With July coming to an end, we have for you this week three light (and sometimes funny) reads on the world of banking and finance for the community FI leader:

- A look at the major open banking players and how like in payments, the big nationals are stepping up.

- A story of customer data gone horribly (and expensively) wrong.

- Listen in on a conversation with some of the leading Fintech CEOs and how they plan to win, maybe at the expense of community banks and credit unions.

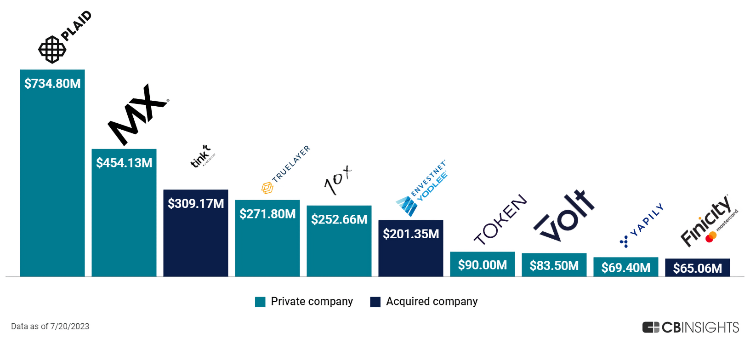

1. The open banking vendor playing field

CBInsights presents a quick market snapshot of the market space of open banking fintech companies. The early success of leaders Plaid and MX has attracted more competition, including Akoya, jointly owned by Fidelity, The Clearing House Payments, JP Morgan Chase, and others.

But all is not rosy for players.

But while companies like Plaid have gained household recognition (and a $10B+ valuation), slowing growth in the fintech sector has increased pressure on the market.

Plaid laid off 260 employees in December 2022, saying it had “hire[d] and invest[ed] ahead of revenue growth.” Competitor TrueLayer has also seen headcount declines, according to CB Insights headcount trend data.

Additionally both MX and Plaid are facing litigation for their privacy and data practices.

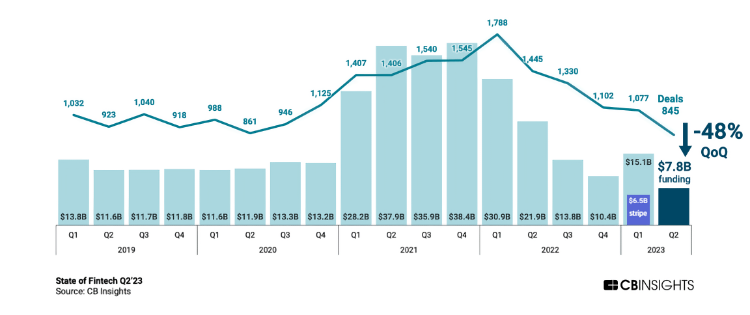

All of this comes at a time when investors are pulling back from the sector overall.

2. The tragedy of data at Deutsche Bank

Olaf Storbeck (cool name) of the FT writes on the 13 year attempt to absorb acquired Postbank’s customer data into Deutsche Bank. The story includes some comical anecdotes like:

As the meticulous plan, rehearsed several times in previous months, unfolded, an unsuspecting member of the team opened a dishwasher in mid-cycle, with the escaping steam setting off a smoke detector and forcing the evacuation of the building. Precious minutes were squandered before firefighters gave the all-clear.

With over €1bn lit on fire in only the first 5 years of the effort led Deutsch to put Postbank back up for sale rather than finish the work. With no suitable bidders, they eventually buckled down to complete the project. All was on track to complete it…. in the Spring of 2020.

The groundwork was laid just as the coronavirus pandemic struck Europe in the spring of 2020, when for the next 18 months more than 1,000 staff analysed the Postbank data, worked out how to move it and unearthed complications.

One stemmed from the fact that some Postbank clients were erroneously still listed as residents of defunct states such as Czechoslovakia or Yugoslavia, designations that Deutsche’s systems rejected. “In such a project, you not only have to deal with decades of data and history but also with junk data,” said Karsten Roesch, who ran the Unity project alongside Peschke.

Roesch, who also led Project Magellan, said lessons were learnt from that failure which has tried to design a new IT architecture for both Deutsche and Postbank. “For the first 18 months during Magellan we just wrote one concepts paper after the next and built test systems for current accounts. None of that got implemented,” Roesch said.

Eventually, they solved the litany of problems and completed the replication of Postbank’s customer records in Deutsche’s systems. However, the albatross isn’t quite off their necks yet.

Despite this month’s success, the process of drawing a line under Postbank’s IT is not finished. While they are no longer in daily use, some systems will remain live until next year as historic transaction data needs archiving.

Major takeaway point -> Data Governance is not just Compliance.

3. Fintech leaders confident of community banking’s demise

VC firm Andreesen-Horowitz hosted the CEOs of SoFi, Wise, and Adyen for their Connect/Fintech conference. The panel discussed AI, SVB’s collapse, and the importance of efficiency in their companies.

SoFI’s CEO Anthony Noto credited their focus on customer-level metrics for driving their growth and performance:

The thing that’s the most critical and all-encompassing is unit economics. Unit economics, to me, is the equivalent of on-base percentage in Moneyball.

If you can gain an edge—from an information, structural, technology data, segmentation, or business mix standpoint—in unit economics, you have a competitive advantage. And if I have superior unit economics to someone else, I can provide better prices, better interest rates, and better services.

Global payment company Wise’s CEO Kristo Käärmann offered a more bleak, if not self-serving, outlook for smaller financial institutions.

I think there’s a bit of a dysfunction in the world where I think there’s like 5,000 banks in the U.S. and about 8,000 globally. Banks are very local in all countries. Very few are cross-border at all. But then if you look at tech companies, tech companies are generally global. So, you only need one Google or a couple of them. But that’s it. There’s a massive scale efficiency that you get from tech. And that doesn’t exist in banking. And therefore, I don’t think this hyper-local banking that has been around for years can exist forever.

And that it for this Friday. Remember kids, never be afraid to ask the tough questions, like which is funnier, cheese or bananas?. Click below to let us know how we did: