3 items from this week: Revisiting a theory on technology maturity cycles, Examining your own in institution’s capacity for innovation, and what the cost of ignoring that imperative is in real dollars.

1. The Death and Birth of Technological Revolutions

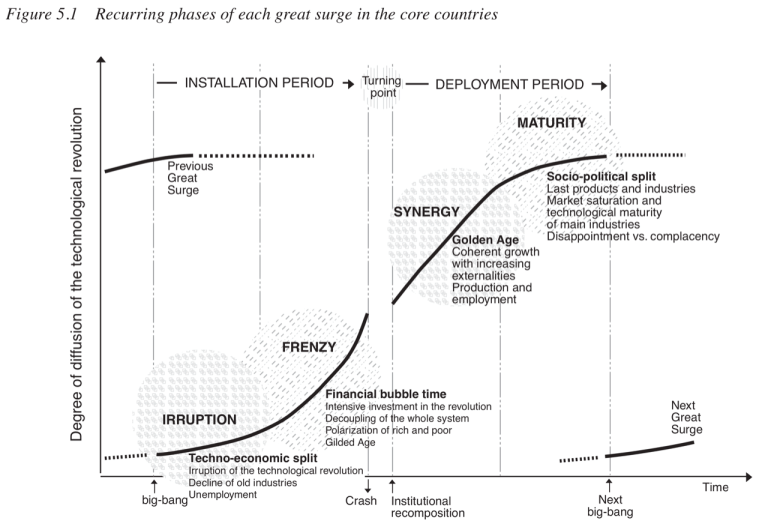

Ben Thomson of Stratechery revisits the 20 year old Carlota Perez’s Technological Revolutions and Financial Capital and speculates if we’re in a turning point from installation to deployment periods of emerging technology and whether her theory suggests there is a coming “Golden Age” in areas like AI, robotics, and crypto.

This financial frenzy is a powerful force in propagating the technological revolution, in particular its infrastructure, and enhancing – even exaggerating – the superiority of the new products, industries and generic technologies… At the same time, as mentioned before, all this excitement divides society, widening the gap between rich and poor and making it less and less tenable in social terms. The economy also becomes unsustainable, due to the appearance of two growing imbalances.

2. Can you effectively innovate in your market?

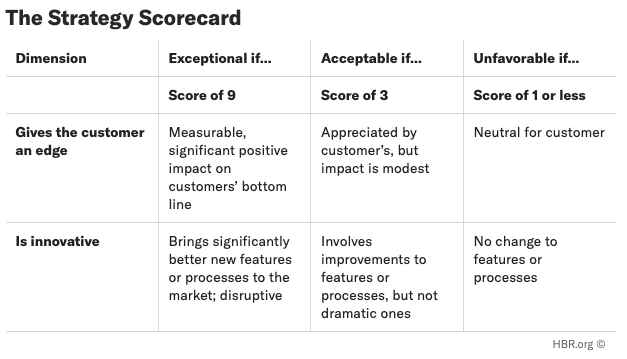

Strategy and innovation thought leader Rita Gunther McGrath shares 5 Questions to Build Your Company’s Capacity for Innovation in her latest Harvard Business Review article. In it she shares her process for helping companies engineer the process of innovation and ensure the efforts product results.

Some years back, I did a strategy exercise with the global elevator company Kone. One of their broad strategic pillars was to “improve the lifetime value of a building to its owners.” We translated that concept into the following scorecard:

3. What does an undifferentiated product cost to advertise

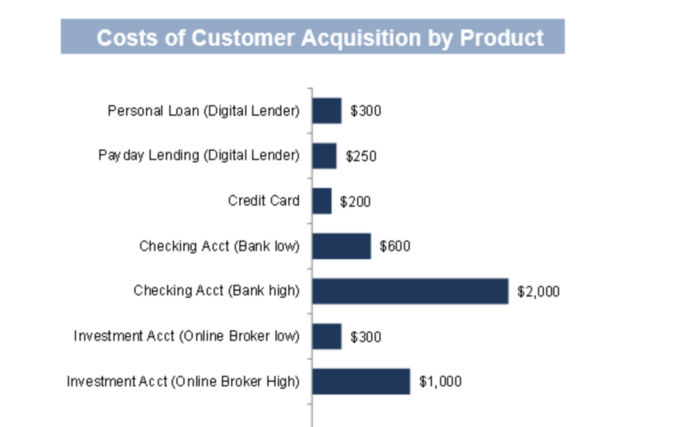

A lot apparently. Unifimoney shares this analysis of acquisition costs and suggests that enabling “low effort” as in “no effort” solutions for consumers may be the solution to the escalating costs of standing out in the crowd for Financial Institutions.

“Marketing and advertising costs have become the tax you pay for not being able to create a better idea than your competitors.”

That’s it for this week. Comments and suggestions to blog@mindspaninc.com.