As summer heats up and we close out a quiet holiday week, here are a few noteworthy items to look at rolling into the weekend. We look at the BaaS deals heating up in 1H, thoughts on managing a banking cloud migration, and whether advances in generative AI will mean more or less white-collar workers.

1. Banking-as-a-Service deals on the rise

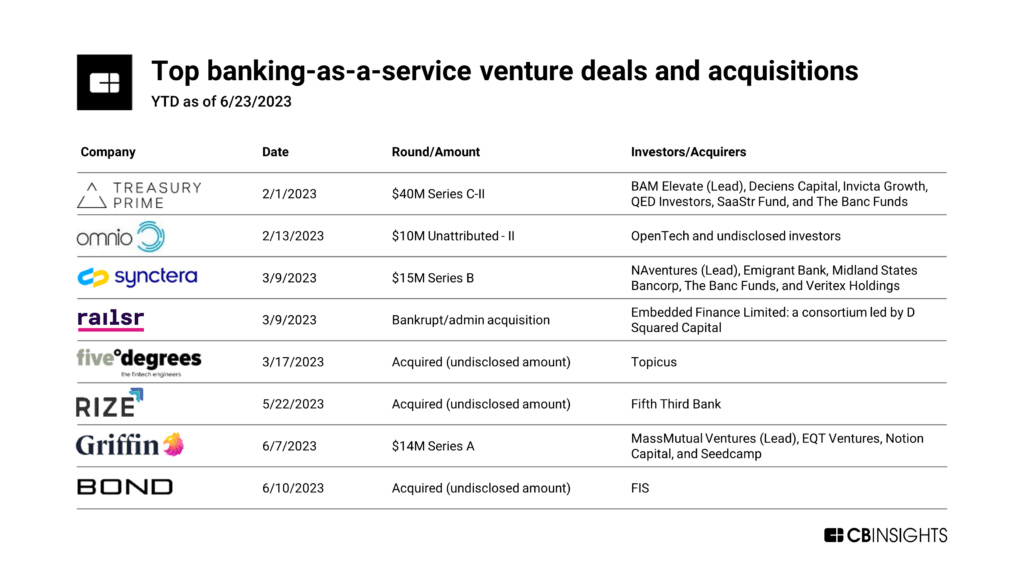

CBInsights reports on the uptick in BaaS deals and valuations. The particular plays into embedded finance, allowing non-financial companies to include bank-like capabilities in their offerings, continues to drive the market.

Despite a slowdown in the overall fintech market, VCs, banks, and tech companies are opening their checkbooks to invest in or acquire banking-as-a-service (BaaS) providers.

The financial technology behemoth FIS — which provides core banking, payments acceptance, and other services to banks and retailers around the world — recently acquired BaaS provider Bond for an undisclosed amount.

Notably, FIS has sold off its stake in Worldpay for $11.7 billion, in response to pressure from activist shareholders.

2. Moving your bank to the cloud

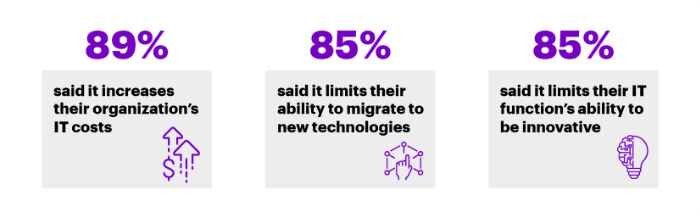

Accenture writes on the problem of when and how to address technical debt for banks, particularly when moving critical parts of operations to the cloud. First, a definition:

Tech debt occurs when either:

Software products are launched before they are fully debugged and do everything they were intended to do, with the intention of getting them into operation quickly and fixing the minor problems later; or

Software becomes outdated and doesn’t work well with more advanced systems, so “quick and dirty” workarounds are implemented to avoid starting from scratch with a newer version. Software that isn’t actively managed can quickly accrue this type of debt.

This problem exists in all major change projects, whether IT/software related or not. The difficult part is having a plan for how to deal with it. It becomes more tricky when it’s part of a major platform and/or operating model change in a cloud adoption initiative.

Banks are generally looking at their options as a tradeoff between two priorities:

Prioritizing modernization by settling their tech debt as soon as possible so that they don’t bring it into their new cloud infrastructure.

Prioritizing speed to the cloud by temporarily carrying their tech debt into the cloud so that it doesn’t slow down their move.

There’s a bit of handwaving at the end about one-size doesn’t fit all, but here are a few considerations when thinking about how to handle technical debt:

- Start with the end in mind- Your organization exists to serve your local communities. Look at the decision to close gaps and solve issues FIRST from your customers’ experience. There are still tradeoffs between cost and needs, but consider it a warning sign if you only solve your own problems at the expense of customers.

- Competitive position- Are you ultimately just closing a gap, keeping up with the Joneses, or providing something your customers can’t get anywhere else? Prioritize the first and last. Providing minimum capabilities is table stakes. Delighting your customers with unexpected value is differentiation. Adding incremental features that might go unnoticed can maybe wait.

3. The existential dread of AI

Benedict Evans writes on AI and the Automation of work, and more so on the societal concerns about what that might mean. He looks at the fear around mass job loss through the lens of Jervon’s paradox.

In the 19th century the British navy ran on coal. Britain had a lot of coal (it was the Saudi Arabia of the steam age) but people worried what would happen when the coal ran out. Ah, said the engineers: don’t worry, because the steam engines keep getting more efficient, so we’ll use less coal. No, said Jevons: if we make steam engines more efficient, then they will be cheaper to run, and we will use more of them and use them for new and different things, and so we will use more coal.

We’ve been applying the Jevons Paradox to white collar work for 150 years.

Ben provides some historical context on the adoption of mainframes, spreadsheets, the PC, and how it generally created more work, not less. Where his take gets interesting is the counterarguments and conclusions on whether this wave of AI is different.

‘If we had a machine that could do anything people do, without any of these limitations, could it do anything people can do, without these limitations?’

Well, indeed, and if so we might have bigger problems than middle-class employment, but is that close? You can spend weeks of your life watching three hour YouTube videos of computer scientists arguing about this, and conclude only that they don’t really know either. You might also suggest that the idea this one magic piece of software will change everything, and override all the complexity of real people, real companies and the real economy, and can now be deployed in weeks instead of years, sounds like classic tech solutionism, but turned from utopia to dystopia.

As an analyst, though, I tend to prefer Hume’s empiricism over Descartes - I can only analyse what we can know. We don’t have AGI, and without that, we have only another wave of automation, and we don’t seem to have any a priori reason why this must be more or less painful than all the others.

And that’s it for this first week of July. For your slow short week, here is a quick post on the weird connection between toast and Ghostbusters. Got thoughts? We’d love to hear them at blog@mindspaninc.com. Keep ‘em coming.