For this Friday, some choice reads on the ABA’s benchmarks for banking marketing and budgets, the loosening of restrictions on banks hiring people with criminal records, and in the age of exploding AI capabilities, why being “weird” and unique will become increasingly valuable.

1. Benchmarks for Community FI Marketing Organizations

The American Banking Association published their 2022 Marketing Planning and Budgeting Survey. The survey showed a continued shift of focus and spending to digital channels and tools with a premium on concrete, measurable results:

The 2022 survey reinforced the 2021 survey finding that bank marketers are shifting more of their budgets to digital tools, at the expense of traditional media. Digital advertising, search engine marketing and social media budgets are being increased by the majority of respondents, while fewer than 20 percent reported they are increasing TV, radio, outdoor or print.

The reason for this shift could be that marketers continue to believe their institutions are earning a higher return on digital marketing techniques than other more traditional tools.

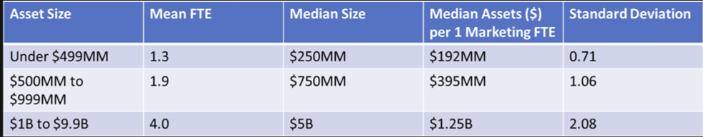

In addition to shifts in budget allocation, the survey also looked at the relative size of marketing departments by institution size, with staff size varying from about 1 FTE per $200M to $1.2B in assets.

2. Making it easier to hire applicants with criminal records

Ebrima Santos Sanneh at American Banker [writes on Congress’s legislation that reduced restrictions on banking sector employment for people with certain criminal records. The FDIC’s more permissive rule change in 2020 and the Fair Hiring in Banking Act increased the number of people eligible to work at FDIC-insured institutions. The moves have received a mixed response from civic groups who argue that the reforms have not gone far enough but solved a pressing problem for banks.

The law amended Section 19 of the Federal Deposit Insurance Act to modify a ban on banks’ ability to hire people with criminal records.

“Banks are facing a tight labor market right now, just like every other industry in the country. There are a lot of other businesses that have been able to expand their worker pool by looking at individuals with criminal records, and I think banks want to be able to do the same thing. In addition, supporting this does give them some cover, saying that they are undertaking DEI community supported actions, but I think it’s mostly that they want to expand their labor pool.” said Todd Phillips, principal at Phillips Policy Consulting and a former FDIC attorney.

3. “The things that are going to be valuable are the things you can’t teach or copy.”

Packy McCormick writes about how differentiation will become more valuable for your business and career. AI tools like DALL-E and ChatGPT seemingly make hard things like writing, drawing, and photography easy, making them more ordinary and less special.

In the current state of the art, models are only as good as the data they’re trained on and the models can’t generate new training data themselves.

Today, it’s so tantalizingly easy to copy others, to create undifferentiated products or ideas in the pursuit of doing something, that it’s become the default. Just as AI doesn’t improve with stale, rehashed data, the world doesn’t progress based upon stale, rehashed ideas.

The only answer is differentiation.

And that’s it for this week. Next week is the birthday of one of the coolest inventors ever with the most bad ass patent drawing. How’d we do this week? Let us know at blog@mindspaninc.com. We love all the feedback we get.