This week we bring a few more thoughtful and deeper links to drink in before the weekend. First, a detailed look at Stripe’s historic rise to mega-unicorn status and its expansion into banking services, the mechanics of deposit insurance and how it does and doesn’t work with fintech, and a reflective post on how to think about your work as separate from your identity.

1. Stripe’s expansion into banking services

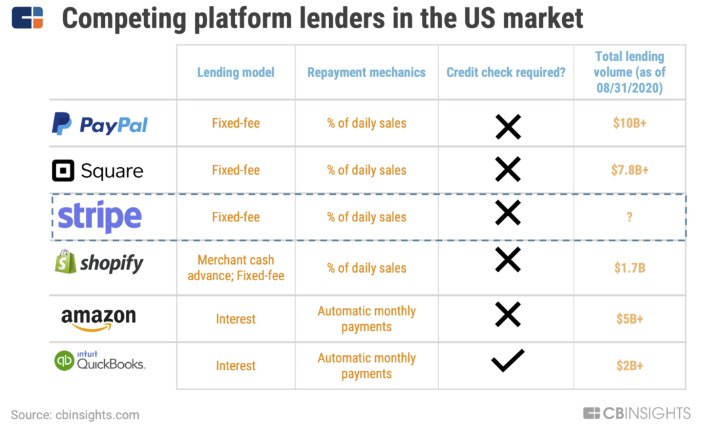

CB Insights has produced a comprehensive analysis of SMB payment company Stripe. The report looks at their history and growth to a $36B valuation at their last funding round. Additionally, CBI breaks down their expansion into traditional financial services, including credit card issuance, embedded Banking-as-a-Service offerings, and direct business lending.

Stripe Capital is a flexible small business loan available to existing Stripe users. The offering funds within one business day and automates repayment as a fixed percentage of daily sales. The product was launched in mid-2019, with the current loan size typically between $10K-$20K (although it can range up to six figures).

2. So when are and are not deposits insured?

And speaking of Stripe, noted payment guru and Stripe employee Patrick Mackenzie delivered another deep dive into banking mechanics. His post delves into deposit insurance and how it does and does not factor into the recent (and likely emerging) trend in crypto company collapses (say that three times fast).

Did a business which has an account at an FDIC-insured institution, but is not itself an FDIC-insured institution, fail? Not covered. If their bank is still open for business, your princess is in another castle, and you’ll very likely have to follow a bankruptcy proceeding with interest.

This last one is a bit of a sticking point for financial technology firms, which experience a dilemma in building products which mimic some features of deposits. On the one hand, they want to message those products to the market as secure. On the other hand, they typically need to keep customers money in the banking system, generally at an FDIC-insured institution.

But they are not themselves FDIC-insured institutions.

Read to the end for the details on bank failures, how boring they usually are, and learn new terms like Shared Loss Agreement (SLA).

3. Professionalism and detachment

And one for the hardcore marketers, the always insightful Seth Godin delivers a concise take on how a professional connects to their work to be successful in the long run.

Working professionals develop emotional detachment. It’s the only way to thrive in the work. Emotional detachment helps us remember that we are not our work, and that feedback is useful, not an attack.

Commitment permits us to keep going (especially when we’re asked to provide more effort than we planned).

It’s easy to confuse the two.

Being detached doesn’t mean you don’t care. It simply means you’re focusing on the work and those you serve, not on your own narrative.

And being committed comes from a professional decision, not from an existential crisis.

Worth reading are the linked essays from Zingerman’s Ari Weinzweig Making dignity part of our daily marketing and Marketing as a Leadership Act for more depth.

And that’s it for this week. Is everything OK Texas?. Let us know what you thought of this post, good and bad, at blog@mindspaninc.com and feel free to share below.