The US economy relies heavily on the small business sector, particularly for the jobs it has created. According to the SBA’s Office of Advocacy, the 30+ million small businesses in the US today employ over 58 million people. It’s not just the overall number of jobs but also the immense source of new jobs that are created.

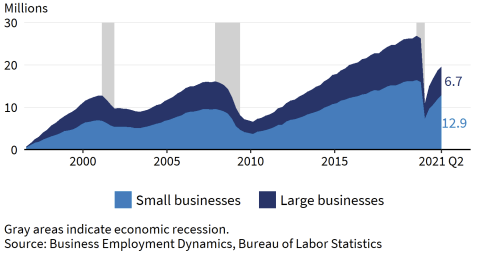

Small businesses have accounted for 2 out of every 3 jobs added in the past 25 years

Additionally, recovery from a recession or general decline happens first and faster in small businesses.

During the first two quarters of 2020, small business employment declined by 9.1 million. The net loss of 8.6 million jobs in the second quarter of 2020 is the biggest quarterly loss since the beginning of the data series in 1992. However, small business employment grew rapidly after the recession. The four quarters following the recession are the four quarters of highest growth in the data series. Growth in those quarters totaled 5.5 million jobs, offsetting 60 percent of the decline during the first two quarters of 2020. source: SBA Small Business Job Create fact sheet

This superpower in the American economy is disproportionately powered by community banking. Local institutions punch way above their weight class in service levels and ability to enable this critical source of jobs and consumer growth.

Smaller lenders with less than $10 billion in total assets held 42.5% of the value of small business loans and roughly 16% of total industry assets in 2020. Larger lenders with $10 billion or more in total assets accounted for 57.5% of total small business loans and 84.1 percent of total industry’s assets in June 2020. source: SBA, Small Business Lending in US

And it’s not just funding. Community FI’s of all types provide access to the various financial services small businesses need to compete and thrive. This includes payment capabilities, credit card issuance, gift card/pre-pay functions, and treasury services. Community FI’s also often provide essential relationship and trusted referral services catering to small business owners in accounting, commercial real estate, and wealth management. It is this institutional knowledge of the local market that no national or Fintech can replace.

Small businesses and their outsized ability to grow jobs and the economy will suffer without a strong community banking industry.

Community banks and credit unions are in the process of being disrupted by Fintech and Neobanks. Regulators are way behind and only now starting to play catchup while hindering the advancement of stable regulated FIs. Legacy core providers are slow with the capabilities and features community banking needs to stay competitive and relevant in today’s market. Both are letting down these vital institutions.

However, the long advantage of community banks and credit unions, their closeness to their customers, can still be an advantage today. Their access to customers, deep insights into local markets, and incredibly valuable customer data are vital advantages. If you’re looking for ways to provide personalized and highly relevant service to your small business and consumer customers, we’re here to help.