Just one article/linked report this week, but it’s a meaty one with lots to draw from.

1. The Great Divergence in Banking

This week McKinsey and Company published their Global Banking Annual Review 2021, aptly subtitled The Great Divergence. The link goes to a summary and download link to the full report).

Out of the gate, they don’t mince words about where that division lies:

Fifty-one percent of banks operate with an ROE below cost of equity (COE), and 17 percent are below COE by more than four percentage points. In an industry that has high capital requirements and is operating amid low interest rates, creating value for shareholders is structurally challenging.

Additionally they pick out the specific activities that are driving the split in performance.

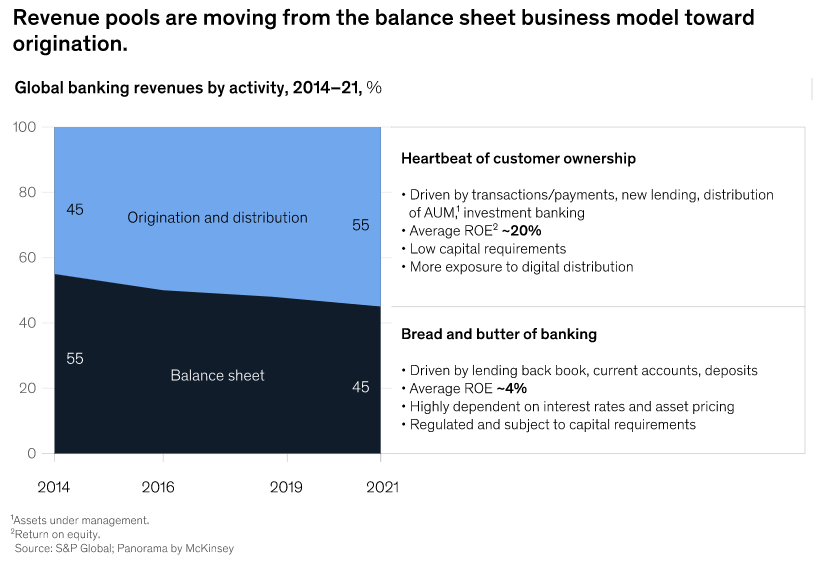

As banks moved in lockstep, their offerings became commoditized, and customer expectations skyrocketed. In a low-interest-rate world, a commoditized business model based on the balance sheet yields less income and brings no differentiation to the customer. If we split revenues between those generated by the balance sheet and those that come from origination and sales (for example, mutual funds distribution, payments, consumer finance), the trend is clear: growth and profitability are shifting to the latter category, which has an ROE of 20 percent—five times higher than the 4 percent for balance-sheet-driven business—and now contributes more than half of banks’ revenues.

In looking at fundamental weaknesses and areas of opportunity for retail banks, McKinsey points about lack of linkage to lifetime values with targeted segments.

Another contributor to the great divergence is differences in banks’ capabilities to serve the fastest-growing and more profitable customer segments. Consider what’s happening in US retail banking. Over the past 15 years, the revenues from middle- and low-income households have shrunk considerably. According to our proprietary data, an average US household generates roughly $2,700 in banking revenues annually after risk costs, while a self-employed customer between the ages of 35 and 55 with a bachelor’s degree and an annual income above $100,000 generates four times more ($11,500).

The divergence in segment profitability is growing, and not only in retail banking. Small and medium-size enterprises (SMEs) represent one-fifth (about $850 billion) of annual global banking revenues, a figure that is expected to grow by 7 to 10 percent annually over the next five years. However, the profits of banks in this segment vary significantly, partly because of highly varied credit quality in the portfolio. Finding the optimal balance between providing a great customer experience and managing the cost to serve has also proven to be difficult. As a result, many banks have not prioritized SMEs—forsaking the vast potential value and leaving many SMEs feeling that their needs are ignored.

The report does end on a hopeful and prescriptive note for banks:

But the biggest factor is a bank’s ability to deploy a future-proof business model that displays three characteristics that make them attractive to investors (and customers):

-They are embedded in customers’ lives (with more touchpoints and greater ownership and engagement), using digital channels and ecosystems to solve specific customer needs with distinctive and personalized experience—and they use the insights they gain to develop even better ways to keep customers engaged.

-They have a sustainable economic model that is less capital-intensive and more focused on growth and customer monetization through services/commissions rather than just financial intermediation.

-They are faster and more flexible, and they invest—both organically and through acquisitions or partnerships, and by attracting the best talent—in delivering multiple releases that delight customers.

Traditional banks that wish to join this elite group have only a limited window. About two-thirds of the value generated during an entire economic recovery cycle is created during the first two years after a crisis

The full report is well worth the time to dig into and think about What did you can take away what might impact your near term plans and strategy. Comments and suggestions to blog@mindspaninc.com.