For your community bank, here is a progression of questions to ask to understand your customer acquisition/retention efforts.

What are your basic unit economics? Whether acquisition or cross-sell/retention, what does it cost you, in aggregate, to run your go-to-market? What are your direct incremental costs (advertising, agency, etc.)? Indirect costs (staff salary, tooling/software)? Allocated costs (particularly real estate, i.e., what part of your branch costs do you consider marketing)?

How much revenue, again in aggregate, do your new and existing customers each generates. A rough measure of contribution, margin, or payback of each gets you to the ability to measure return. Start with what you have. The more granular detail, the better, but avoid “boiling the ocean.”

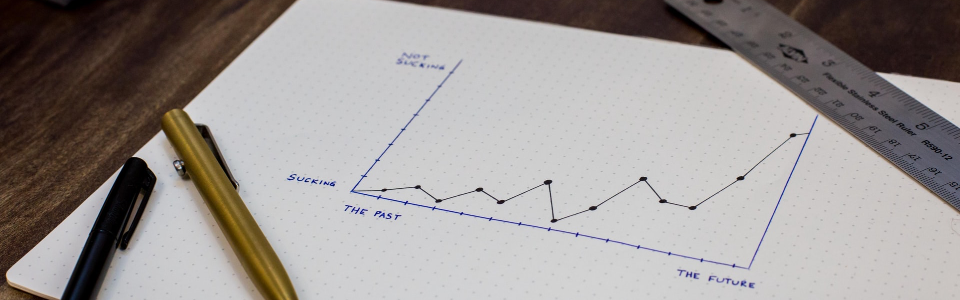

At this level, you’ll have a good start in understanding what the contributions of your efforts are to the organization. It doesn’t give you any prescriptive next steps, but it provides a foundation to measure improvement.

Now start with basic analytics—website visitors, app downloads, in-branch activity. Start with a simple funnel of your customers’ experiences, new and existing. Look for where you can objectively measure activity. Even if this (likely) proves to be a manual and messy process, establish a baseline of your conversion/retention rate.

Now, do a rough cost per acquisition/action (CPA). What is the performance of your different experiences/funnels above? Use both raw #’s and %’s, and split by channel. Look at revenue and Return on Ad Spend (ROAS), which are particularly useful for benchmarking. Use margin to get Return on Investment (ROI).

Again, at this point, you’re still looking at aggregates. You need to do more work to get to the real valuable view of incremental performance or what the next dollar will yield.

Next, run conversion lift experiments by channel. This doesn’t quite get you to a true incremental view. However, it is much better and more informing than simple attribution models.

With all of this data now in hand, use matched market tests to get the incremental contribution of each channel. How much will the next dollar investment yield for each journey you spend time and budget on?

Finally, engage your data science chops and apply marketing mix modeling to get an accurate incremental return view for the whole portfolio. How much more revenue does the next dollar of overall spending generate? Use this to evaluate your budget allocation across your channels.

Not sure where you are with this or whether it’s even worth the effort to try? Reach out; we’d love to talk about it and give you a sense of the opportunities vs. efforts for your situation.

*HT to Avinash Kausik for his Hierarchy of Reality on which this progression is based.