Every week, we bring you a few reads for the community banking professional that are worth your time. Today, we have PenFed’s takeaways from a strategy focused on personalization for their customers, a data-rich report on the trends in local banking, and an example of extracting the needs of niche banking customers.

1. Personalization as a strategic priority

PenFed Credit Union’s head of strategy Ricardo Chamorro shares his top 3 lesson’s learned from their success in standing out from competitors using personalization. In addition to the observable efforts in product/UI, Ricardo points to deeper reasons this effort paid off for PenFed:

The relationship between trust and customer satisfaction is a two-way street. A growing number of financial institutions are adopting new practices to improve customer experiences and in turn cultivate trust in their products and services. The use of emerging technologies like artificial intelligence and data analytics, for example, have allowed financial institutions to deliver seamless, consistent and enjoyable customer interactions.

2. Where are the banking market inflection points?

Bancography, known for its banking branch market research and planning, published its annual banking industry outlook. Mixing a view of market demographics and balance sheet analysis, the report identifies some interesting potential tipping points:

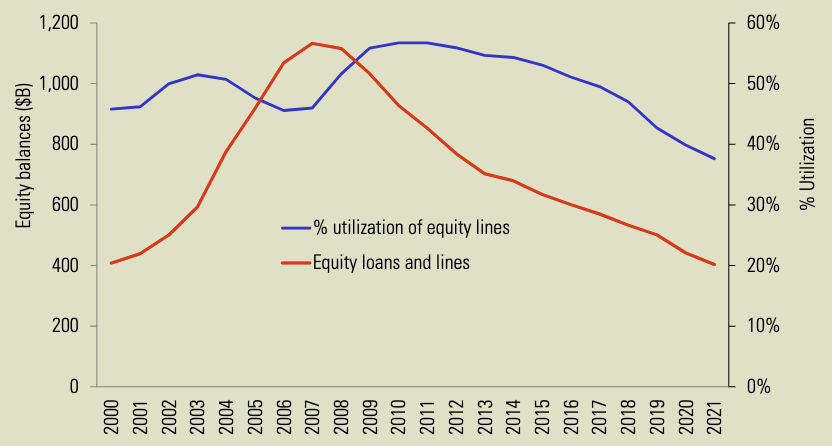

Even with rising home values providing a greater buffer of equity (as illustrated on the prior page), a years-long trend away from home equity borrowing dating to the 2008-09 financial crisis remained intact. Across the industry, total home equity balances sit at 400B, the lowest level since 2001 and only 36% of the peak levels of 2007. Home equity line utilization also remains well below peak levels, with current balances equating to 39% of credit line amount, versus 57% in 2010. As the COVID liquidity cushion erodes and as rising rates give greater value to the tax deductibility of HELOCs, we may finally see revival of that product.

3. Understanding niche opportunities in banking

Payment guru Pat McKenzie writes about his experience and the opportunities serving a niche with banking services. He shares his experience managing a charitable 501(c)3 non-profit, specifically the unique problems that could serve as a high value differentiator for banking partners.

Charitable bank accounts basically look like all bank accounts, at least in the status quo, but that will likely change over time. The advantages to having software which is aware that you’re a charity and aware that you accordingly have charity-specific needs are overwhelming, and the people who specialize in the needs of charities will likely partner with the banking sector to bring better charity-specific banking products to market.

Charities are not the only sector with a relatively small number of extremely high-salience requirements, often caused by regulation. Increasingly, these requirements are going to be administered not just by professionals who have specialized in those requirements for most of their career, but by software systems catering to those professionals. You’ll see a lot of the dollars follow the software, rather than the software merely keeping track of the dollars.

And so ends another week. I’m sure you’ve made your Mom proud. Let us know what you got out of this at blog@mindspaninc.com, and if it wasn’t ‘nothing’, share below.