For this Friday, a look at the state of potential asset flight to larger banks. We have the distribution at the start of the quarter, the impact from early earnings reports, and consumer confidence for the future.

1. How it started

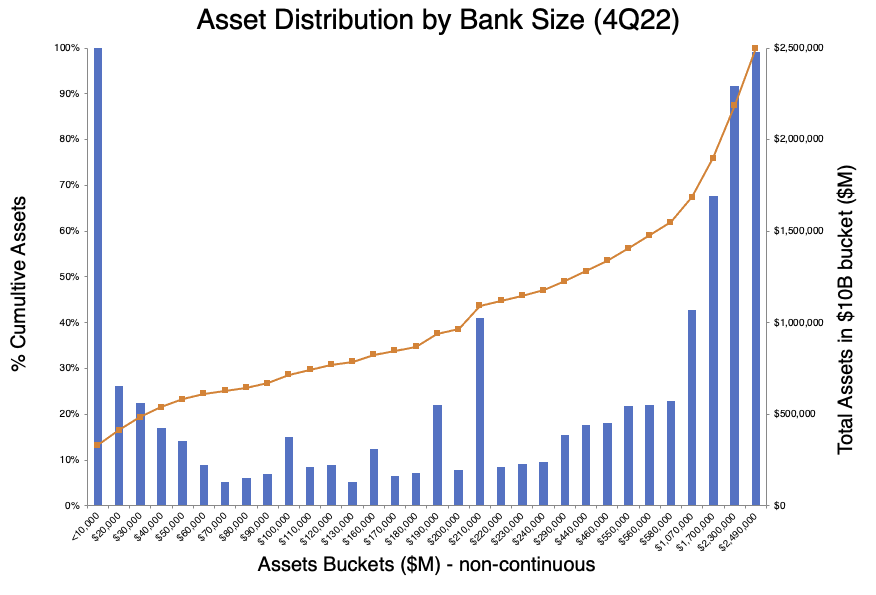

The chart above shows the distribution of assets from the Federal Reserve’s quarterly Large Commercial Bank release. The analysis covers domestic chartered insured banks with assets greater than $300M.

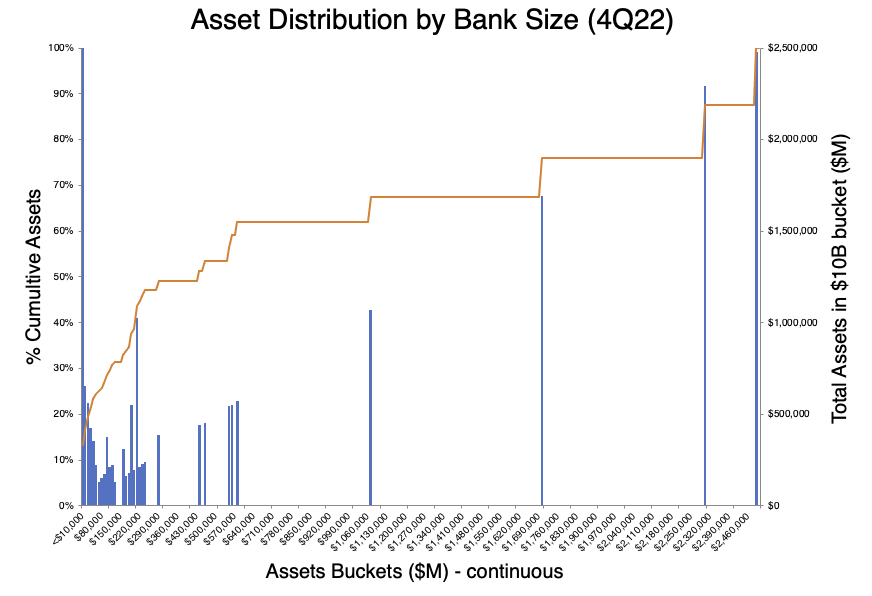

The chart above is non-continuous. The $10B buckets of bank sizes along the x-axis skip the buckets where there are no banks of that size. The continuous view below shows the starker difference between institution sizes.

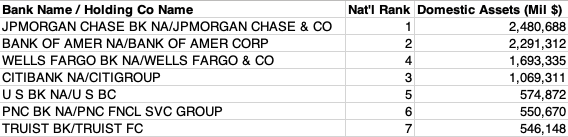

The skew of assets at the end of the year had seven banks with >$500B in assets, holding 46% of all domestic assets.

The growth of deposit share by the giants, both organic and from M&A, is a long-term trend.

2. How it’s going

So far, earnings reports have shown some movement of deposits.

Big US financial groups Charles Schwab, State Street and M&T suffered almost $60bn in combined bank deposit outflows in the first quarter as customers continued to move their money in search of higher returns.

Schwab on Monday said deposits fell 11 per cent, or $41bn, in the first quarter and 30 per cent year on year to $325.7bn. Custody bank State Street’s total deposits fell 5 per cent in the first quarter to $224bn, more than expected, and the group told analysts that another $4bn to $5bn of outflows of non-interest-bearing deposits could leave in the second quarter.

M&T Bank reported total deposits had declined 3 per cent from $163.5bn at the end of 2022 to $159.1bn.

3. And how it might go

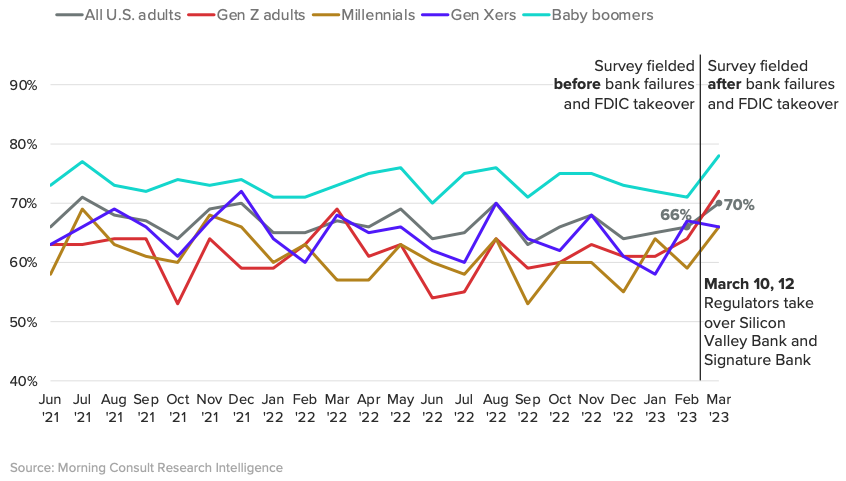

Morning Consult reports on the trend in consumer sentiment. So far, there is little erosion of trust in the banking industry in general.

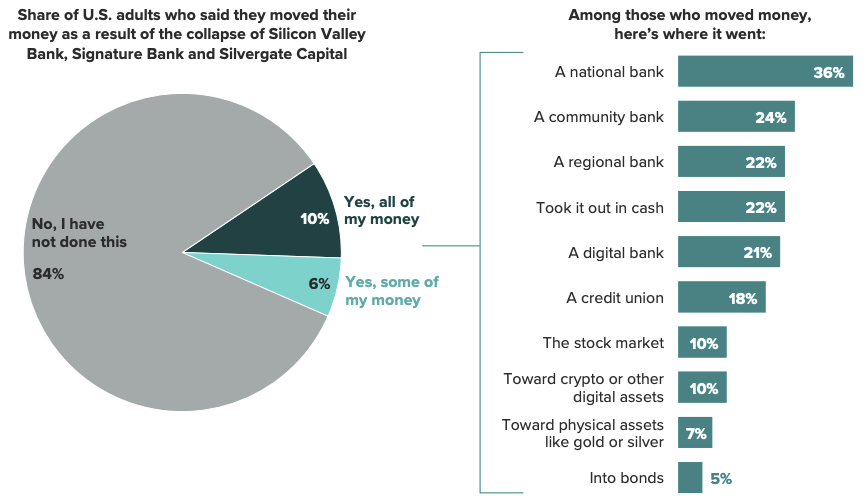

In the immediate aftermath of SVB, Signature, etc., only pockets of consumers moved assets.

As of March 17, 2023, 10% of consumers said they had moved all of their money somewhere else as a direct result of bank collapses, and an additional 6% said they had moved at least some money.

Those who moved money were disproportionately high earners, they were much more likely to own cryptocurrency than the general population and a majority were millennials.

And as for intent:

Despite some money movement, the primary banking provider landscape remains largely unchanged. Only 5% of consumers said they changed their primary bank provider as a result of the bank failures, but 23% are considering starting a relationship with a new bank in the next six months, up 8 percentage points from February.

That’s it for the week. It turn’s out, with a fair amount of effort, you can teach an old dog new tricks, or at least car phones from the early ’90s. Thank you for reading to the bottom. Let us know how we did -> blog@mindspaninc.com.