A few more choice reads and pointers to end your week on, analytics on the bleeding edge, a delayed decision in consumer financial data, and the upside of coaching as a manager.

1. Leveraging Analytics to really move the needle

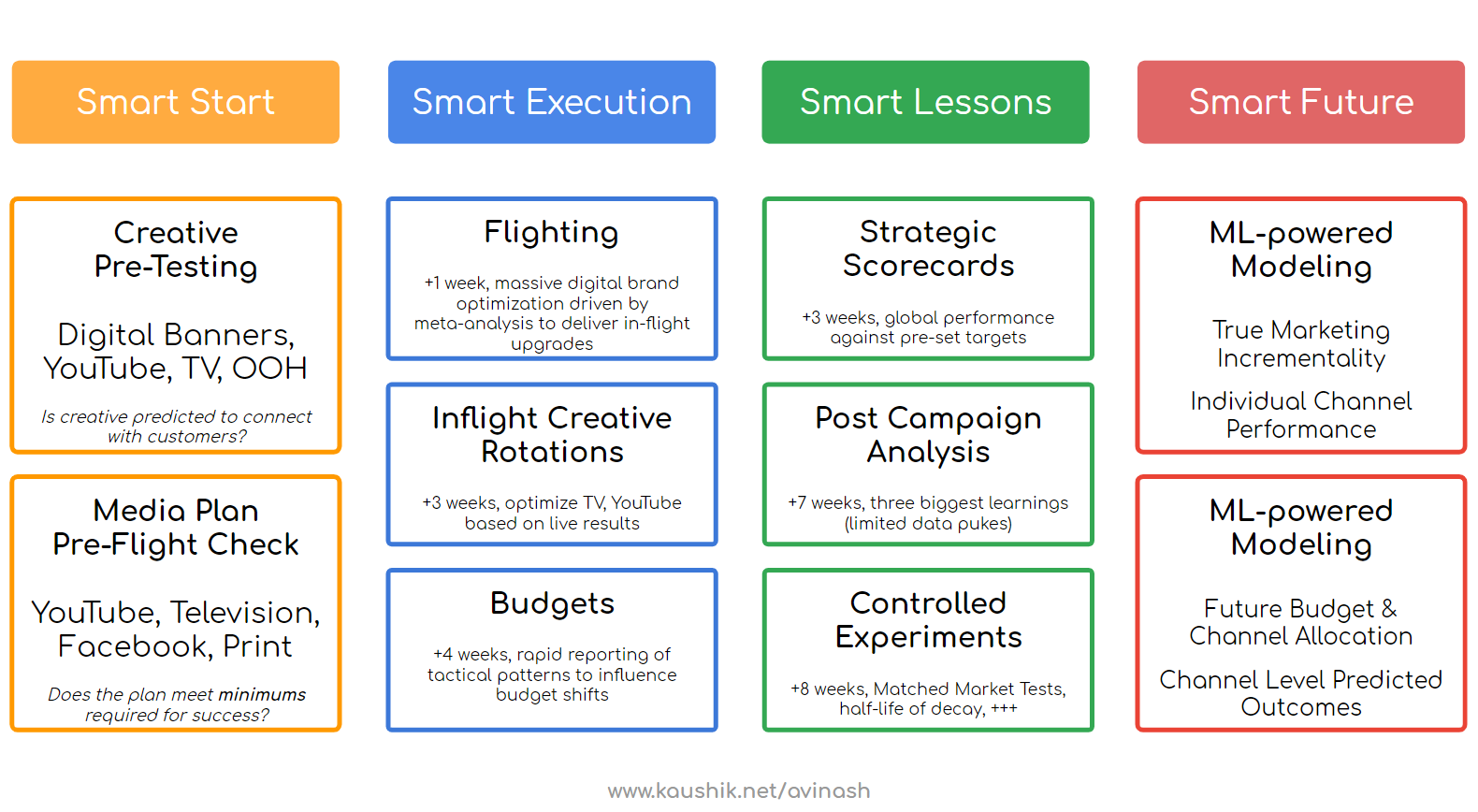

Analytics guru Avinash Kaushik shares a high level approach to go beyond reporting and getting a real competitive advantage from a firms data, particularly in advertising planning and mix:

The first component is a gloriously scaled global creative pre-testing program. Creative is the thing you see in the ad. The text. The goats. The slow music. The repeated mention of the product (hopefully). The use of a celebrity (or not!). Yada, yada, yada. It turns out, hold on to your seats, the creative has approximately 60% influence on the ultimate success of your campaign!

We pre-test pretty much everything in an online labish environment, and predict whether a piece of a TV or Billboard or Radio or YouTube or Facebook creative will be successful. With the support of our progressive CMO, we spend money on creative that passes pre-test.

Now, our Marketing teams know before they spend money if the campaign’s creative will deliver success.

2. CFPB likely to punt data-sharing rule into 2023

The Consumer Financial Protection Bureau is signaling a delay in any action on updated rules related to consumer control of their financial data. The scope of these decisions would likely impact Fintech companies’ ability to collect data from banks and impose additional protection for consumers and data security measures.

While fintech companies primarily use screen scraping to obtain access to consumer bank records, many aggregators have created partnerships with the top 20 banks using APIs. Some banks do not make data that they consider proprietary — such as the interest rate on a loan or the cost of certain fees — available to third parties. Those limitations make it harder, for example, for challenger banks to offer consumers cheaper rates or help them comparison-shop for financial products.

3. The Best Managers Don’t Fix, They Coach — Four Tools to Add to Your Toolkit

Coaching is very different than managing day-to-day. First Round Capital pulls together a detailed and prescriptive article on where the pitfalls of fixing problems for direct reports are, what the alternative approaches are, and when each is appropriate.

The best scenario for you and your team members is when you can leverage their unique perspectives, experiences, and skills:

When we instead use coaching to unearth someone’s own wisdom, two things happen:

We invest in their inner teacher: This means that you’re not just solving a one-time problem; you’re helping them see patterns and behaviors so that going forward, they can develop their own resources and best practices to navigate their challenges.

We empower them to trust themselves: You’ll see a shift in your team member’s ability to more clearly and confidently articulate next steps they can take to solve a problem or achieve their goal.

That’s it for this week. Here’s to keeping the right side up and keeping going when you can’t. If you got anything out of this, share it below, and let us know what you think at blog@mindspaninc.com.