Another Friday and a few more must reads for the community banking pros out there. We have for you new privacy regulations coming from congress, how JP Morgan Chase is monetizing their transactional data with small business clients, and the importance of unit economics and customer lifetime value in overall firm valuation.

1. More privacy regulation is on its way

Rebecca Kern at Politico writes on the compromise in the House and Senate that has led to a draft bill enhancing consumer privacy.

The compromise bill includes provisions that would require that groups gathering data minimize what they collect. “Covered entities are prohibited from collecting, processing, or transferring covered data beyond what is reasonably necessary, proportionate, and limited to provide specific products and services,” according to a summary of the bill provided by its sponsors.

The bill would also prohibit the transfer of sensitive data to third parties without the “express affirmative consent of the individual to whom it pertains,” according to the summary. It would also require that “large data holders that use algorithms to assess their algorithms annually and submit annual algorithmic impact assessments to the FTC.” It increases online data privacy protections for children under age 17, and would ban targeted advertising to kids under age 17.

While specific advice and tactics will require a careful review of the bill’s final version, what is clear Data Governance is no longer a nice to have capability. Having your hands wrapped around what data you have, where it exists, how it’s used, and who is using it is now table stakes. You must have a comprehensive data strategy, and not just to mitigate the risks of litigation/enforcement.

2. Banks selling data as part of financial services

Kate Fitzgerald at American Banker writes how How JPMorgan Chase is using payments data to woo merchants from fintechs.

The bank is betting its trove of data can be a competitive differentiator against other card issuers and payment technology firms that offer merchant services to businesses, such as Fiserv’s Clover, Block and Stripe. As the largest U.S. bank by assets, at nearly $4 trillion, Chase commands the highest number of payment cards, with 93 million cards in circulation, significantly higher than its nearest rival, Citi, which supports about 48 million U.S. cards.

The new service harnesses anonymized customer card and purchase data so small businesses can compare their own customers’ demographic details and shopping habits with those of nearby rivals through a dashboard with tools to apply the insights to refine advertising, operations and loyalty programs.

The two-fold takeaway is both the extent regionals are going to protect their install base from Fintech and the inherent unlocked value of the data within FIs. This may not be the approach for everyone, but it certainly shows one way in which a valuable asset that doesn’t appear on a balance sheet can add quite a bit to the top line of firms willing to use it.

3. When customer unit economics drive or undermine valuation

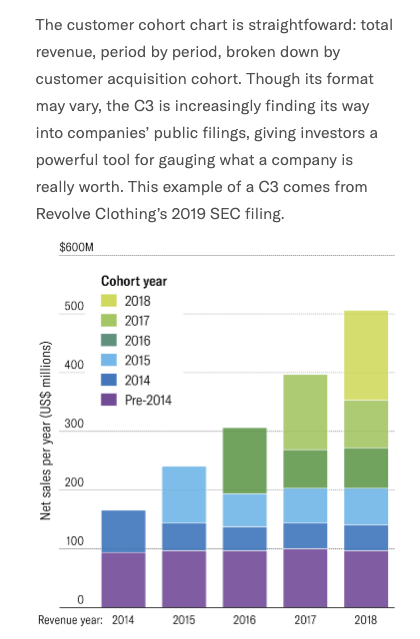

Emory’s Dan McCarthy and Wharton’s Peter Fader write in the Harvard Business Review on valuing a company by analyzing its customers. In the article, they look at the framework for valuation based on unit economics of customers and how it leads to a mispriced “successful” IPO:

Revolve’s IPO success illustrates the movement toward customer-driven investment methodologies. Using customer metrics to assess a firm’s underlying value, a process our research has popularized, is called customer-based corporate valuation (CBCV). This approach is driving a meaningful shift away from the common but dangerous mindset of “growth at all costs” toward revenue durability and unit economics—and bringing a much higher degree of precision, accountability, and diagnostic value to the new loyalty economy.

McCarthy and Fader aren’t just academics. Previously selling their Customer Lifetime Value firm Zodiac to Nike, their current company Theta leverages this methodology in corporate and PE valuation services/consulting.

And that’s the week. Be sure you’re standing behind (or under) your advertising. Drop us a line at blog@mindspaninc.com, and share below if anything was useful to you.