Happy Cinco de Mayo! And with it, another short list of must-reads for you, the community banking leader. We have a fascinating visualization and analysis of banking failures, Warren Buffet’s right-hand man on commercial real estate risks in banking, and how to think about AI in your institution.

1. FDIC banking failures visualized

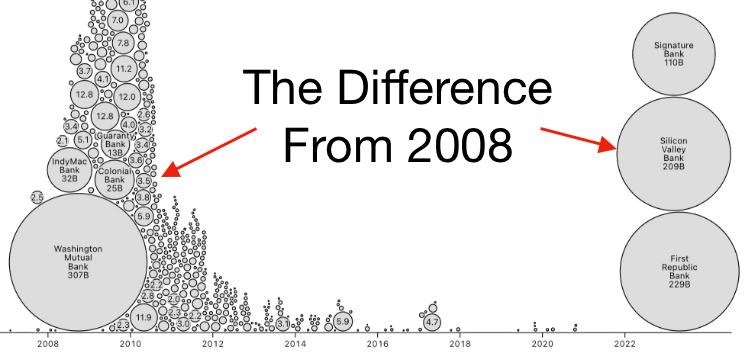

While we wait on the Fed to update their Large Commercial Bank study for 1Q to see the effect of asset flight, Mike Bostock, founder of visualization company Observable, presents this view of bank failures since 2000:

It’s a little less stark adjusted for inflation, which you can do using Observables tools here.

However, what immediately jumps out is the size of institutions affected by rapid interest rate changes so far. Many community bank and credit leaders have patiently explained how to assess the risk of their institutions. What remains to be seen is how much that translates into asset movement out of those smaller banks and credit unions across the board.

2. Charlie Munger on CRE risk in banking

In the run-up to Berkshire Hathaway’s annual shareholder meeting this weekend, vice chairman Charlie Munger spoke to the Financial Times on the risk in commercial real estate for US banks:

“It’s not nearly as bad as it was in 2008,” the Berkshire Hathaway vice-chair told the Financial Times in an interview. “But trouble happens to banking just like trouble happens everywhere else. In the good times you get into bad habits . . . When bad times come they lose too much.”

“A lot of real estate isn’t so good any more,” Munger said. “We have a lot of troubled office buildings, a lot of troubled shopping centres, a lot of troubled other properties. There’s a lot of agony out there.”

He noted that banks were already pulling back from lending to commercial developers. “Every bank in the country is way tighter on real estate loans today than they were six months ago,” he said. “They all seem [to be] too much trouble.”

Sidenote: David Senra of the Founders podcast has a great analysis of Munger’s biography The Tao of Charlie Munger, including insights from a meeting with him. A must listen.

3. Positioning AI in your org

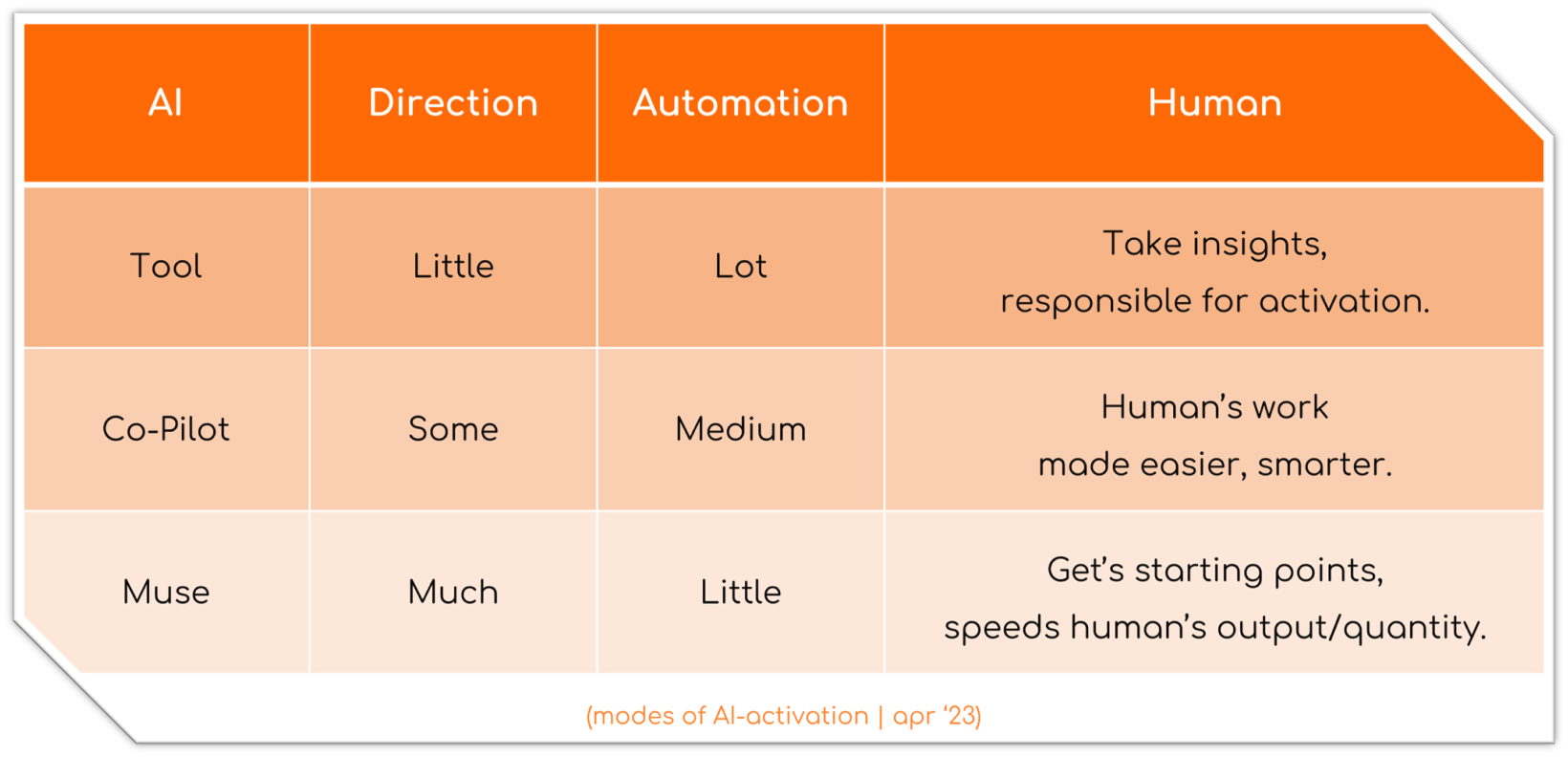

Analytics thought leader Avinash Kaushik presents a framework for thinking about AI in any company. With all the pressure on leaders to think about getting ahead, or at least not being left behind, Avinash offers a way to look at the possibilities.

The category of AI possibilities contains countless Tools. Algorithms which can chew through an entire problem/opportunity space, the human needs to just wait at the other end for the answer/decision/output and, maybe, work on activation (though often even this can be automated).

The second category is AI as a Co-Pilot. Present alongside you, all the time, helping you do what you are doing better, smarter.

A complex example: Using Co-Pilot in GitHub to suggest code and entire functions in real-time, right in your editor as you are programming.

The third category is AI as a Muse. You don’t have a starting point, or you have a sketch of an idea or a wish, but you don’t have the details (or even skills to write/build/draw/create). AI to the rescue.

And that’s it for this first week in May. It’s always nice to meet your neighbors. Thanks for reading. Let us know what you thought at blog@mindspaninc.com.