And with that, Memorial Day weekend is upon us. The beach. The BBQ. The race. But first, here are a few compelling stories from the world of banking to send you off with. We look at the change in deposits for 1Q, the meme stock crowd looking at banks, and a soap opera worthy story from Greece.

Also, this week I had the chance to speak with investor and entrepreneur Peter Faleskini on his podcast to talk about the growth opportunities for community FIs.

1. Community FIs hold onto assets in 1Q

Bill Moreland of BankRegData writes on banking asset shifts in 1Q. The winners by the numbers….

The 4,100+ banks in the sub-$5 Billion fared exceptionally well and should be commended. As a group, the sub-$5 Billion banks have:

1) The highest Core Deposits to Assets ratio

2) The highest Insured Deposits ratio

3) The lowest FHLB to Asset ratio

4) The lowest Brokered Deposits usage

5) The lowest Total Delinquency rate

6) The lowest Net Charge Off rate

7) The highest Tier 1 Leverage ratio

This leads to the conclusion about the relative risk of smaller institutions:

I think a strong case could be made that we should consider a two-tiered FDIC insurance system where each group is responsible for insuring themselves. Banks below $30 Billion should be in one group, while those above (nearly all publicly traded) should be in another.

2. ‘I Came to Kill the Banks.’

In somewhat debt ceiling related news, Gunjan Banerji writes in the WSJ on meme-stock traders taking up short positions in bank stock.

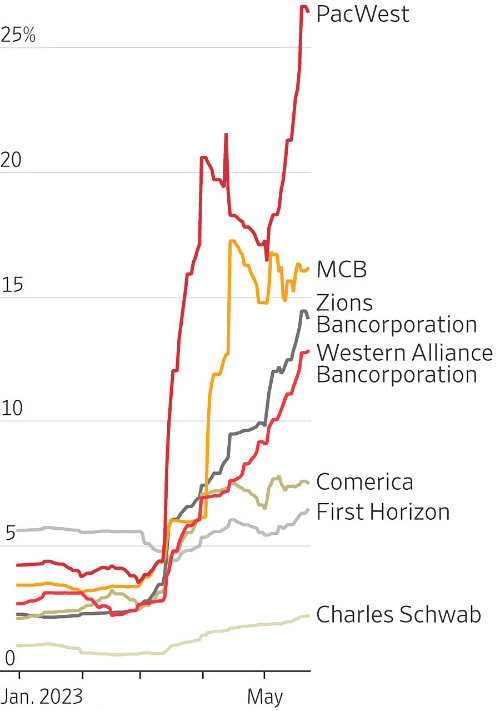

A near-record number of shares in regional banks has changed hands this month, and the number of options bets against the sector has exploded. Big Wall Street institutions and at-home individual investors alike are taking part, feeding on each other’s selling and buying.

Rookie traders are flooding social media with doomsday theories on the next bank that might fail. Others are loading up on bank stocks, speculating that there will soon be an epic jump in shares.

The result? A market that moves from calm to chaotic faster than ever.

Daniel Betancourt, a 30-year-old pub owner in Pomona, Calif., used to bet on stocks rising, but now he was doing the opposite. Weeks before, he said, he had won big with wagers against Signature Bank.

Shares of many regional banks were slipping. Betancourt says he spotted some options activity tied to PacWest that he found odd, and suspected that a big institutional player might know something he didn’t. He scooped up put options tied to PacWest that would profit if the shares dropped to as low as $5. That day, PacWest shares fell 11% to $9.07.

Social-media mentions of PacWest kept rising, with nearly 42,000 posts referencing the bank on forums such as Twitter, Facebook and Reddit, according to Hootsuite. The Wednesday before, there had been fewer than 3,000.

3. From poor returns to fraud

Another week, another surprising story out of Greece.

When real estate investor Yannis Delikanakis woke up from a 26-day coma in April 2020, he discovered that his bank accounts had been frozen and he’d been ousted from the private equity fund that he had co-founded 16 years earlier.

It’s a wild ride about Greek PE firm Bluehouse, which is not coincidentally winding down. The story covers the alleged skimming of investor interest by partners and an explosive email leak:

Tensions erupted one snowy day in Athens in February 2021, when the realization spread in the Bluehouse office that hundreds of internal emails had been sent to investors, banks and third parties, according to a person present who asked not to be identified when discussing sensitive matters. Within the emails were allegations that a banker at Deutsche Pfandbriefbank helped Bluehouse get a “haircut” — repay less than what was due on a loan after collateral was written down. That allegedly took place in exchange for an €800,000 personal payment to the banker.

And onto Summer. For your weekending viewing pleasure, P!NK the Border Collie. Like it or hate it, let us know at blog@mindspaninc.com. Enjoy the weekend, and we’ll see you next week.