of 10 min? An analysis of where you are from a competitive benchmark standpoint, what you could reasonably expect to achieve in a data-driven personalization approach, how long it would take, and how much effort would be required. This is meant to be a concise frank discussion of your specific situation. If you're not sure what to say if you're asked by your board what you're doing about data-driven competition or the role of personalization in your strategy, this will be an extremely valuable 10 minutes.