When is a payment transaction permanent and community banking’s readiness to compete is a data-rich and AI-driven market.

1. Finality does not exist in payments

Patrick McKenzie brings us another great insight into the world of payments, this time on the difference between finality and predictability in how payment systems have and now run:

And yet: someone sent $70 million worth of Bitcoin in 2016, and that transaction was partially voided, with the reversal being worth slightly more than $70 million due to Bitcoin volatility. This didn’t happen an hour later; it happened in 2022. How?

The answer is nowhere in the Bitcoin whitepaper or any codebase. A full recounting of it is outside the scope of this anecdote, but it rhymes with “If you and the United States federal government disagree whether a transaction is final, you are wrong.” That is true for notorious Bitcoin thefts, but also true for wire transfers, conveyances of real estate, credit card payments, and graverobbing. “Possession is nine-tenths of the law,” so the saying goes, but the state can conjure as many tenths as required if it is motivated to.

BONUS: A throwback short segment from the BBC on the modernization of retail payments in 1969:

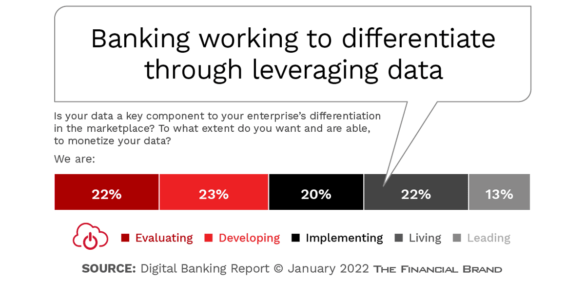

2. Data as a Differentiating Capability in Community Banking

Jim Marous of the Financial Brand explores why data and AI will transform the future of banking, and how community FI’s are/are not prepared to accelerate or even survive in this market.

Banks and credit unions must illustrate that they know a customer, understand a customer, and will reward a customer by customizing interactions to each individual’s financial journey and objectives. Consumers want a personalized experience regardless of the channel they select. They want the GPS of financial relationships, with advice delivered based on real-time changes in marketplace and their financial life. This is achieved with data and advanced analytics driving a humanized communication stream.

That’s all for this week. Remember that the life you live with write your obituary. Let us know what you liked and what you didn’t at blog@mindspaninc.com and share below with your loved ones.