This week we have research from the National Bureau of Economic Research (NBER) on the value of branches during asset flight. Also, we look at consumer sentiment research and where the wack-a-mole game of blame-shifting for the economic crisis shakes out by generation and income.

1. Branches make bank runs harder

Matt Levine of Bloomberg’s excellent Money Stuff column writes on a study from the NBER on branch density and asset flight in 1Q23.

The prevailing wisdom is that everything in banking is moving to a digital mostly/only approach. This strategy, of course, drives behavior for both depositors and banks:

Relationship businesses in general are on the decline. In a world of electronic communication and global supply chains and work-from-home and the gig economy, business relationships are less sticky and “I am going to go into my bank branch and shake the hand of the manager and trust her with my life savings” doesn’t work. …

I suppose if that were true you would see it on both sides. Customers would feel less committed to their banking relationships, but also banks would work less hard to build those relationships. If nobody cares about shaking hands with their bank’s branch managers, then banks would invest less in branches. You don’t build a bank branch just to attract overnight funding.

However, the weakness of that approach seems to have been exposed, no relationship = no deposit franchise.

If you invested less in branches and more in websites in the past few years, you were able to get a lot of deposits cheaply — but in the spring of 2023, you weren’t able to keep them, because nobody was shaking hands with your website. (From the NBER paper):

We find that branch density is positively correlated with deposits flows during Q1 2023. A one standard deviation decrease in branch density is associated with a 4.4% net outflow of uninsured deposits.

Stock prices of banks with low branch density plummeted during the 2023 Banking Crisis as these banks experienced larger outflows of uninsured deposits. Our results suggest that digital banking enabled banks to grow faster and attract uninsured deposits, but those large deposits inflows took the form of “hot money” that changed its course when economic conditions worsened.

You can read the full text of the working paper from the NBER here.

2. Gen Z leads the pack in cynicism

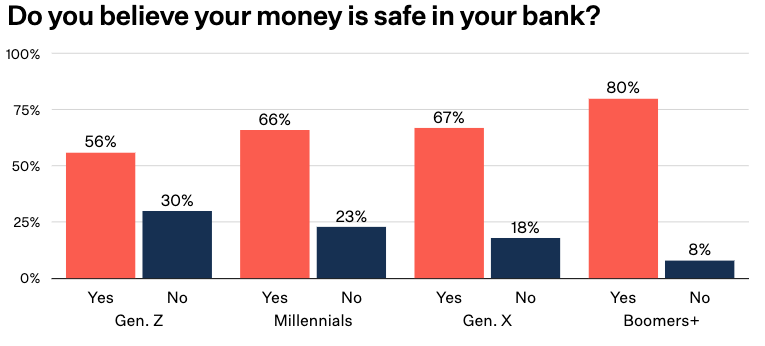

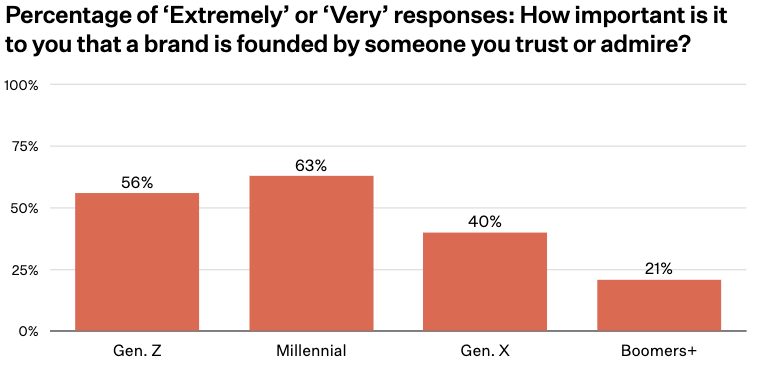

Dan Frommer of The New Consumer has published his must-read mid-year consumer trends report. The report provides insight into generational sentiment on many topics like AI and health care and the economy and brand trust. In addition to Gen Z’s lower trust in banks (above), their buying drivers provide some insight into the growth of creator/influencer-driven brands:

Sentiment on the banking crisis has also bled over into tech and startups in general:

25% of consumers say the banking crisis negatively impacts their view of tech companies (21% say it positively impacts their view; 54% say it has no impact.)

20% of consumers say the banking crisis negatively impacts their view of startup companies (23% say it positively impacts their view; 57% say it has no impact.)

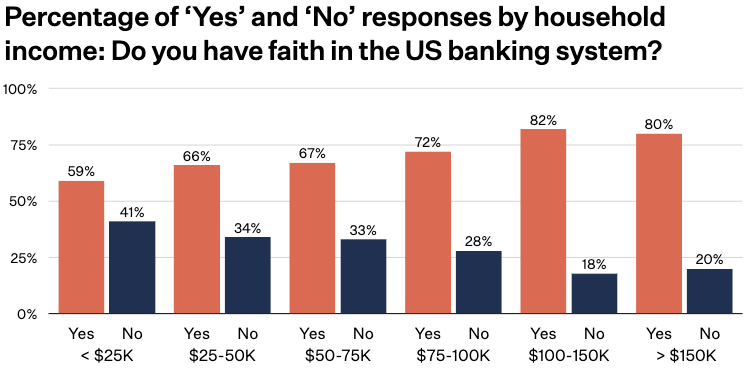

Additionally, consumer faith in the banking system almost directly correlates to income levels.

And that closes this week. For the aspiring car thieves, a guide to stealing Porsches, or at least one in particular. Have thoughts? We love it all. Praise, criticism, unadulterated vitriol. Let us know at blog@mindspaninc.com.