We bring you a few must-reads for the community banking marketer to help you stay in the know and the marketing thought leader in your institution. The week Facebook/Meta’s run at digital payments, a look at a potential future of direct consumer messaging in China, and the real value that data can provide.

1. Meta is still swinging on digital payments

Following Facebook/Meta’s abandoning and sale of Diem, their attempt at a cryptocurrency/stablecoin, the company announced a plan to enable payments for content and virtual assets, at least starting, on the Horizon World’s VR platform. Instead of a broad replacement for currency, their efforts now are focused internally on their own services/ecosystem, easing launch and pesky issues like government oversight.

Within a virtual environment these closed-loop funds can be used to purchase items and could also establish credit functions, Sloane said, In the virtual world the virtual currency could accomplish everything crypto does in the open environment, but with significantly less regulatory oversight…

The card networks and other payment companies are expanding support for NFTs, either as a processing rail for purchases, or as a means of fundraising or incentive marketing. And the metaverse is of growing interest to financial institutions. Banks such as JPMorgan Chase and HSBC are working on metaverse services, while American Express and Mastercard have filed metaverse-related patents. The metaverse could generate as much as $13 trillion in yearly revenue and have more than 5 billion users by 2030, according to Citigroup.

2. Does the future of direct marketing look more like Chinese retail?

Connie Chan on VC firm Andreesen Horowitz writes Why China’s Version of Email Marketing Is So Effective. In contrast to outbound email campaigns, Connie writes on the prevalence of private traffic, or the direct messaging of sales associates and customers:

In the last couple years, the retail industry has been thinking a lot about how to make brands and products more accessible to customers. A lot of Western brands have interpreted more accessible to mean more relatable, and leaned into the idea of making people think we’re just like them.

In contrast, many Chinese marketers came away with a different interpretation of accessibility. They seized on the literal definition of the term, using technology to make it easier for customers to reach brands and vice versa.

3. Data isn’t a silver bullet

ESG investment thought leader Sasha Dichter writes about addressing complexity in Better Data Doesn’t Give you Answers. Sasha cautions against viewing data as a shortcut or quick fix to a problem vs. the signal that guides us to genuine insight.

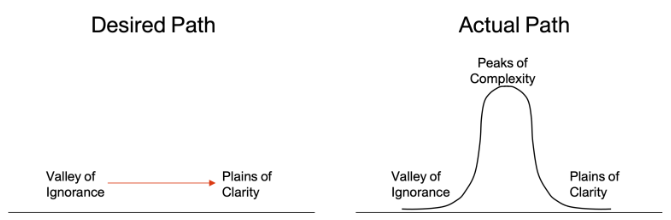

Our misconception is that we think we can go directly from ignorance to clarity… In reality, for any topic that matters, as we learn more we embark on a journey. Over time, we will climb a mountain of increased complexity—with new insight, new inquiry, new investigation — until ultimately, after a great deal of focused attention, we begin seeing the world more clearly and, ultimately, arrive at deeper understanding and the simplicity that we seek.

The question isn’t whether sophisticated data and a nuanced understanding are needed.

The question is who will start on this journey first, thereby establishing an insurmountable lead on those who are happy to dawdle at the base of the mountain, in search of a way around or through.

Have a great weekend, but for the sake of those people in Maine go easy on the margarine. Drop us an email and let us know what you think (I’m looking at you too haters) blog@mindspaninc.com. If you’re so inclined, share below.