For this last Friday in June, and 2Q, we look at the CRE risk problem and its uneven distribution. Also, an analysis of why most Fintech products only offer incremental vs. groundbreaking benefits. Finally, a breakdown of the often derided 1 on 1 and turning into a potent asset in the manager’s toolkit.

Also, I had the opportunity this week to address the personalization gap at community banks and credit unions on the Navigating the Customer Experience podcast.

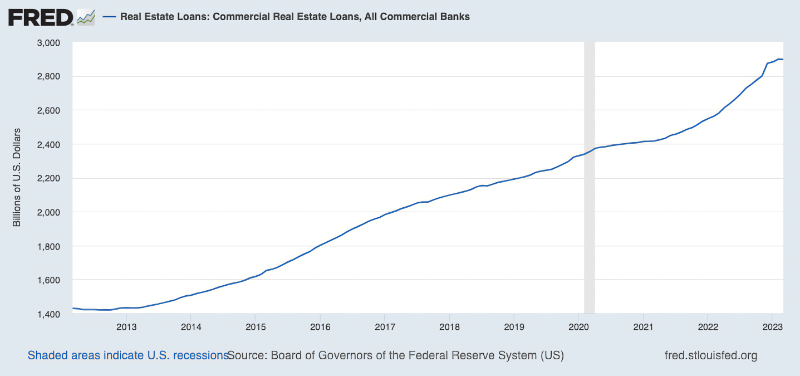

1. How much of CRE risk sits with Community Banks and Credit Unions?

Bill Moreland of Bank Reg Data writes in his newsletter on the CRE risk and its concentration in larger banks.

The $100+ Billion banks saw significant increases in their Non Owner NPL % in Q1. Not surprisingly, the list of those with the largest Q on Q dollar increases contains some very familiar names.

These 5 banks in aggregate had $1.92B of Non Owner Q on Q NPL increase which is 72% of the industry total.

Interesting, considering every single article I read is about smaller and regional bank CRE exposure as being the concern.

As a group, the largest banks (over $100B) have the highest NPL and Total Delinquency %. This group collectively holds 553.98B of CRE which makes up 31.07% of the industry total. We also see the smallest banks less than $250 Million in assets starting to have issues with their 30-89% and NPL buckets. That group, however, holds $27.51B of CRE representing just 1.54% of industry CRE.

The banks between $250 Million and $99 Billion hold $1.201 Trillion of CRE (67.38% of total) and they have remarkably low delinquencies. The more immediate concern is the largest banks.

This post isn’t up on BankRegData.com yet, but The post is now live here, and you can sign up for Bill’s excellent newsletter here.

2. Fintech is incremental; there are no 10X products

Ayo Kunle leans on his experience creating Cash App’s Cash Card to look at how current Fintech products seem to be 2x’s better at a few things rather than 10x at any one thing.

To win in financial services you need to deliver differentiated money benefits vs the alternatives. By money benefits, I mean delivering a benefit that the customer can’t get if they tried to use another institution to store or move money.

There are only a few kinds of differentiated financial benefits you can create:

- Store money better (eg provide higher APR on deposits, increased/faster funds availability etc)

- Move money faster (eg settle securities sales faster, attribute paychecks or social security benefits faster, optimize withholdings better, etc)

- Save money for the customer (eg lower fees, sometimes on money storage, sometimes on transactions, sometimes both)

- (Maybe) Reduce complexity

- (Maybe) Increase access

He posits that between the hurdle of regulation and the speed of competition in finance, there aren’t many 10x opportunities.

For example, to increase the returns on risk free deposits (which are currently around ~5%) by 10x, you’d have to find something to invest in that will consistently yield 50% annual returns at scale on a functionally infinite deposit base, with no risk of principal loss. Even if you did this (and you should look with a skeptical eye at anyone who claims they’re doing this), one of 2 things would happen: either you’d quickly acquire 100% of deposits on the planet, or your competitors would bid away the return and pay more for that asset until the return on capital invested dropped to the right risk adjusted rate.

Using Cash App’s Cash Card as an example, he explores the incremental value of many Fintech solutions.

These individual benefits are/were better than the competition at the time, but incrementally better, not by a step function. None of these, by itself, is so head and shoulders better than the competition. They’re all incremental, but instead of mattering all at once (because customers instantly understand the benefit and sign up), they compound over time as you penetrate the awareness of more customers.

3. “If they think the conversation was pleasant but largely unmemorable, you can do better.”

First Round Capital wrote up a great list of ways to uplevel your 1:1’s with direct reports. The article provides a summary of the career experience of several leaders and authors. It drills into the skill and art of the 1:1, an area most managers need to deliberately work on to improve their ability to manage performance and develop the people who work for you.

Your job as a manager isn’t to dole out advice or ‘save the day’ — it’s to empower your report to find the answer herself. She has more context than you on the problems she’s dealing with, so she’s in the best position to uncover the solution. Let her lead the 1:1 while you listen and probe.”

To that end the team also compiled a list of better questions for your next 1:1:

Additionally, the groups of experienced managers recommend careful and structured followed as part of the process:

We want to believe our carefully-chosen words of wisdom are interpreted correctly and seared into the minds of our reports. It’s safer to assume they aren’t.

In other words, failing to formulate a follow-up plan after performance discussions is one of the biggest mistakes you can make as a manager. And if that initial conversation is only the beginning, the rest of the process should play out over the course of the year in the ongoing, regular touchpoints you have with your direct report.

The whole article is worth reading and thinking about. Lots of great tips and resources to help improve your coaching/mentoring skills as a leader.

(HT to Sasha Dichter for the pointer)

And that’s a close to the first half. Sidebar -> is this a Cocaine Bear wannabe or the anti-Goldilocks? Thoughts on the post? Let us know at blog@mindspaninc.com. We love all the comments, even the mean ones.