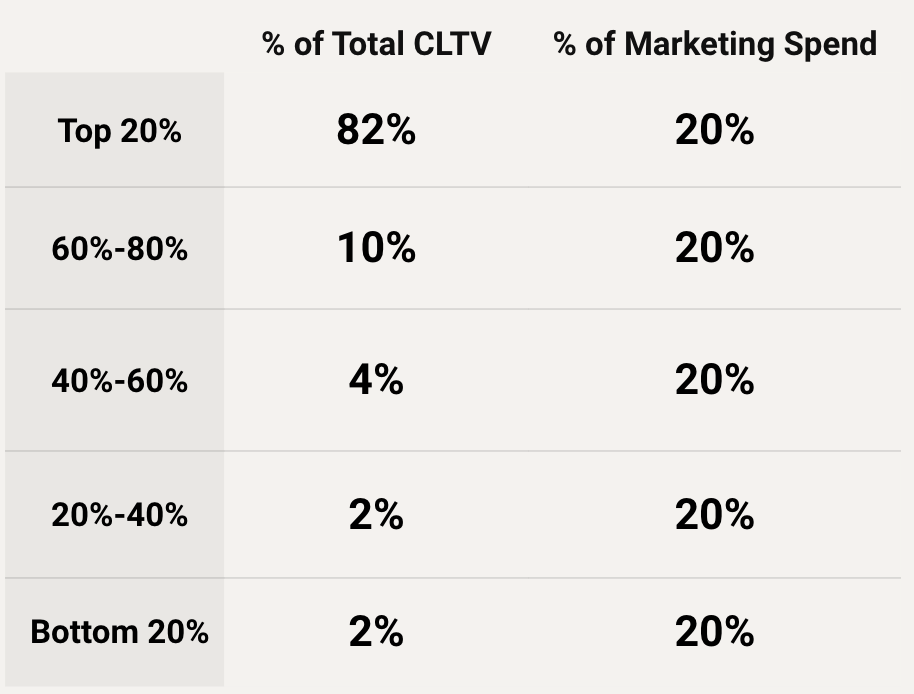

The above chart is a real-world example of how where the money comes from and how it gets spent can diverge.

Customer Lifetime Value (CLTV) has many uses, like optimizing service levels, understanding segments, and forecasting. One way to look at CLTV, particularly when using a predictive model, is as the worth or “asset” value of all of your marketing to date. The money you have spent to acquire, service/retain your customers has resulted in this future profit stream.

You unlock very powerful insight if you look at it as an asset and employ a method that reliably predicts CLTV at the individual customer level. Not all customers are worth the same. It’s not always intuitive who they are, either. Recent studies into the effects of eliminating NSF have shown that demographics or deposit levels don’t help identify the most profitable customers. Behavior and life circumstance are often better predictors and better at defining segments to target for growth.

Which gets back to the table above. With the all too common Pareto rule in effect, more than 80% of this organization’s future value was coming from only 20% of its depositors. And yet, they’ve been spreading the peanut butter for a customer acquisition strategy. They had spent as much acquiring a segment that will only produce 2% of their future income as they did on their top customers.

Do you think this resulted in a change in their customer acquisition strategy? You betcha!

Now a couple of things you shouldn’t/can’t do with this insight:

- Fire all the “bad” customers at the bottom

- Turn all the bottom performing customers into top customers

- Only focus on the top performing customers

In this situation, remember that even a bottom segment customer is still a customer and, in most cases, is still profitable. Additionally, you might be subject to regulations like CRA, however understanding this requirement and having a demonstrable process for how you market services can be helpful in audits and scoring. It can also be useful to nudge the right customers and reward activities and behavior that improves profitability or fixed service costs.

The best use of this info is to help you clearly identify your best customers so that you can become more attractive to the customers that matter most. Your goals should be to acquire customers across the board with slightly higher CLTV tomorrow than today. Use this insight to target similar audiences directly, evolve to more clear attributes/jobs-to-be-done models of ideal customers, and eventually use CLTV over immediate conversion values in return calculations. The best part is you can start small, with representative samples and a few spreadsheets. Have questions or aren’t sure where to start, reach out; we’re here to offer advice and hands-on assistance if needed.