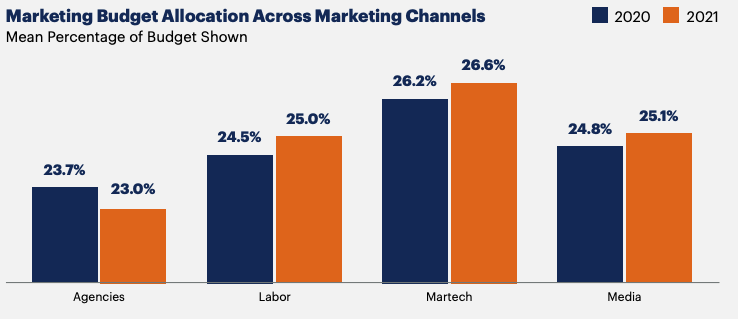

Gartner’s The State of Marketing Budgets 2021 reveals that while overall marketing budgets declined last year as a % of revenue, much more of that spend went into technology and (predominantly digital) ad buys.

More and more options continually emerge for solving problems like messaging, web/app flow optimization, customer profiling, predictive analytics, marketing automation, social media management, digital asset management, etc. Marketers report using, on average more than seven marketing technology tools every week in the ordinary course of their work*. This number has steadily increased in the past few years.

But the problems and goals you’re focused on often bridge these point solutions, particularly when addressing things harder to draw a clear line around, like “customer experience.”

McKinsey, in their report on the Value of Personalization, advocated a more pragmatic approach to how best in class marketers leverage data and technology:

They invest in fit-for-purpose martech and data. Rather than letting a “thousand flowers bloom,” personalization leaders target a specific set of customer outcomes and use cases that support them. They align organizational resources around these use cases and work back from the desired outcomes to build the data and martech road map and identify the enablers and investments needed to deliver.

Banking sector marketers, particularly at FI’s with a view towards M&A, are being challenged with more efficiency across the organization. The Chief Marketing Officer is increasingly becoming the Chief Coordinating Officer, tasked with driving alignment and focusing on getting the most from resources.

To win in today’s market means serving your customers in a way that sets your FI apart. The key is to align your efforts into clearly defined outcomes, assemble the required capabilities, and make sure it all works in concert to meet that goal.

*Dunn and Bradstreet 2021 Sales and Marketing Data Report