Another happy Friday as we approach the end of the quarter and the depths of summer. This week we have stats and analysis on the changing practices and consumer behavior in overdraft/NSF fees. Also, a look at the downsides of automation in consumer facing parts of banking. Finally, a view on the untapped potential generative AI like ChatGPT has to leapfrog certain aspects of business not completely served with SaaS solutions.

1. NSF revenue drops, but the number of depositors paying stays the same

In the NYT, Ann Carns writes on the sharp pivot in overdraft fees. Overall fees continue to drop industry-wide.

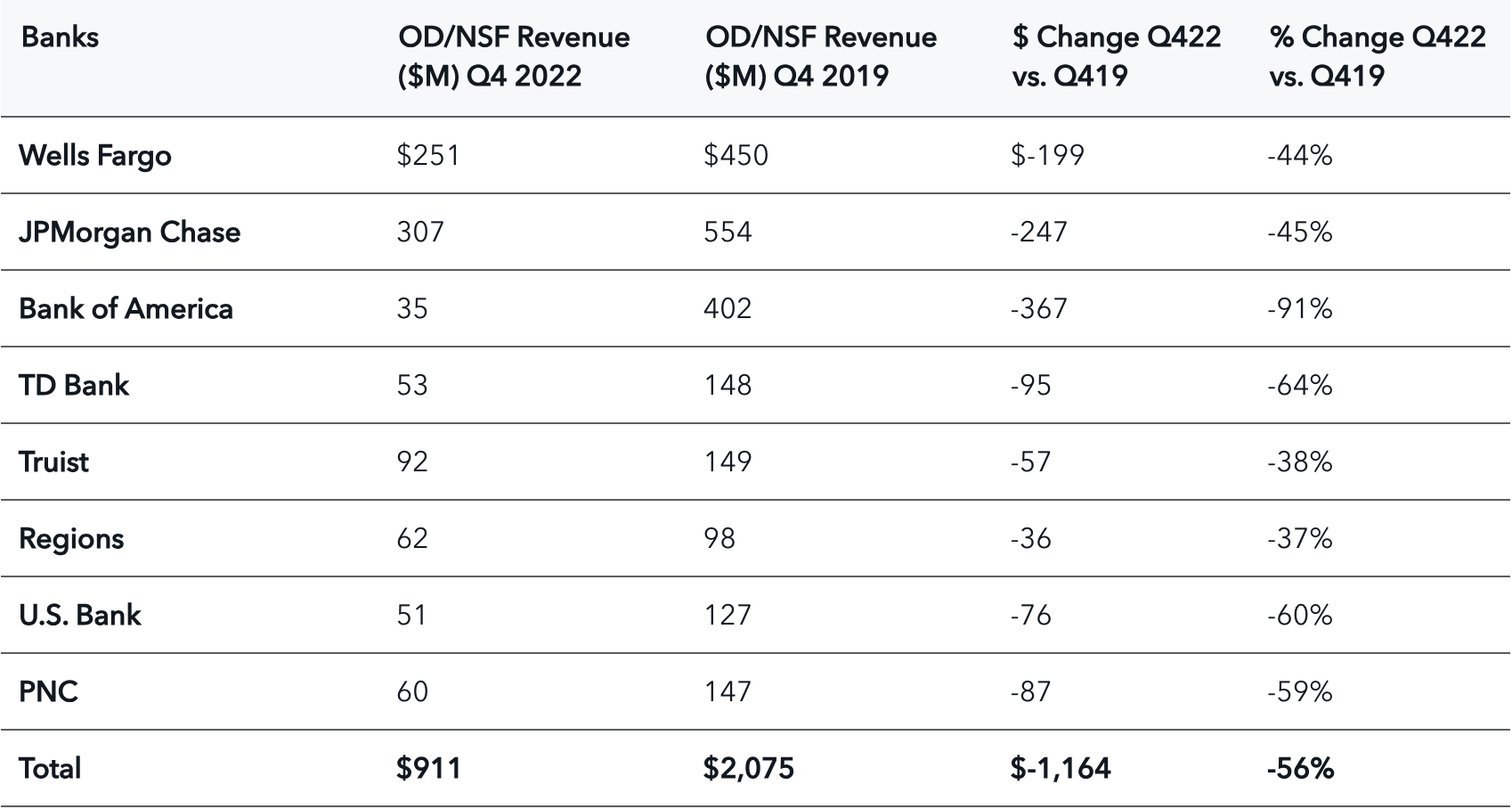

Last year, bank revenue from overdraft and similar fees fell an estimated 6 percent from 2021, to $9.9 billion, and remains “far below” prepandemic levels of about $15.5 billion, according to a report from the Financial Health Network, a nonprofit focused on financial stability.

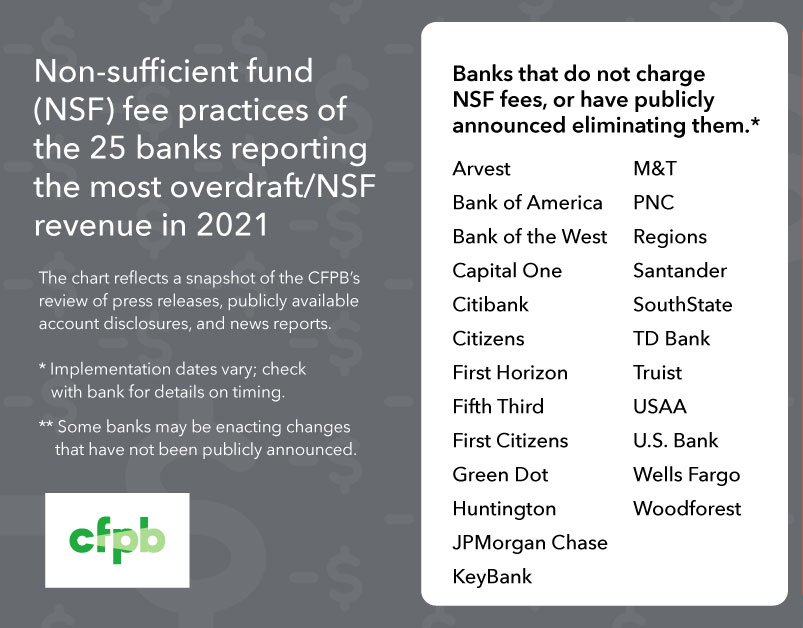

Most of this effect is from large institutions changing their NSF terms or dropping them altogether.

Many large institutions have done away with fees for insufficient funds, and some banks no longer charge overdraft fees, including Citi, Ally Bank, Capital One and Alliant Credit Union. Other banks that have made changes include Bank of America, which last year cut overdraft fees to $10 from $35.

The CFPB curates a view of large institution policy details and analysis of overall trends.

The nonprofit Financial Health Network provided additional consumer-level research on trends and gets into the particulars of how individual behavior varies among consumer groups.

17% of households with checking accounts reported an overdraft or NSF fee in 2022, unchanged from 2021. Meaningful shifts in frequency of overdraft are also not evident. However, aggregate fees from overdraft dropped more than $600 million in 2022 compared to 2021, and remain far below pre-pandemic levels.

Half (50%) of those who overdrafted reported that their most recent overdraft was unintentional.

28% reported that their most recent overdraft was effectively a gamble, where they knew their balance was low, but thought there was a chance it could cover the purchase.

Only 16% of respondents reported that they knew their balance was insufficient when overdrafting. However, 35% of those with more than 10 overdrafts said their last overdraft was intentional.

2. The bad outcome, automating empathy out of your customer experience

Chris Skinner of The Finaser writes on the growing dissatisfaction with banking customer service. In particular, is the clumsy and frustrating experience of having no choice but to deal with an automated system.

“In my bank, a very bewildered employee said I had to report the loss (of stolen bank cards) by phone. After I explained that the phone had also been stolen, she consulted various levels of management and eventually escorted me to an office where I used their phone. It took three weeks for replacement cards to be issued.”

Also is difficultly of being forced through a poor DOA process:

“I chose a specific bank because they have a local branch near me. Since then, I have been back and forth to said branch three times… (I was told) it can only be done online and to talk to ‘the robot’ if I have a problem”. After “multiple chats with ‘the robot’ that have lasted hours and then contacting the call centre. No-one helped, so I complained and in response was told it was all largely my own fault. So I gave up and am now progressing with a competitor”

There may be some selection bias in only picking out the most egregious cases. However, would you be OK with your customers or members having this experience?

Technology to drive a faster and less labor-intensive process can provide benefits, but only when designed and executed properly. However, it fails when technology is used to drive lower costs at the expense of treating customers as individuals. This is essentially the opposite of personalization.

This is a strategy of scale and cost savings, not personalization.

The question becomes, then -> are you going to compete on your capital structure? On reducing your noninterest expense a few points? Will that enable you to stand out? Are you willing to risk an experience that tarnishes the trust of consumers and your differentiated service levels?

3. The leapfrogging potential of generative AI

Noted VC firm NfX (from network effects) writes on how generative AI may provide a leapfrog effect for some industry solutions.

We’ve called this approach “AI inside.” Your selling point is not the “cool factor” of AI technology, but the ease of use, and the value that AI brings to your organization. It’s about delivering instant value, seamlessly on day 1.

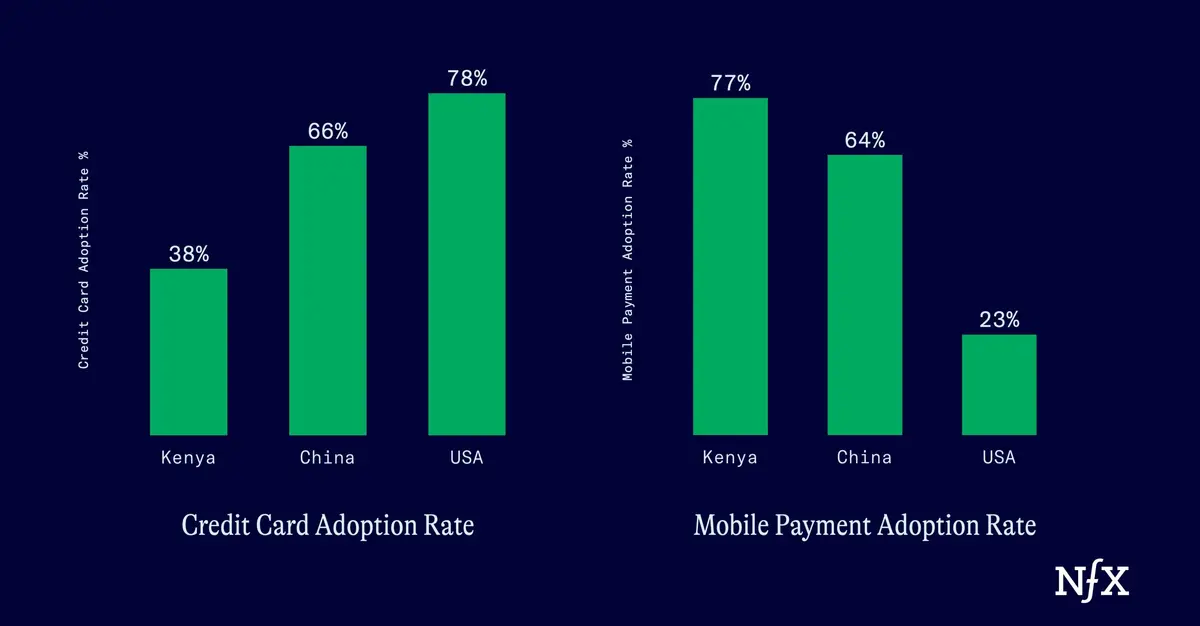

The potential is similar to emerging markets that never largely deployed landline telephony and jumped straight to mobile. This enabled consumer behavior to more quickly adopt mobile payments over traditional methods.

Members of these industries know that they’re way behind when it comes to automation. Generative AI is the first time we have had an opportunity to package full automation in a way that is efficient, cost-effective, and intuitive.

Packaged correctly, Generative AI will be the end of complex onboarding processes and unintuitive workflows that have kept switching costs high.

It sweetens the value prop immensely. It has created a tipping point by both reducing the burden of a shift to digitization, and enhancing the value of that change 100x.

This view provides a different way to look at opportunities for generative AI. What way of business do you feel “stuck with” because there isn’t a better way, or the costs for changing are too high? Top of mind is the poor satisfaction rating from community banks of their core banking providers (*pg 48).

Also, where is the greatest friction/loss in acquiring new customers? What part of your process could benefit the most from 10X or XX% improvement in yield or time to completion? The top-of-mind responses here are probably worth exploring as a candidate to innovate or “provide instant value” to improve your performance.

And that’s it for this Friday. With rising inflation, tactics like stretching a tank of gas are on the rise. Like or hate what you’ve seen here? Drop us a line at blog@mindspaninc.com. Comments make these Friday posts better.