Welcome to the New Year, and to get you off to a good start, a few choice reads to you up to speed.

1. Advertising Outside Google and Facebook Has a Promising Future

Among some pretty interesting trends, Scott Belsky dishes up several ideas to think about in your strategy and market analysis in 10 Forecasts For The Near Future Of Tech, including one that ad tech and the use of intent data is already delivering today with tools like Universal ID.

We will all start to opt-in for ads [read: personalized experiences]

My growing contrarian view about the trend of privacy and opting out of ads (especially for the next generation, who tend to prefer transparency over privacy) is that artificial intelligence will make personalization so damn incredible that opting out will be the equivalent of using an old flip phone or going to a restaurant and getting served a random dish. We all want to be known, but the benefits must exceed costs. Getting served disturbing teeth whitening or weight-loss ads would make anyone opt out. And frankly, “ads” conjures up the era of annoying banner ads and pop-ups. But “personalized experiences” are the new advertising, and most of us would prefer it whether we admit it or not.

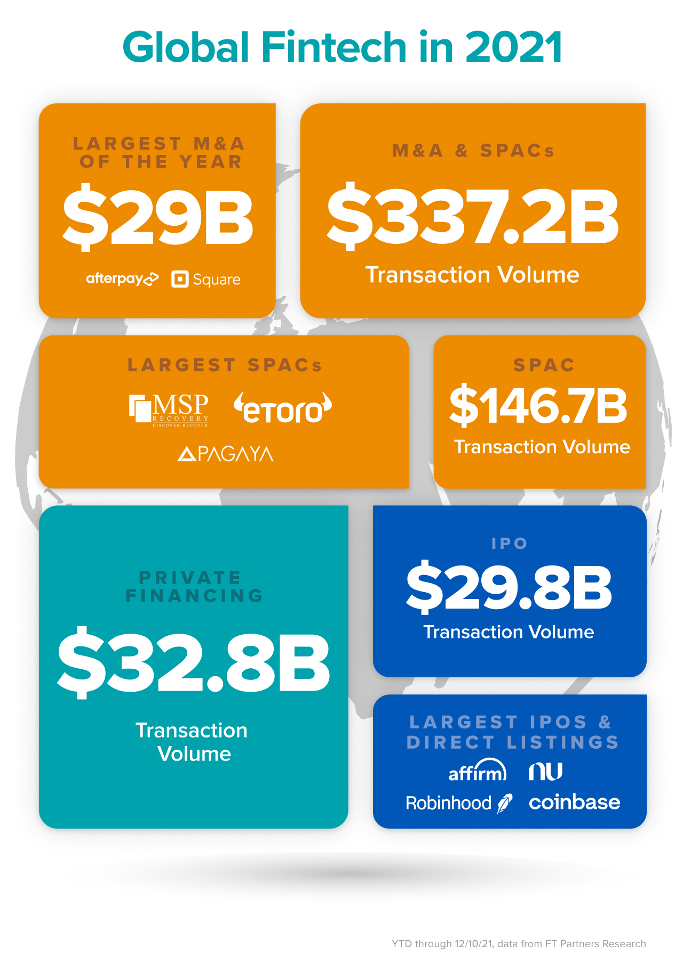

2. Fintech Tops Investment Areas in 2021

Much reported in many year-end missives, Fintech topped many lists as the investment of choice in 2021. The Fintech team at Andreesen Horowitz lays out where the money is moving into and where you can expect to see more innovation and competition in the coming year.

Of note is the increasing cost and difficulty of throwing money at the Google/Facebook ad machine for customer acquisition:

Beating rising CAC with partnerships and product-led growth

Over the last few years we’ve seen meaningful inflation in digital customer acquisition channels (e.g., Facebook and Google) as competition has increased and changes like Apple Ad Tracking have made attribution harder. Furthering competition, the vast majority of fintech companies have focused on the same customer profile (subprime), with the same product offering (e.g., banking, investing, lending) and a set of ever increasing customer subsidies to join (free money on the internet!). How then will a company distinguish itself in 2022 in the face of increasingly competitive and constrained digital acquisition channels?

We believe that there are two answers –- the best companies will either achieve growth through products that lend themselves to product-led growth or partnerships represent non-inflationary distribution opportunities.

That’s it for this week. Welcome to the new age. Comments and suggestions as always to blog@mindspaninc.com.