Another week, another debt showdown avoided (for now). For you, though, we have some below-the-fold stories affecting your customers. We have a story on the resistance to giving up paper money. Also, the call for Fintech to measure their impact on society and how pizza may be the key to gaining trust with Gen Z.

1. “I paid cash today for a reason”

James Hookway and Joe Pinsker in the WSJ write on the pro-cash consumer movement that is resisting the move to card and digital payments by stores and banks.

“Let’s boycott the shops that won’t take cash—where are they?” Debbie Hicks yelled into a microphone in the town square on a recent Saturday. A few in the 200-strong crowd murmured some names—a coffee shop, a bakery.

“OK, we can do this,” Hicks said. “It’s not too late!”

Some organized groups align the move to cash with conspiracies about government control and the World Economic Forum. But, the more practical concerns make for surprising bedfellows.

Among pro-cash sympathizers are the brothers behind Right Said Fred, the group known for 1991 hit “I’m Too Sexy.”

“We were working with an old people’s home and a homeless shelter,” said one of the brothers, Fred Fairbrass. “Without cash, those people are absolutely stranded.”

2. Holding Fintech accountable for social impact

Sasha Dichter, impact investing thought leader, writes on the potential societal perils of Fintech’s rapid growth.

Many new digital financial products are repackaging old business models that present as much risk as opportunity.

Most are pushing for growth at all costs, expecting that competitive and regulatory forces will play out over time. This approach is short-sighted and ignores the risk of regulatory backlash or a shift in public sentiment.

Just last year, headline-grabbing collapses in crypto markets led to a shift that wiped out $1trillion of market value, over 50 per cent of global market capitalisation. Could the fintech market be facing a potential 10 – 30 per cent decrease in value, of $30billion or more in market cap?

There are already signs of backlash.

At a global level, Dichter proposes, through voluntary measures or regulation, a “KYC” of impact. A study of the microfinance industry shows the benefits to the entire marketplace of measured efficacy.

The data revealed that six per cent of clients say they’re materially worse because of their microfinance loan. However, the vast majority consider their lives to be the same, better, or much better thanks to their access to microfinance.

Armed with this data – rigorous evidence from a large-scale data set gathered directly from customers – microfinance institutions and their investors have a convincing argument in the face of criticism, can use it to mobilise and further strengthen consumer protections, and protect themselves against regulatory overreach.

3. To win with Gen Z, look to pizza

Winning share with younger depositors and lenders is a consistent theme with community FIs, and almost all consumer businesses. Morning Consult’s brand trust survey offers an unlikely winner in Little Ceasar’s..

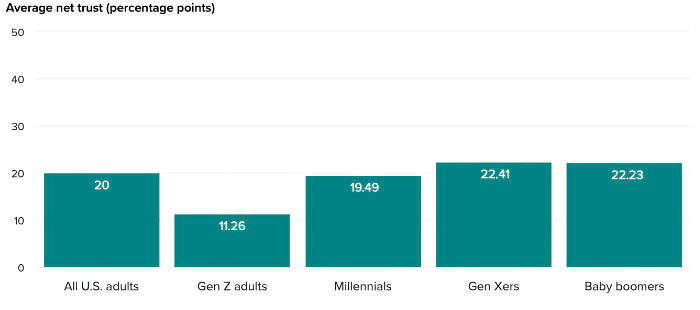

To start with, Gen Z stands out for their skepticism across the board.

Gen Z has trust issues

Even brands that garner the highest levels of trust have work to do with Gen Z. The youngest generation of adults is less likely than the general population to say they trust every brand on our “Most Trusted Brands: United States” list to do what is right. They’re also more likely to have lower average net trust…

However, Little Ceasar’s stands out and offers several principals to emulate.

Coming of age alongside social media and the internet with unlimited access to information at their fingertips, younger consumers can get to know brands more intimately than generations that came before them. This behind-the-scenes view can make consumers more skeptical of marketing efforts. It can also open the door for two-way communication and interaction with young customers.

That’s a wrap for this week. Our Gen Z favorite had one of the all-time great commercials. Also, Mike Ilitch, what a guy. How’d we do this week? Drop us a line at blog@mindspaninc.com.